Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

3 Jun, 2022

By David Hayes and Ronamil Portes

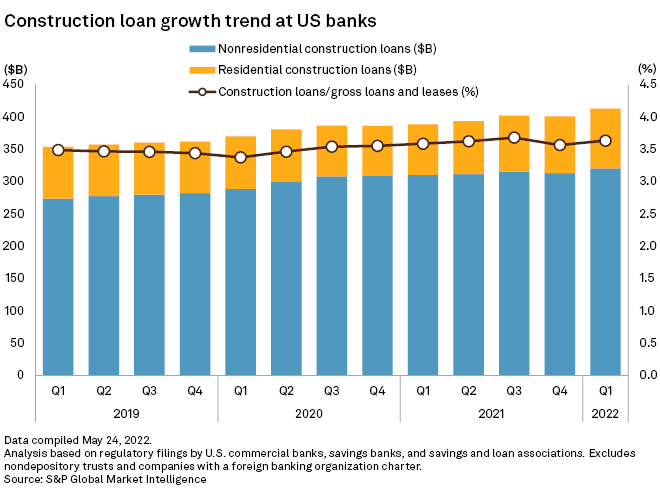

Residential construction loans surged again in the first quarter, but rapidly rising mortgage rates and slowing home sales could temper future gains.

At the end of March, U.S. banks and thrifts reported $92.40 billion in one- to four-family residential construction loans, a 5.3% increase quarter over quarter and an 18.2% jump compared to the first quarter of 2021. This was the largest annual increase since the first quarter of 2016 when total residential construction loans grew by 18.3%, according to S&P Global Market Intelligence data.

Residential construction loans include loans for the purpose of constructing one- to four-family residential properties. All other types of construction loans, as well as land development loans and other land loans, are categorized as nonresidential construction loans.

The last time the U.S. banking industry reported over $90 billion in residential construction loans was the fourth quarter of 2009. Such loans were then in a precipitous decline during the housing market collapse, down from a peak of $203.71 billion in the first quarter of 2008.

Nonresidential construction loans increased 2.3% in the first quarter to $320.45 billion, a 3.3% increase year over year.

Credit quality remains strong

As of March 31, only 0.60% of home construction loans were 30-plus days past due or in nonaccrual status, down 40 basis points year over year, but up 7 basis points from the end of 2021.

The percent of past due and nonaccrual nonresidential construction loans fell to 0.84% at the end of the first quarter, down 30 basis points year over year and 6 basis points quarter over quarter.

Construction loan activity diverges among top lenders

Despite the overall surge in residential construction lending, the U.S.'s top three bank construction lenders, Wells Fargo & Co., Bank of America Corp. and JPMorgan Chase & Co., all reported year-over-year declines in both residential and nonresidential construction loans in the first quarter.

M&T Bank Corp., the No. 5 construction lender in the country as of March 31, could jump to the No. 2 spot now that its acquisition of People's United Financial Inc. closed April 1. People's United reported $920.7 million in total construction loans at the end of the first quarter.

During M&T's April 20 earnings call, CFO Darren King noted that while the company experienced increased paydowns for construction loans as customers rushed to lock in fixed-rate permanent financing before interest rates increased, line utilization for existing construction loans also increased from 2019 lows.

Little Rock, Ark.-based Bank OZK, the nation's sixth-largest construction lender as of March 31, and by far the bank most concentrated in construction loans among the top 20 lenders, reported a 28.5% increase in residential construction loans year over year and an 8.6% increase in nonresidential construction loans.

Outlook cloudy as interest rates rise

According to the U.S. Census Bureau's latest monthly reports, the seasonally adjusted annual rate of new home sales plummeted 26.9% year over year in April as average 15- and 30-year mortgage rates have soared since the end of 2021.

Meanwhile, the annual rate for privately owned new house building permits and housing starts were 3.1% and 14.6% higher, respectively, year over year in April. However, the annual rate for housing completions dropped 8.6% compared to April 2021.