S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

3 May, 2021

By Morgan Frey, Jiayue Huang, and Jason Woleben

Global healthcare IPOs during the first quarter of 2021 more than doubled year over year as the pandemic highlighted the need for innovative therapies, vaccines and diagnostics.

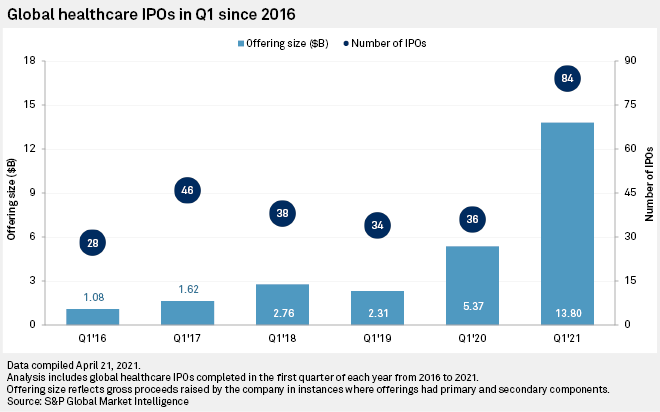

According to data compiled by S&P Global Market Intelligence, 84 healthcare companies went public globally, the highest number of first-quarter IPOs over the last five years. The total valuation of these offerings was $13.80 billion, more than double the $5.37 billion of offerings in the first quarter of 2020.

The offerings continued a strong trend from the fourth quarter of 2020, which saw 87 companies go public at a total valuation of $13.75 billion.

According to an April 15 report by consulting firm Ernst & Young, healthcare joined industrials and technology as the sectors that saw the highest number of global IPOs during the first quarter. The report's authors attributed the IPO "boom" to the value placed on vaccines, therapeutics and virtual healthcare during the pandemic, as well as the U.S. Food and Drug Administration's continued review and approval of new treatments.

Peter Behner, EY's global life sciences transactions leader, told S&P Global Market Intelligence that healthcare IPO deal values for the remainder of 2021 were likely to fall between 2019 and 2020 levels.

"2020 was an all-time record here, actually. 2021 will probably not get quite there, but I still expect a very strong year," Behner said.

A "massive" amount of liquidity in the IPO market has fueled some of this growth, with some companies trying to hop on the bull IPO market ride while there is still time, Behner said.

"There is still a lot of liquidity in the market. [Companies have] very high valuations, which is a point of concern, and a lot of people expect the market at some point to take a nosedive," Behner added.

The pandemic's impact on sectors like traditional retail and hospitality may drive investors to other industries, EY said, and technology and healthcare will still lead the pack in the short term.

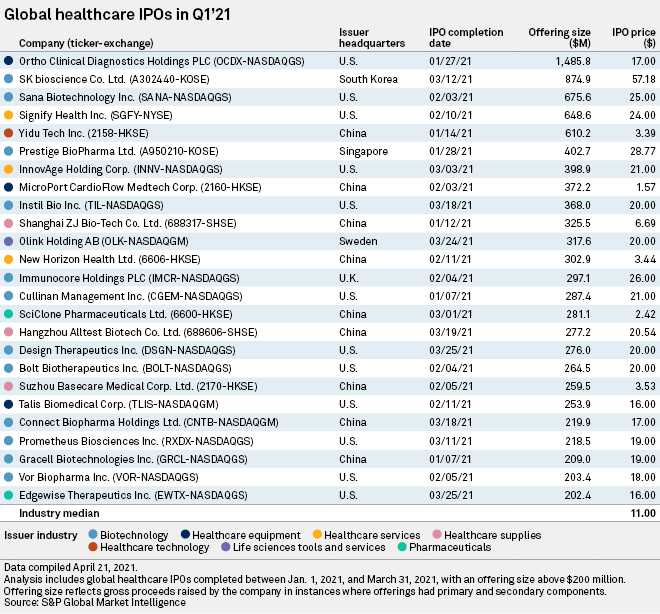

Healthcare equipment company Ortho Clinical Diagnostics Holdings PLC, for example, was the largest offering of the quarter, raising about $1.49 billion in proceeds. The Raritan, N.J.-based company provides medical instruments and assays used for diagnosing various conditions. In March, the company was awarded a contract with the U.S. Biomedical Advanced Research and Development Authority, or BARDA, and the U.S. Defense Department to support the production of their COVID-19 serological and diagnostic tests.

SK bioscience Co. Ltd.'s offering in March was the second-largest IPO of the quarter at nearly $875 million. Known for its vaccines, including flu, rotavirus and chickenpox, the South Korean company signed an agreement to domestically manufacture and commercialize Novavax Inc.'s coronavirus vaccine candidate prior to the public offering.

Other notable moves included cell-engineering company Sana Biotechnology Inc.'s $675.6 million offering in the U.S. and Chinese medical device manufacturer MicroPort CardioFlow Medtech Corp.'s $372.2 million listing in Hong Kong.

Ke Yan, Singapore-based head of research at DZT Research, said on average the size of IPOs in Hong Kong will likely be smaller than last year.

"The listing craze of Chinese biotech companies in Hong Kong has entered a mid-phase, meaning the ones focusing on red-hot treatments for large indications such as PD-1 cancer therapies have mostly listed," Ke said.

"Many companies seeking to go public now are working on either niche areas with small patient populations or are in the early stages of exploring innovative treatments for large indications that do not have an effective therapy yet," Ke added. "Both, in general, may have smaller valuation than the companies listed before."

Biotech, equipment suppliers lead listings

Of the top 25 IPOs of the quarter, 12 were biotechnology companies. There were three offerings each from healthcare services, healthcare equipment and healthcare supplies providers, as well as two pharmaceutical companies, one healthcare technology company, and one life sciences tools and services company.

"If you look at the year-to-date numbers, biotech [and] healthcare equipment and supplies make up 90% of the initial public offering value. So from my point of view, those two segments will also drive the year home," EY's Behner said.

Despite early growth in public listings by Chinese biotech companies, the first quarter saw larger offerings from healthcare technology, healthcare equipment and medical supplies companies. China's largest offering for the quarter was Yidu Tech Inc., a healthcare technology company whose stock price jumped 148% shortly after its trading debut in January.

Tencent Holdings Ltd.-backed online medical consultation platform We Doctor Holdings Ltd. also applied to go public on the Hong Kong Stock Exchange amid a surge in pandemic-related demand for remote medical services.

Ke said the We Doctor filing will be one of the main listings in the Hong Kong healthcare market in future quarters, with other online medical healthcare companies expected to join it.