Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

21 Mar, 2022

| An industrial steelmaking mill in operation. Steelmakers are feeling squeezed by rising fuel costs on two fronts, as the energy-intensive sector primarily relies on metallurgical coal or electricity. Source: Frank Huang/E+ via Getty Images |

An energy price spike triggered by Russia's invasion of Ukraine has laid bare supply chain vulnerabilities that could curb global growth in the near term.

Flows of Russian oil, natural gas and coal have been disrupted, driving up prices for available energy commodities. Russian metals and mining companies have continued to make shipments and avoid sanctions despite broad global opposition to their government's war on Ukraine, but higher energy costs have battered Europe's aluminum, nickel and steel sectors, as well as South Africa's platinum miners. Russia's invasion came as prices for many metals were already increasing due to supply tightness for commodities such as aluminum, nickel and coal.

Some metal producers in less affected parts of the world such as the U.S. and Canada benefit from relatively lower energy costs, but they may be unable to quickly compensate for decreased production from higher-cost countries. Mining companies may also be reluctant to expand amid sudden price surges due to the expensive, years-long development process to grow production. The combined commodity and energy inflation is poised to diminish demand for metal-intensive consumer products and drive down global growth, analysts and companies said, though it may also accelerate a move away from fossil fuels by some companies.

"This whole war in Ukraine is going to fuel prolonged and severe inflation globally," said Tom Mulqueen, head of research at Amalgamated Metal Trading Ltd.

Steel, aluminum, nickel get pricey

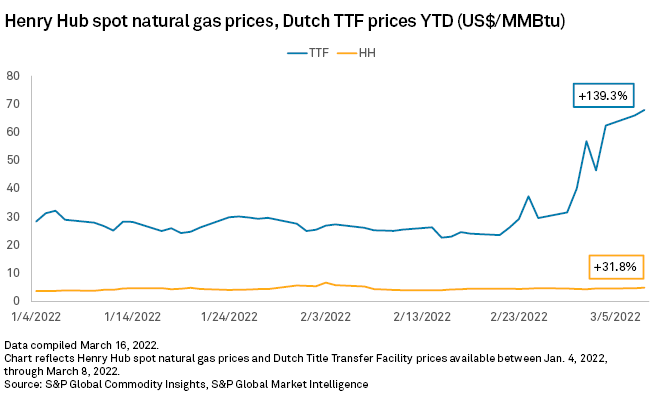

Recent spikes in energy prices could push more European metals such as aluminum out of the market, analysts and industry experts said. European metal producers are subject to fluctuations in electric costs, which often follow natural gas prices as the region is heavily dependent on Russian supply. Eurometaux, which represents major European metal producers including Glencore PLC and Norsk Hydro ASA, sounded the alarm in a Jan. 18 letter about rising energy costs and resulting cuts to aluminum and zinc production. European gas prices leaped to $67.92 per MMBtu in early March, up 139% from the start of the year.

"Europe is probably the place in the world that will be by far the most impacted," said Jean Simard, president and CEO of the Aluminum Association of Canada. "It's unfortunate, given the situation in Ukraine, but Canada is benefiting."

For steelmakers, the squeeze from rising fuel costs is coming on two fronts as the energy-intensive sector primarily uses either blast furnace or electric arc furnace technology. The former relies heavily on metallurgical coal, while the latter requires other energy inputs such as electricity from a grid.

"It's almost like it's a double whammy," said Ronnie Cecil, an analyst with S&P Global Commodity Insights' Metals and Mining Research team. "You can't escape from this either way. If you're a coal-based steelmaker, you're going to be hit by the massive increase in coking coal prices. If you're an electric arc furnace steelmaker, particularly in Europe, you're going to be fried by the power costs."

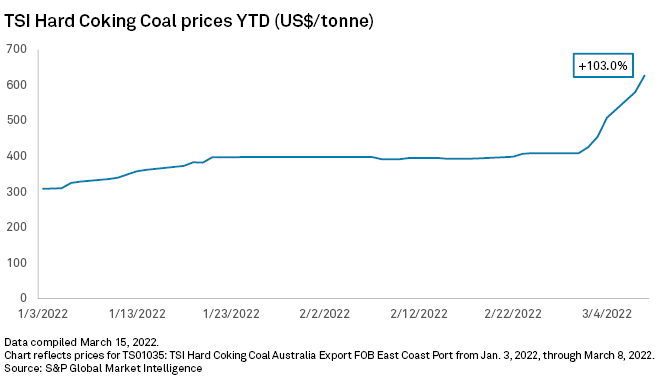

In a March 8 note, B. Riley Securities analysts Lucas Pipes and Matthew Key increased share price targets on coal companies producing metallurgical coal due to rising prices. Commodity Insights assessed the Australian premium low-vol hard coking coal at $670/t as of March 14, representing an increase of more than 50% in one month. As coal prices soared, so too have prices for liquid natural gas and oil, which has recently traded for over $100 a barrel.

Timna Tanners, a mining analyst with Wolfe Research LLC, noted that coal prices also face upward pressure from other sources, including impacts related to COVID-19. While prices were already climbing, the Russia-Ukraine conflict sent the price of the metallurgical coal used in steelmaking skyward.

"The market is really paying the price for not having an alternative to Russian coal [or] Ukrainian coal," Tanners said.

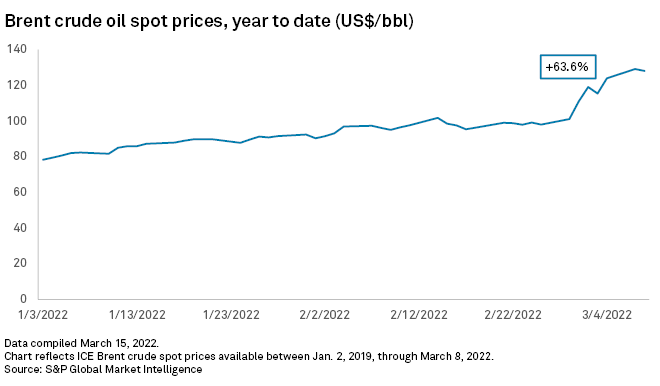

The high price of diesel

Miners without much exposure to natural gas or power prices are under pressure due to the rapidly increasing price of diesel fuel. The price of Brent crude jumped to over $130 a barrel as the invasion of Ukraine ramped up, though it began to fall closer to $100 a barrel in recent trading.

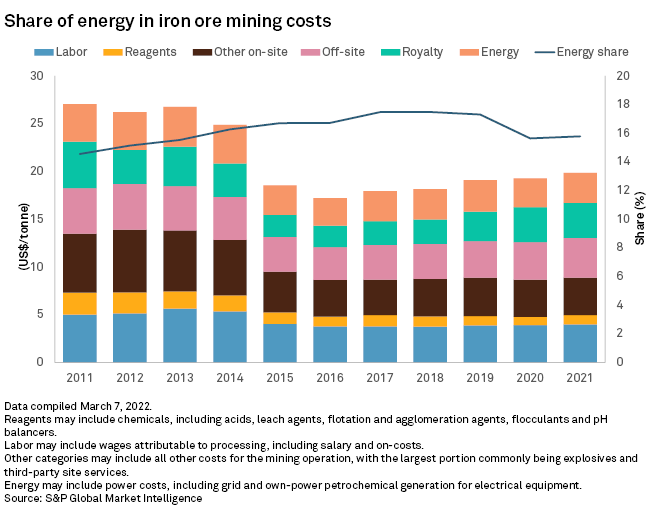

While iron ore is among the few commodities to avoid war-related price volatility, its miners still depend on heavy, diesel-fueled trucks.

Energy accounted for about 15.8% of mined iron ore costs in 2021, and that proportion has been as high as 17.5% in the past decade, according to Commodity Insights data. A BHP Group Ltd. spokesperson confirmed to Commodity Insights that energy costs are increasing as a result of Russia's invasion of Ukraine, and said the company is well-positioned to manage them.

Iron ore miner Fortescue Metals Group Ltd. is "operating in an environment of industry-wide cost inflation due to strong demand for labor and skilled resources, as well as an exposure to external factors, including the escalating cost of diesel," CEO Elizabeth Gaines said in an email.

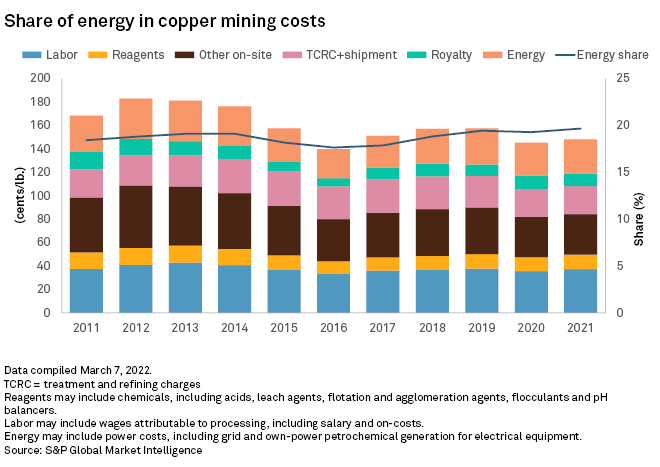

Energy accounts for 19%-20% of copper mining costs, according to Commodity Insights data, and the industry will be spared some of the effects of rising energy prices where hydropower is a significant energy source, such as in Canada and Chile. But analysts noted most truck fleets operating in large open-pit copper mines use fossil fuels.

"It's massively exposed to diesel," said Mark Fellows, CEO of Skarn Associates, a U.K.-based consultancy that focuses on carbon emissions in the mining sector. "The same is true to a large extent for gold."

Remote mines without direct access to energy are set to be hit hardest by rising energy prices, due to their dependence on diesel generators, Dan Kemp, chief investment officer at Morningstar Investment Management, said in an email. Rising energy costs are "likely to offset some of the benefit of rising prices on the profitability of miners," Kemp said.

On that front, South Africa's platinum producers are among the miners most heavily exposed to rising energy prices, in part because platinum prices have not jumped as much as many other metals in recent months, resulting in less ability to absorb higher costs, said Jason Holden, a Commodity Insights analyst.

Still, some miners will have locked in fuel contracts and may not be immediately hit by the recent spike in energy prices, said Commodity Insights analyst William Mason. For those miners with contracts, the impact of higher energy prices may not be felt until later in 2022. "But for the ones that buy basically off barrel, they're going to see an increase in their mining cost," Mason said.

Trying to make up the difference

Producers outside of Europe are not as directly affected by natural gas and power prices, as local sources of hydropower or coal provide insulation from Russia-related disruptions. But few have much slack to raise production to levels needed to make up for disruption elsewhere.

"Refineries for these metals, which are largely concentrated in [the Asia-Pacific region], are relatively less impacted compared to those based in Europe, where metals producers in general have been dealing with higher energy costs even before Russia's invasion of Ukraine just like what has been observed in European aluminum producers," said Allan Ray Restauro, a metals and mining associate at BloombergNEF.

Canada, a key aluminum-producing country, is unlikely to be able to increase output to meet shifting demand due to shutdowns by European producers or in the event Russian aluminum stops flowing into the European market. Canadian aluminum producers have little spare capacity and are operating at 93%-95% of smelter utilization, Simard said. This could mean European aluminum buyers will have to source more supply from China, where production typically relies on coal-fired electricity.

"We probably will end up with more carbon-heavy footprints of semi-finished products coming from China," Simard said, noting that energy accounts for nearly a third of the cost of smelting aluminum.

Slower growth, faster decarbonization

Globally, growth could also slow, BHP CEO Mike Henry told the Australian Financial Review Business Summit on March 8. The diversified mining giant is forecasting a possible 0.5% decrease to global growth forecasts in the coming year, as compared to what it was previously anticipating, which Henry attributed to "a combination of the impacts of Russia-Ukraine, but also China coming out with a slightly more positive, or aggressive, growth target than some were anticipating."

Taking a similar view, Chris Berry, an independent analyst and president of House Mountain Partners, said rising energy prices will hit growth and may impact the price and roll out of metal-intensive products such as electric vehicles.

"If oil and gas and your commodity input costs increase across the board, it's just going to slow growth down," Berry said. "I don't care what the industry is."

Beyond the more immediate increases to operating costs, skyrocketing fossil fuel prices could also speed the longer-term push by many mining companies to decarbonize operations. Miners are increasingly looking to electrify their truck fleets, while equipment suppliers are racing to develop electric or lower-carbon large-tonnage trucks.

Gaines said Fortescue Metals is working to decrease diesel use across operations to cut exposure to fossil fuels and price volatility due to geopolitics, among other things.

"What we're experiencing right now could well be the energy shock that catalyzes an acceleration in that decarbonization," Fellows said.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.