S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

13 Apr, 2021

By Chris Rogers

Container line Hapag-Lloyd AG has noted a marked increase in vessels waiting to be unloaded outside the port of Oakland, Calif., with 24 ships at anchor representing a doubling in the past month. The company said that is due in part to reduced capacity linked to a crane replacement. The latter may not be back in place until May. Congestion at the ports of Los Angeles and Long Beach, meanwhile, has continued close to prior elevated levels.

U.S. seaports more broadly remain under pressure. Total U.S. seaborne imports increased 50.5% year over year in March and by 36.9% compared to March 2019 due to stronger consumer products deliveries, as discussed in Panjiva's research of April 12.

Panjiva's analysis of official data shows total container handling through the port increased 27.0% year over year in March and by 12.9% compared to the same period of 2019. That was led by a 45.5% year-over-year increase in imports of loaded containers, which was also equivalent to a 30.5% rise versus 2019.

There was also a 65.6% jump in exports of empty containers, which may draw the Federal Maritime Commission's attention given its ongoing review of the container-lines handling practices, though handling was 6.3% lower than the same period in 2019.

Oakland's crane upgrade has been partly the result of the need to meet the needs of ever-larger vessels and the container lines' desire to offer higher-reliability and expedited services. The most recent of the latter has been the shift by CMA CGM SA of its SeaPriority service to call at Oakland.

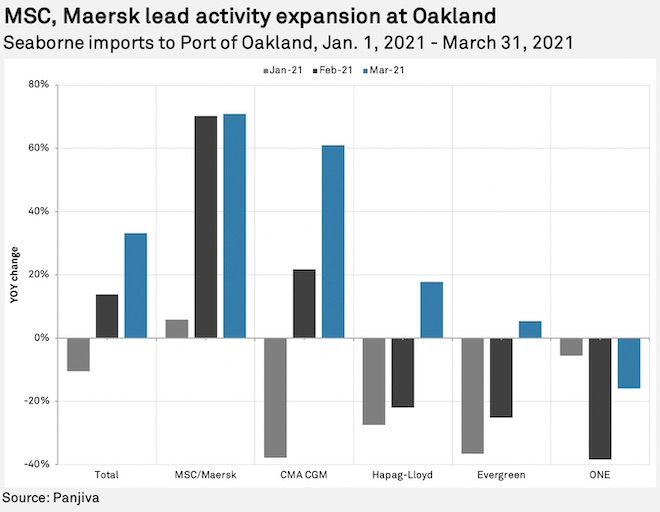

Panjiva's data shows seaborne imports to Oakland handled by CMA CGM surged 60.9% year over year. Leading users of CMA CGM's services into Oakland in 2021 have included Carlyle Group Inc.'s Saverglass, Berkshire Hathaway Inc.'s RC Wiley and Anheuser-Busch Inbev SA. Shipments linked to Hapag-Lloyd, meanwhile, increased by a more modest 17.8%, possibly at the expense of its THE Alliance partner Ocean Network Express Pte. Ltd., whose shipments fell 15.9%. MSC Mediterranean Shipping Co. SA and A.P. Møller - Mærsk A/S, however, remained the largest shippers into the port with growth of 70.9% following similar growth in February.

Christopher Rogers is a senior researcher at Panjiva, which is a business line of S&P Global Market Intelligence, a division of S&P Global Inc. This content does not constitute investment advice, and the views and opinions expressed in this piece are those of the author and do not necessarily represent the views of S&P Global Market Intelligence. Links are current at the time of publication. S&P Global Market Intelligence is not responsible if those links are unavailable later.