Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

24 Aug, 2021

By Joyce Guevarra and Drew Wilson

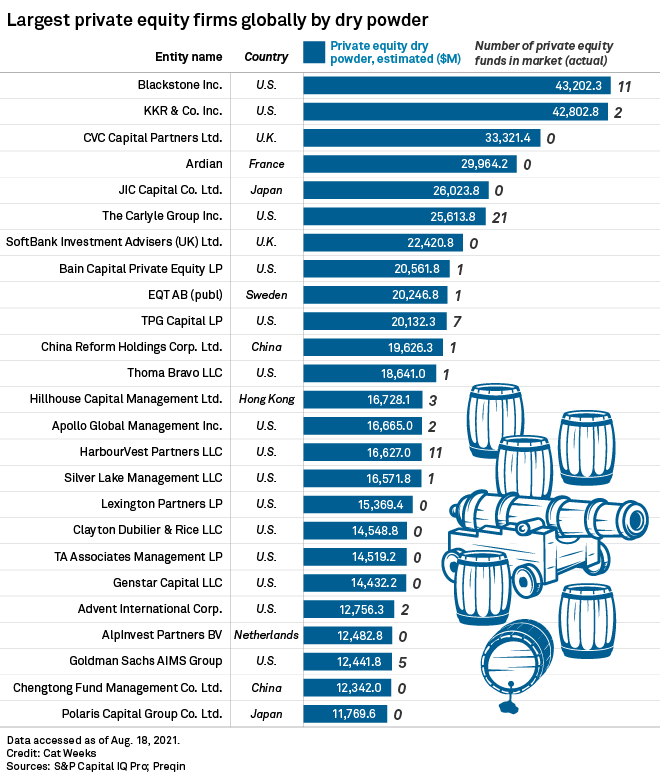

Globally, 25 private equity firms hold $509.81 billion in dry powder, or capital committed by investors that has not been invested or allocated, according to data from S&P Global Market Intelligence and Preqin as of Aug. 18.

The firms hold 22.3% of the record $2.286 trillion in total global dry powder, Preqin estimates show.

The U.S. dominates with 15 private equity firms on the list. Blackstone Inc. holds the highest amount of cash with $43.20 billion followed by KKR & Co. Inc. with $42.80 billion.

Both firms have funds in market, with Blackstone raising capital across 11 platforms. The funds include Blackstone Capital Partners Asia II LP with a target of $6.4 billion; Blackstone Energy Partners III LP, which aims to raise $4.5 billion; and Blackstone Strategic Capital Holdings II LP, which is targeting $4 billion in commitments.

KKR is in the market with two funds. In April, the firm said it intends to raise over $100 billion during 2021 and 2022 after a record $44 billion global fundraising in 2020.

European firms CVC Capital Partners Ltd. and Ardian, and Japan's JIC Capital Co. Ltd. round off the top five. JIC, which is sponsored by Japan's Ministry of Finance, is one of two firms on the list with government backing. The other is China's Chengtong Fund Management Co. Ltd., which is backed by state-owned SASAC.

In terms of the main regions, North American firms hold about 50% of the dry powder total, Asia about 27% and Europe 18%, Preqin data shows.

Deployment and deals

The flight to familiar brand name funds during the pandemic, low-interest rates providing cheap leverage and the popularity of special purpose acquisition companies are among the factors driving capital accumulation.

Six of the firms from the list have invested 5% or more in at least one SPAC, data from S&P Global Market Intelligence shows. These firms include Blackstone, KKR, Softbank, Bain Capital Pvt. Equity LP, TPG Capital LP and Apollo Global Management Inc.

The concerns are now about deployment. With record capital to invest, private equity firms competing for desirable target companies can drive up valuations, which may dilute expected returns. Additional pressure to invest may come from LPs, who want to see their capital at work.

Against this backdrop, deals continue unabated. A huge cash pile has helped boost private equity and venture capital deal-making globally in the first half with U.S. entry volume and value reaching five-year first-half highs in 2021. European deal-making, on the other hand, is on track to set records for 2021 after first-half transaction volume and value figures topped all first-half results since 2017.