S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

27 Nov, 2024

By Cathal McElroy and David Hayes

Ireland's lenders could face a doubling of the country's bank levy and restrictions on the use of deferred tax assets under proposals from the country's main opposition party ahead of a Nov. 29 general election.

Sinn Féin wants to increase the bank levy, which more than doubled to €200 million per year in 2023, to €400 million per year. The center-left party also proposed reducing banks' use of deferred tax assets, which has, since 2014, allowed lenders to reduce their tax bill by deducting historic losses.

The party was polling in second place, with 20% of the vote, going into the last week of the election campaign — wedged between its two main rivals, Fianna Fáil and Fine Gael, at 21% and 19%, respectively. Fianna Fáil and Fine Gael, which both openly refuse to serve in government with Sinn Féin due to its role in Northern Ireland’s "Troubles" conflict, have been in coalition government along with the Green Party since 2020.

"Policies like the increase to the bank levy and restrictions on the use of deferred tax assets would be unwelcome from a banking perspective," said Diarmaid Sheridan, senior director of equity research of Irish wealth management and investment banking services provider Davy.

Struggling to keep pace

An increase in the bank levy would disproportionately impact the smallest of Ireland's three banks, Permanent TSB Group Holdings PLC, or PTSB, which has struggled in recent years to keep pace with the growth of its two larger rivals, Bank of Ireland Group PLC and AIB Group PLC.

"The bank levy would present problems for PTSB unless there is another recalibration of how it's calculated," said John Cronin, European bank analyst at Seapoint Insights. "PTSB has much thinner profitability than the other two and if you double the levy the impact of that would be far more significant for PTSB than it would for AIB and the Bank of Ireland."

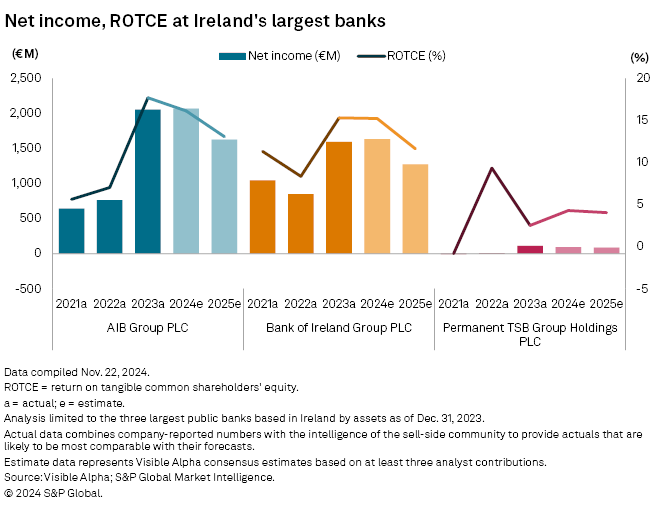

PTSB's return on tangible common shareholders' equity (ROTCE) — a key measure of profitability — is expected to reach 4.3% by 2024 year-end and remain relatively stable into 2025, according to Visible Alpha analyst consensus estimates.

The bank's profitability severely trails that of its peers, despite a similar business model and operating environment. Bank of Ireland is projected to record a 15.3% ROTCE for 2024 year-end, while AIB is forecast to post 16.2%.

"PTSB's results are still moderate," said Maria Parra, bank credit analyst at Morningstar DBRS. "They keep having a very high operating cost base which results in higher-than-peers' efficiency ratios."

Traumatic past

Any damage to PTSB from an increase in the banking levy could negatively impact the government, said Cronin. It could reduce PTSB's appetite for lending, harming economic growth and reducing tax revenues, while also devaluing the 57.4% stake the government still owns in the bank following its public bailout in 2010.

Sinn Féin's manifesto also proposes that the government retain its 19.98% stake in AIB, which received a similar bailout following the global financial crisis. The Irish government completed the sale of its stake in Bank of Ireland in 2022.

"It's unclear what Sinn Féin's intentions are in that respect," said Cronin. "So that would be negative from an investor sentiment perspective."

Sinn Féin's proposal to restrict the use of deferred tax assets would also dent banks' profits. The party wants to reduce the tax break for lenders, which are able to write off 100% of their historic losses against future profits, to 50%.

AIB had more than €2.5 billion of DTAs as of the end of June, Bank of Ireland had €665 million and PTSB had €298 million, S&P Global Market Intelligence data shows.

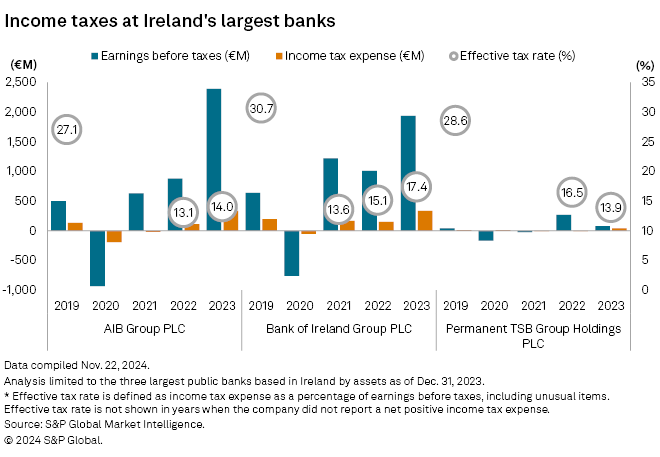

Irish banks and other corporations already enjoy a much lower tax regime than in most other European countries. The aggregate effective income tax rate at Ireland's three largest banks in 2023 was 15.5% compared to 21.4% among Europe's 25 largest lenders, according to Market Intelligence data.

Still, Sinn Féin's proposal for DTAs is "not exactly radical," said Cronin. The UK limits banks' use of DTAs to 25% of historic losses by comparison, he said.

Troubled history

The likelihood of Sinn Féin's proposals being implemented are slim. Beyond the sharp slump in support the party has suffered in the last 18 months, mainly due to in-party scandals and its liberal stance on immigration at a time of elevated tensions around the issue, Sinn Féin is unlikely to secure a role in any coalition government.

The party's links to outlawed paramilitary organization the Provisional Irish Republican Army during Northern Ireland's bloody "Troubles" conflict in the late 20th century makes it toxic to much of Ireland's political class and a large swathe of the country's voters. Sinn Féin was unable to form a coalition government after winning the most votes in 2020 due to opposition from other major parties, which have long vowed to never serve in government alongside it because of its role in the conflict.

The most likely election outcome is a continuation of the current coalition between Fianna Fáil and Fine Gael, Ireland's two establishment parties that have governed the country since its independence from the UK in 1922, according to political analysts. "There isn't anything radical or massively different that they're advocating relative to what they've been implementing in power over the last four years or so," said Sheridan.

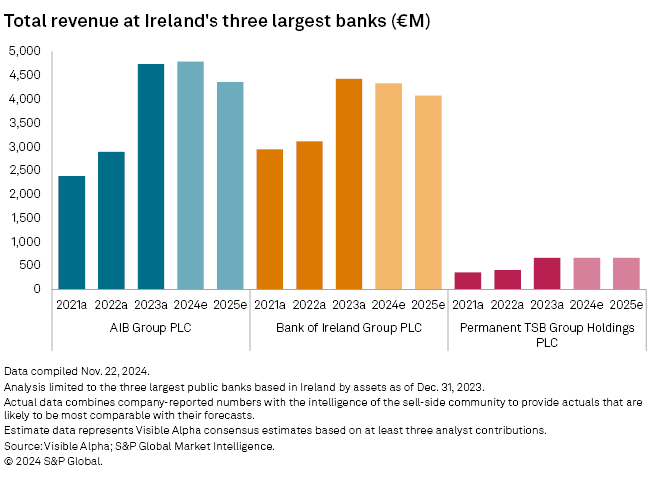

Ireland's two largest banks in particular will face any changes from a new government from a position of strength. Bank of Ireland and AIB's profitability and share prices have soared as higher interest rates, low deposit costs and strong economic growth have driven a surge in net interest income (NII), the banks' largest source of revenues. The exits of Belgian lender KBC Group NV and NatWest Group PLC's Ulster Bank from the Republic of Ireland have also boosted the banks' share of the lending market.

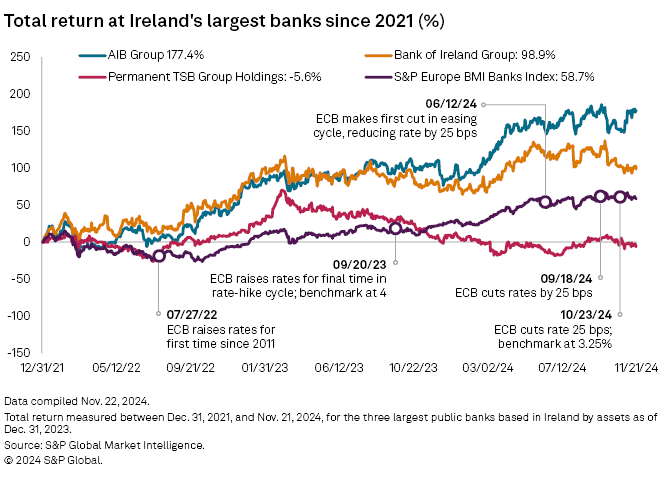

Total stock returns since the beginning of 2022 have increased 177.4% at AIB and 98.9% at Bank of Ireland, compared to a 58.7% rise by the S&P Europe BMI Banks Index, Market Intelligence data shows.

The banks' strong run is forecast to weaken slightly into 2025 as the impact of falling interest rates is felt. Profits are expected to shrink by around a quarter annually for both in 2025, according to Visible Alpha analyst consensus estimates. Still, ROTCE would remain in double-digits for both banks.

"Bank of Ireland and AIB have structural hedging programs, which are effectively hedges or risk insurance policies in the event that rates reduce, and that's going to be constructive in terms of their earnings profile over the coming years," said Cronin. "There's been a remarkable turnaround at both banks that's been strongly capital generative."