Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

11 May, 2022

By Peter Brennan and Umer Khan

The cost of doing business is a growing concern in the U.S.

Operating expenses of U.S. companies climbed sharply in the fourth quarter of 2021, reducing margins for companies in most sectors.

Margin squeeze

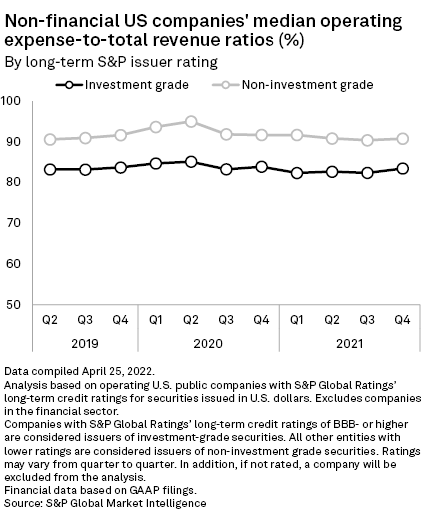

The median operating expenses-to-total revenue ratio — an important metric for measuring a company's margin — for investment grade-rated nonfinancial companies rose 1.1 percentage points to 83.5% in the fourth quarter of 2021, according to data from S&P Global Market Intelligence. That was the highest ratio since the fourth quarter of 2020, though still below the pre-COVID-19 level of 83.7%.

The median ratio for lower-rated non-investment-grade companies rose 0.4 percentage point, to 90.8%.

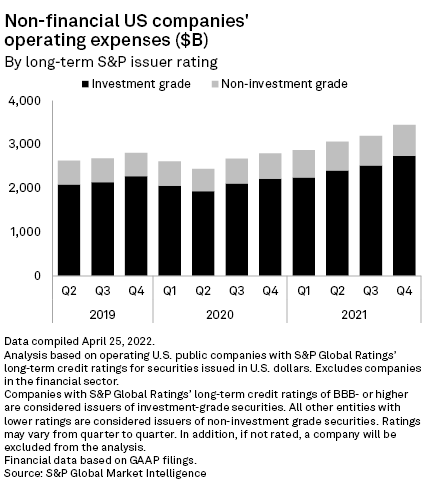

The relatively large quarter-over-quarter increase for higher-rated companies was driven by a sharp rise in operating expenses such as wages, energy costs, cost of inventories and rent. The total costs for investment-grade-rated nonfinancial public companies rose by 8.9% to $2.745 trillion from $2.521 trillion in the third quarter of 2021.

The quarterly increase in expenses for non-investment-grade companies was 3.5% to $702.8 billion. A strong quarter for earnings offset most but not all of these extra costs.

Wages, energy surge

The median ratio for investment grade utilities rose the most, increasing by 5.7 percentage points to 82.2% in the fourth quarter of 2021, ahead of consumer staples companies, where the ratio rose by 3.6 percentage points to 87.5% despite a relatively modest 4% increase in expenses.

Expenses have continued to rise in 2022 for U.S. companies as wages and energy costs surge. Inflation and a slowing economy are also putting pressure on revenues, potentially putting further pressure on the operating expenses ratio going forward.

Investment-grade-rated communication services companies increased operating expenses the most — by 21% quarter over quarter — and the median ratio rose the third-most, by 3.3 percentage points to 84.8%.