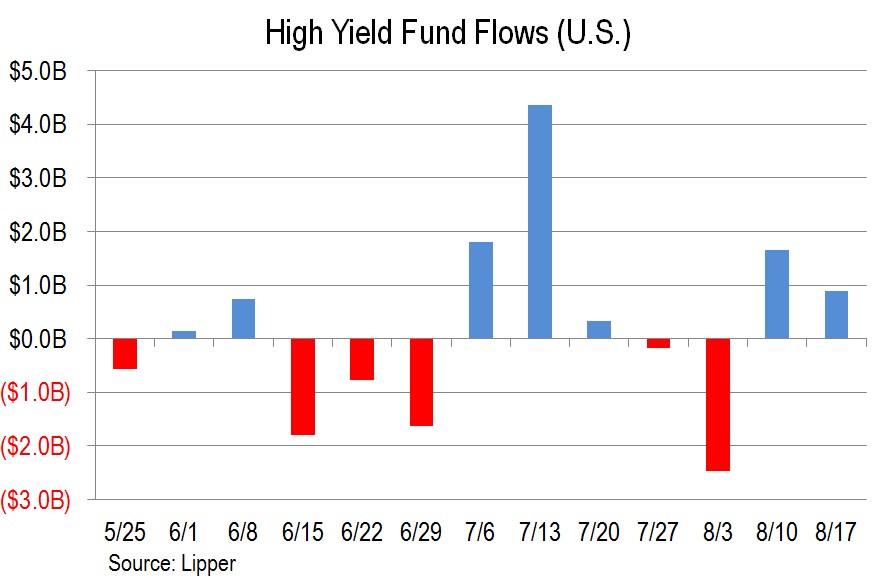

U.S. high-yield funds recorded an inflow of $888.9 million for the week ended Aug. 17, according to the weekly reporters to Lipper only. It’s the second consecutive week of inflows, but down from $1.65 billion last week.

ETF influence accounted for just 41% of the total, or $366 million, compared to 76% of last week’s ballooning inflow.

With another inflow, the four-week trailing average narrowed to negative $24 million, from negative $166 million last week.

The year-to-date total inflow is now $9.6 billion, with 32% ETF-related. A year ago at this juncture, the measure was an outflow of $1.45 billion, with 72% ETF-related.

The change due to market conditions this past week was positive $751.5 million, representing 0.4% of total assets. Total assets at the end of the observation period were $200.9 billion. ETFs account for about 21% of the total, at $41.9 billion. — Jon Hemingway

This story first appeared on www.lcdcomps.com, an offering of S&P Global Market Intelligence. LCD’s subscription site offers complete news, analysis and data covering the global leveraged loan and high yield bond markets. You can learn more about LCD here.