Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

24 Sep, 2021

|

|

A worker installs a battery on Toyota Motor Corp.'s production line in Onnaing, near Valenciennes, France. Toyota and other automakers aim to lower electric vehicle battery costs, but high raw material costs could hamper that effort, according to experts. |

Rising metal prices could slow the world's transition to clean energy by stalling efforts to cut the price of electric vehicles and battery storage systems.

Many countries are bent on electrifying transportation and energy sectors to avoid catastrophic damage from climate change. Achieving a low-carbon economy will hinge in part on making batteries less expensive. But prices for the critical minerals used in batteries, including lithium, nickel and cobalt, have exploded this year, pressured by pandemic-fueled supply chain constraints, a fresh surge in demand and a lack of new mining projects. That price boom could drive up battery costs and throw a wrench into plans to roll out cheap cars and energy storage systems, industry experts said.

"In the short term, the elevated metal prices are going to really hamper battery manufacturers' ability to continue to get cost reductions to their end-users and to their [original equipment manufacturers]," said Stuart Burns, founder and editor-at-large of Metal Miner, a metals procurement platform. "That could slow the uptake of EVs in the short to medium term."

Battery inputs key to prices

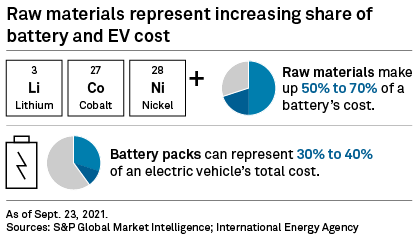

Raw materials represent the bulk of the total cost of a battery, between 50% to 70%, according to the International Energy Agency, or IEA. In turn, battery packs, or groups of individual battery cells, can represent 30% or more of an EV's overall cost. And in recent years that has worked to EV-makers' benefit, as the cost of certain lithium-ion batteries — the most expensive part of making an EV — declined by nearly two-thirds between 2014 and 2020, from $290/kWh to $110/kWh, according to Benchmark Mineral Intelligence data.

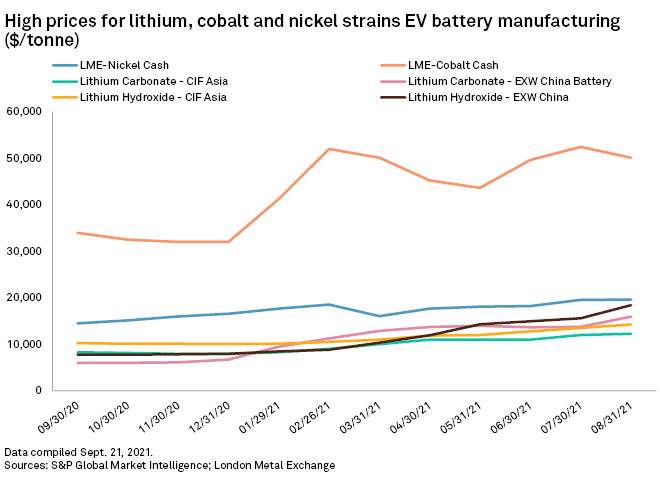

But prices for the ingredients for those batteries have been on the rise in 2021. The lithium carbonate CIF Asia price booked a 48.5% year-over-year increase, according to S&P Global Market Intelligence Aug. 31 data. Market Intelligence analysts forecast the price for lithium will stay high for the remainder of 2021, climbing by 33% this year, before declining slightly from those highs by 4% in 2022. Meanwhile, the London Metal Exchange nickel cash price soared 27.7% over the past year, while the LME cobalt cash price jumped 51.9% year over year.

Supply chain constraints sparked by the COVID-19 pandemic have exacerbated the price volatility across commodities. Labor force challenges and increased scrutiny on mining's environmental impacts have also weighed on manufacturers' ability to secure sufficient supply. The added expense associated with lesser-known battery materials like the chemical polyvinylidene fluoride has also caused overall battery prices to heat up, according to an analysis by Benchmark Mineral Intelligence.

"It's not a given that we are going to achieve these really low [battery] cell costs that people have targeted," Caspar Rawles, head of price and data assessments at Benchmark Mineral Intelligence, said in an interview. "It's extremely challenging to bring the cell costs down further when you've got raw material costs increasing rapidly."

Mining companies have shied away from pumping money into new mines, despite the expected high prices for their products, adding to the pressure on car companies and battery makers.

"W e are not seeing exploration budgets revisit their highs from almost a decade ago, as mining companies have taken a more prudent and conservative approach since 2012 to growing their asset portfolios," Market Intelligence analysts Paul Manalo and Kevin Murphy said in a June 30 report. " The lower exploration budgets in recent years due to this risk-averse attitude may threaten future supply pipelines as medium-term demand for certain commodities expands."

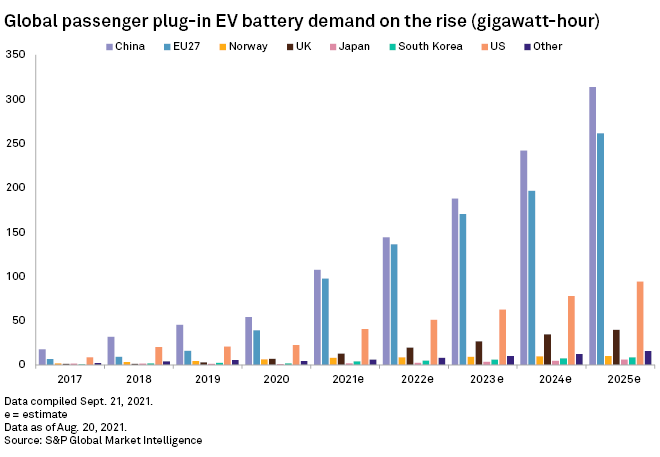

Without that funding, it is less likely there will be sufficient new mineral sources to meet rocketing demand for EVs. Those sales are expected to more than double in 2021 from last year to a record 6.6 million units, according to Market Intelligence data.

Higher prices could have a "significant effect," on the clean energy transition and industry's ability to meet cost targets, the IEA concluded in a May 5 report.

"A doubling of lithium or nickel prices would induce a 6% increase in battery costs," the report stated. "If both lithium and nickel prices were to double at the same time, this would offset all the anticipated unit cost reductions associated with a doubling of battery production capacity."

Battery storage pinch

Higher raw material prices could also slow grid decarbonization, as utilities, which use batteries all over the network, may have to keep fossil-fuel power plants in operation longer.

"A stable supply chain is absolutely critical to a timely clean energy transition," said Jason Burwen, interim CEO of the Washington, D.C.-based Energy Storage Association, which represents utilities, battery suppliers and energy storage project developers.

Suppliers of energy storage systems to the power market are also feeling the pinch of rising battery prices and product shortages this year, which come on top of appreciating prices for steel, electronics and shipping.

"All of those inflationary pressures are having a negative impact," Aaron Jagdfeld, CEO of Generac Power Systems Inc., a supplier of energy storage systems, said in an interview. "Supply chain is an area of high anxiety for anybody manufacturing anything today … If it's not supply shortages with cells or raw components, it's the logistics to get it to our customers."

Developers of small-scale and large-scale energy storage systems this year have been unable to keep up with ongoing strong demand. A big part of the challenge is competition for battery cells with producers of EVs.

Elon Musk, CEO of California-based car and battery maker Tesla Inc., said in July the company has "significant unmet demand" in storage as it prioritizes cells for its primary electric car business.

"This industry, storage, is going to kind of rise and fall, in terms of supply, based on what EV adoption or penetration rates look like," Jagdfeld said. "I think this is a momentary period, though," he added.

Hope in technology

Pandemic-induced supply chain constraints such as high prices may only have a short-term impact on the transition to clean energy. High material costs or other supply chain constraints will encourage energy storage manufacturers to accelerate technological advancements to ease the bottlenecks, said Haresh Kamath, director of energy storage and distributed energy storage resources for the Electric Power Research Institute, an electric utility-funded think tank.

"There's still quite a bit of manufacturing process costs that could probably be brought down over the next few years," Kamath said. "The question is whether the material supply costs rise to eat up some of those gains. "Right now, it doesn't look like they will, and that's happened because a lot of these manufacturers are looking ahead and trying to make sure that their supply chains are in order."

Automakers banking on EV sales to carry them into the future may seek novel battery chemistries or alternative materials amid high prices.

Toyota Motor Corp., the world's biggest automaker by volume, pledged to dish out $13.5 billion through 2030 for battery research, and it seeks to lower battery costs by at least 30%. Volkswagen AG, the No. 2 automaker, announced a plan to gradually chip away at the cost of EV batteries by 50%. Neither company responded to requests for comment for this story, but executives for both companies have made public goals to slash costs.

"As we develop battery materials in-house, we will be looking for lower-cost materials," Masahiko Maeda, Toyota's chief technology officer of battery development and supply, told reporters at a Sept. 7 media briefing.

In March, Thomas Schmall, Volkswagen's group board member for technology, said: "On average, we will drive down the cost of battery systems to significantly below €100 per kilowatt hour."

Leading battery producers Contemporary Amperex Technology Co. Ltd., BYD Co. Ltd., LG Chem Ltd., SK Innovation Co. Ltd. and others, have also sought to lower battery prices through technological advancements.

The U.S. government may also contribute $6 billion in grants for battery material processing, manufacturing and recycling to ease the battery industry's woes if the U.S. House passes an infrastructure bill in the coming weeks.

Still time

Although most manufacturers will have trouble controlling the prices of raw materials in the short term, many will look to soften the blow by trimming costs at other points along the production process and innovating. And manufacturers with longer-term contracts for raw materials could be shielded from the price volatility in the immediate term too.

"They are not going to be paying those really, really high spot prices immediately overnight," Rawles said. "It takes some time for that price to translate all the way through the market into long-term contracts and long-term agreements."