S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

16 Nov, 2021

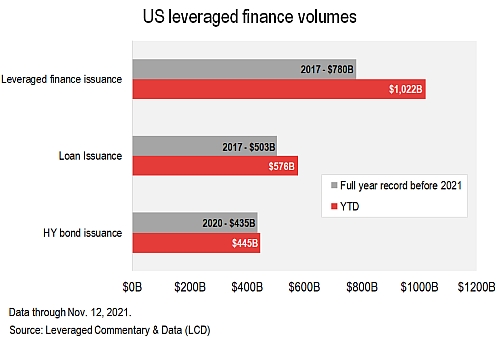

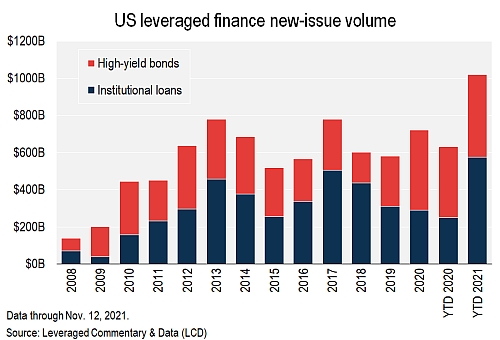

Sales of high-yield bonds and leveraged loans have surpassed the $1 trillion milestone for the first time in a calendar year, as speculative-rated companies have amassed cheap funding from yield-hungry investors.

Through Nov. 12, institutional term loan issuance totaled $576 billion, shattering the prior $503 billion record set in 2017, according to LCD.

The $445 billion of high-yield issuance in the year-to-date has also topped the prior record, 2020's $435 billion.

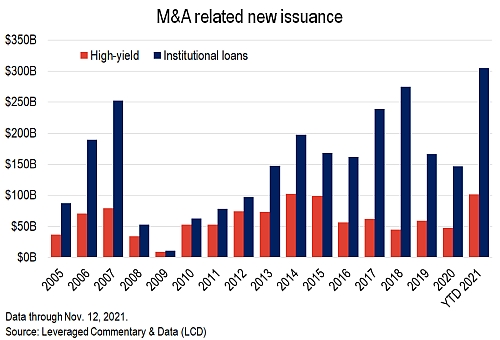

The volume of bonds and loans supporting mergers and acquisitions — the main source of net new supply — has been unprecedented.

Leveraged loans funding M&A has soared to a new high of $305 billion, far outpacing the 2018 full-year record of $275 billion. And with plentiful unspent capital at private equity firms meeting exceptionally low funding costs in 2021 (the average yield-to-maturity of new-issue LBO loans fell below 5% for the first time ever this year), a record $224 billion was driven by sponsored companies.

The amount of high-yield bonds issued for M&A purposes, meanwhile, is less than $1 billion shy of the $102.7 billion record set in 2014.

Setting this trend in motion, central bank actions to ease borrowing conditions for companies in the wake of the pandemic have kept yields low across the board in most asset classes, allowing issuers to tap funding from investors at some of the tightest yields on record. In addition to facilitating M&A financing, the current environment of low benchmark rates has also provided an opportunity to refinance costlier high-yield bond debt at a record pace in 2021.

Per LCD data, $283.6 billion of high-yield issuance this year has refinanced existing debt. That is up 13% from 2020's record-setting pace of refinancings and just $11 billion shy of the full-year 2020 record.

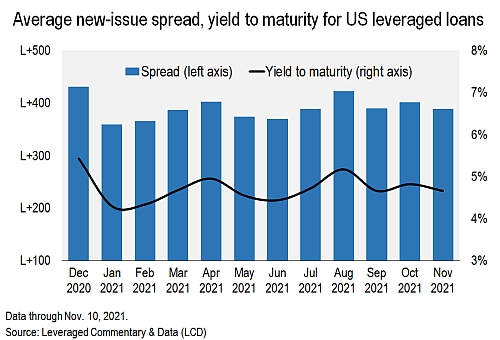

In regard to pricing, high-yield primary market issues in June sported a record low yield of 4.83%. In the six months through October, the average monthly new-issue yield was 5.26%. By comparison, before the Federal Reserve rolled out its 2020 support measures, the average new-issue yield in 2019 was 6.39%, and in 2018 it was 7.20%.

Similarly, companies on average paid a record low yield of 4.3% to fund in the leveraged loan market in January, and yields have remained below 5% every month this year, except August.

To put this all into perspective, high-grade borrowers paid an average yield of 2.15% to fund in 2021. In 2019, investors on average were offered a yield of 3.54% to buy investment-grade bonds in the primary market and 4% in 2018.

Looking ahead, 2021 will be a hard act to follow, both in terms of volumes and funding costs. Expectations that rates will rise across most asset classes will likely prompt a decline in refinancings, with companies having already made use of favorable conditions to push out debt maturities. Per Barclays credit research, high-yield issuance in 2022 is expected to fall roughly 17% from this year's annualized level. In loans, analysts led by Bradley Rogoff forecast an 11% drop from the 2021 annualized level.