Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

20 Apr, 2022

By Avery Chen

|

China Baowu Steel Group employees work at its steel factory in Maanshan, in China's Anhui province. Baowu is the parent of Baoshan Iron & Steel Co. Ltd., which has hedging plans for 2022 including as much as 8 million tonnes of iron ore and 2.2 Mt of hot rolled steel. |

A growing number of Chinese metals and mining companies have started using derivatives to hedge against unprecedented volatility in commodity prices, despite risks that could prove disastrous.

Global commodity prices fluctuated in recent years amid the COVID-19 pandemic, Russia's war in Ukraine and the global energy crisis. Metals and mining companies in China have reacted by hedging their bets in financial markets. In general, companies trade in futures and options to lock in trading prices of their raw materials and products. They hope to secure revenues and reduce potential losses and gains.

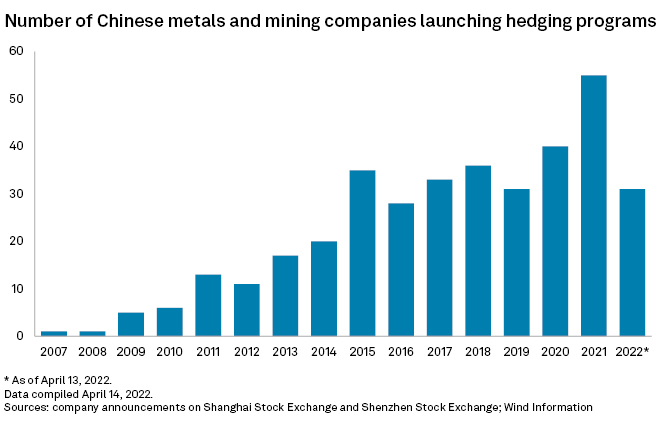

Fifty-five Chinese companies from the metals, steel and coal sectors kicked off hedging programs in 2021, up by 29% year over year and hitting a record high, according to S&P Global Commodity Insights' calculation based on companies' voluntary announcements on the Shanghai Stock Exchange and the Shenzhen Stock Exchange. In 2022, 31 Chinese metals and mining firms released hedging plans as of April 13, 14.8% higher than the same period of 2021.

But hedging is a double-edged sword, as nickel traders learned March 8, after nickel and stainless steel giant Tsingshan Holding Group Co. Ltd. tried to cover a short position that drove up nickel prices so fast that the London Metal Exchange halted trading and unwound all deals made on the day.

"Hedging should aid companies in reducing the impact of prices' fluctuation on their main business," Kenny Ng, securities strategist at Hong Kong-based China Everbright Securities International, told Commodity Insights in an April 11 interview.

Hedging against volatility

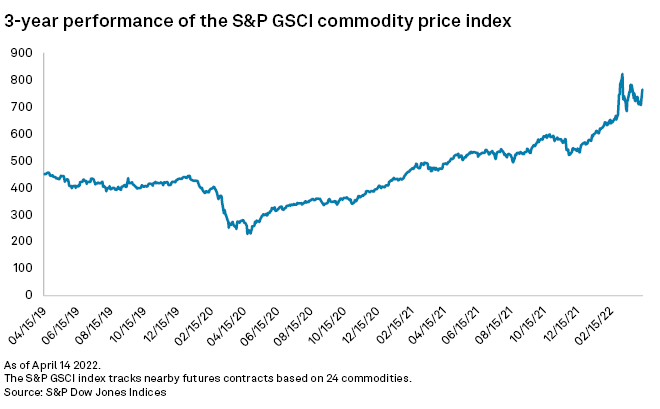

Commodity prices have been surging in the past couple of years. The S&P GSCI index, which tracks 24 commodities, jumped more than 260% from a low of 228.24 on April 21, 2020 to 822.3 on March 8, the highest level since 2008, and has since been in flux.

With some metals prices hitting historical highs, miners concerned that metals prices will fall sharply this year might take a short position to prevent a potential shock to their earnings, Ng said.

However, if they have built a large hedging position and those predictions go wrong, the losses will hurt their profits, Ng said.

"For most of the Chinese miners, the main purpose of hedging is to prevent falling raw ore prices [to cause losses]," Xia Yingying, a metal analyst at Nanhua Futures Co., told Commodity Insights April 14.

In practice, those companies usually sell futures contracts that cover the same amount of ore to be sold in the spot market, with a delivery date in the futures market that is the same as, or close to, the trading date in the spot market. Then the miners can close out the futures contract position when they actually sell the ore in the spot market and lock in trading prices, the Hangzhou-based analyst said. Some miners use options, which have more complex structures and provide more flexibility, Xia added.

Integrated metals producers are also looking to hedge against rising raw material prices.

"[The smelting segment] must use derivative instruments to lock in processing profits and reduce the volatility of the operation," Wu Honghui, financial controller of Zijin Mining Group Co. Ltd. told investors on a March 21 call.

Zijin mainly conducts its smelting business in the domestic market, but it relies on foreign raw materials and sells the majority of its products in the overseas market, Wu said.

Meanwhile, companies with overseas operations have started foreign currency hedging. For example, top steelmaker Baoshan Iron & Steel Co. Ltd. plans to use cross-currency swaps, interest rate swaps and structured products for its foreign currency hedging program in 2022, involving a total of no more than $15.99 billion.

China's largest lithium company, Ganfeng Lithium Co. Ltd., plans to invest no more than 10 billion yuan in 2022 foreign currency hedging, up from 5 billion yuan in 2021. Ganfeng uses forward settlements, foreign currency swaps and foreign currency options for its foreign exchange hedging, Yang Manying, CFO and vice president of Ganfeng, told investors April 8. "In order to hedge the impact of interest rate and exchange rate fluctuations on the operation, foreign exchange hedging business is carried out opportunistically according to the market fluctuations," Yang said.

Those companies are preparing for a much greater fluctuation of foreign exchange rates, China Everbright's Ng said. The U.S. Federal Reserve has entered an interest-rate hiking cycle in 2022, but China is expected to further ease monetary policies to counter downward economic pressure from a COVID-19 resurgence, which might drive overseas investors to pull money out of China, the securities strategist added.

Double-edged sword

While hedging strategies are designed to lower risk and volatility, risks are inherent in using derivatives.

The biggest risk faced by Chinese miners is that they might not find products in futures markets that completely match what they produce, Xia said.

Tsingshan Holding Group Co. Ltd. faced $8 billion in paper losses after nickel prices more than doubled to hit a record high of above $100,000/tonne on March 8 after Russia invaded Ukraine.

Tsingshan had built a short position of 150,000 tonnes of nickel on the LME through regular hedging over years, Bloomberg News reported. The world's largest nickel producer believed prices would fall after it ramped up battery-grade nickel capacity in Indonesia, according to the report.

Ideally, short-sellers such as Tsingshan borrow commodities and immediately sell them, then repurchase them when the prices fall. And they can give those commodities back to lenders and profit from the price differentials. However, the unprecedented rally in nickel prices forced Tsingshan to provide more cash to meet the minimum margin requirements, which also kept rising with nickel prices.

Tsingshan could return nickel to lenders. But the company mainly produces lower-grade nickel pig iron, compared to the high-grade metallic nickel that it trades on the LME.

"The mismatch on assets and maturity turns Tsingshan's hedging into speculation," Gu Fengda, director of the research and consulting department of Guosen Futures, said during an April 12 webinar.

Tsighshan's derivative department failed to issue early warnings and adjust hedging positions when nickel prices rose about 20% over approximately 20 days in January, Gu added.

Hedging against hedging

Other Chinese miners are more cautious. Zijin "has always been prudent in hedging," and has hired a professional team to manage its complicated bets, Zijin's Wu said. There is strict control on the scale of hedging and clear regulations on the stop-loss limit, and the smelters also have exposure limits, Wu added.

Zijin is hedging no more than 4% of the current year's output for mined products.

"We have been very cautious this year, with a gold position of just over 300 kilograms, a copper position of only 500 tonnes of observational positions, a zinc position of about 12,000 tonnes and a 40,000-tonne iron ore position. So, the overall position is very small," Wu said.

As of April 19, US$1 was equivalent to 6.39 Chinese yuan.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.