S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

31 Jan, 2022

By Morgan Frey and Kris Elaine Figuracion

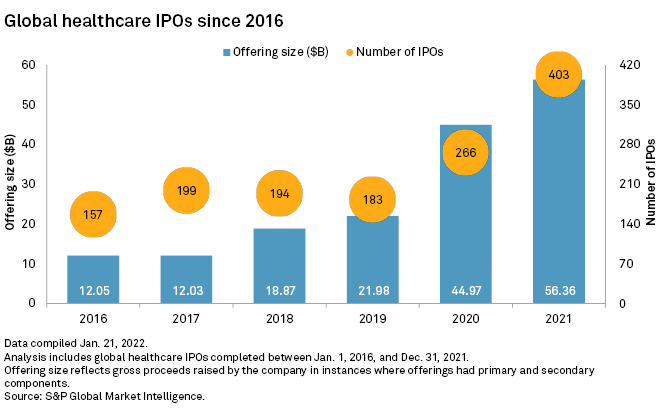

Healthcare companies raised a record-breaking $56.36 billion across 403 IPOs in 2021, with Chinese companies accounting for the majority of fourth-quarter offerings.

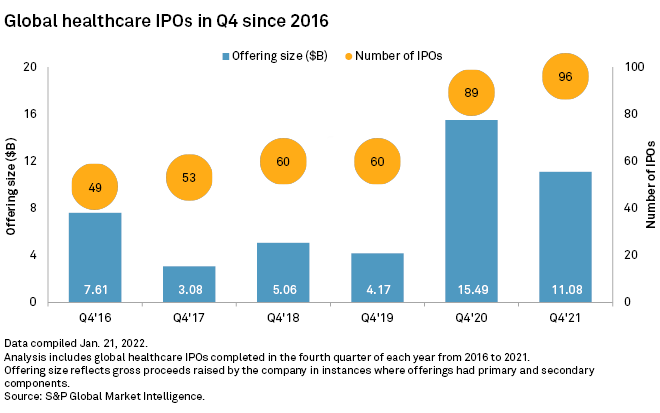

Despite the highest full-year IPO volume and amount raised to date, the fourth quarter only brought in seven more offerings than the prior-year period and raised $4.41 billion less, according to an S&P Global Market Intelligence analysis.

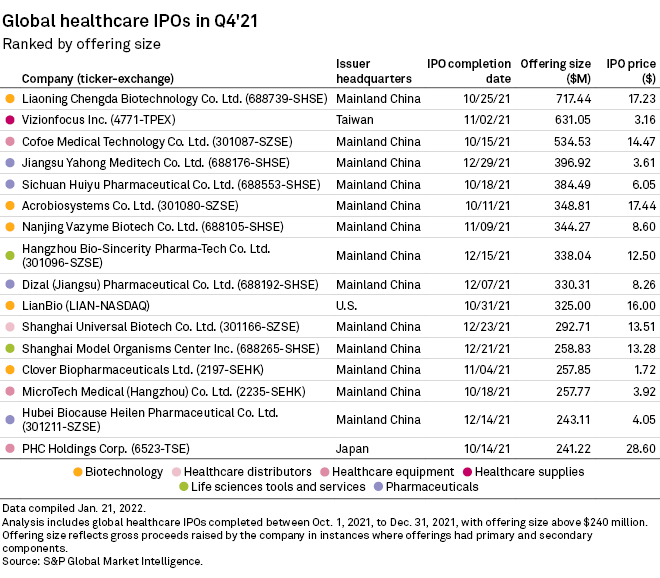

Healthcare companies based in mainland China followed up on a strong third quarter by accounting for 13 of the 16 largest IPOs in the final three months of 2021. Vaccine-maker Liaoning Chengda Biotechnology Co. Ltd. led the pack with its $717.4 million offering on the Shanghai Stock Exchange, followed by contact lens-maker Vizionfocus Inc. and at-home medical device-maker Cofoe Medical Technology Co. Ltd.

The fourth quarter also saw major cross-listings. Cancer-focused BeiGene Ltd. — which is already listed on both the Nasdaq and the Hong Kong Stock Exchange — raised $3.5 billion in its December IPO on the Shanghai Stock Exchange's STAR market, while German drug discovery company Evotec SE, which trades on the Frankfurt Stock Exchange, raised $500 million from its IPO on the Nasdaq.

Drop expected this year

While 2021 was a blockbuster year for healthcare IPOs, 2022 is likely to see a drop back to 2020 levels, according to Glenn Hunzinger, partner and pharmaceutical and life sciences consulting solutions leader at consulting firm PwC.

"2021 was really a unique and exceptional period of investment," Hunzinger told Market Intelligence. "The opportunity to raise capital will still be there, it just won't be at the levels it was in 2021."

The price paid for biotechs is likely to drop after the poor performance of many newly listed companies, Hunzinger said.

The biotechnology subsector accounted for 45% of all global healthcare IPOs and 43% of global healthcare IPO proceeds in 2021, according to consulting firm Ernst & Young. While the S&P 500 ended the year up nearly 27%, the S&P Biotechnology Select Industry Index fell 20.5%.

Despite this trend, 2022 is still expected to be an exciting year for biotechs, driven by an acceleration of mergers and acquisitions, Hunzinger said. "That should continue to refuel the level of venture investing as well as IPOs."