S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

14 Jan, 2022

By Tim Siccion

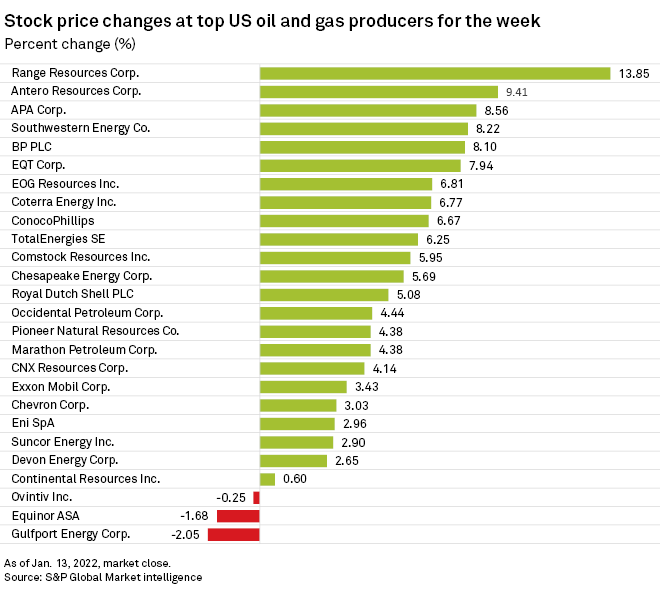

High natural gas prices will likely help oil and gas stocks sustain their 2021 rally into 2022 and keep large volumes of gas flowing to U.S. export terminals while inhibiting growth in the global LNG market.

The discipline of U.S. shale oil and gas producers in returning cash to shareholders rather than spending on growth has set the sector up for another year of outsized stock market gains in 2022.

In 2021, shares of U.S. shale oil and gas producers outperformed the S&P 500 for the first time in eight years. The broad S&P 500 Index gained 27%, while the S&P Oil & Gas Exploration & Production Industry Index gained 65%, according to S&P Global Market Intelligence data. For oil and gas exploration and production companies with market capitalizations of $1 billion or more, the gains were even greater at 136%; 21 of 37 drillers doubled or tripled in value for the year.

"The state of the energy sector — especially the upstream — versus a year ago is in many ways nearly unrecognizable," Sanford C. Bernstein & Co. analyst Bob Brackett told clients Jan. 4. "Crude prices rose ~55%, equities did better, beating the S&P handily while U.S. shale held to the low-growth, cash-return mantra that many investors may have dismissed as empty promises at the bottom of the cycle."

Another effect of the high gas prices is high volumes of natural gas deliveries to U.S. LNG export terminals, which show that operators have been pushing their facilities to produce extra cargoes to capitalize on the trend, sector analysts said.

Total feedgas deliveries to the six major operating U.S. LNG export terminals hit a high of nearly 13 Bcf/d in mid-December 2021 and have remained above 11 Bcf/d in the weeks since, according to S&P Global Market Intelligence pipeline flow data.

Average daily flows of about 11.7 Bcf/d in the first nine days of 2022 compare to about 11.1 Bcf/d over the same period of 2021, when LNG prices were also hovering around then-record highs as northern Asia's coldest winter in decades caused demand to soar.

Gas prices in Europe and Asia have fallen from late December 2021 highs but remain stronger than year-ago levels. Analysts generally expected prices in end-user markets to remain well supported throughout 2022.

But the high prices for LNG have a downside for the sector. Price volatility, combined with limited supply additions, will likely constrain the growth of the global LNG trade over the course of 2022, according to an outlook from Poten & Partners.

The oil and gas shipbroker forecast about 13.5 million tonnes per year of global supply additions in 2022, or about half of the world supply growth in 2021. Poten expected the U.S. to be a key driver of this growth in 2022 by contributing about 5 Mt/y of the new capacity.

"A lot has to go right for us to hit even this small growth forecast," Kristen Holmquist, Poten & Partners LNG forecasting manager, said during a Jan. 12 webinar. "We think that the volatility will continue and the market tightness will continue."

The outlook cited operational risks, such as weather disruptions or other unplanned outages, that could further limit supply growth. Production issues have lingered at some world facilities, including operations in Australia.