Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

11 May, 2022

By Robert Clark

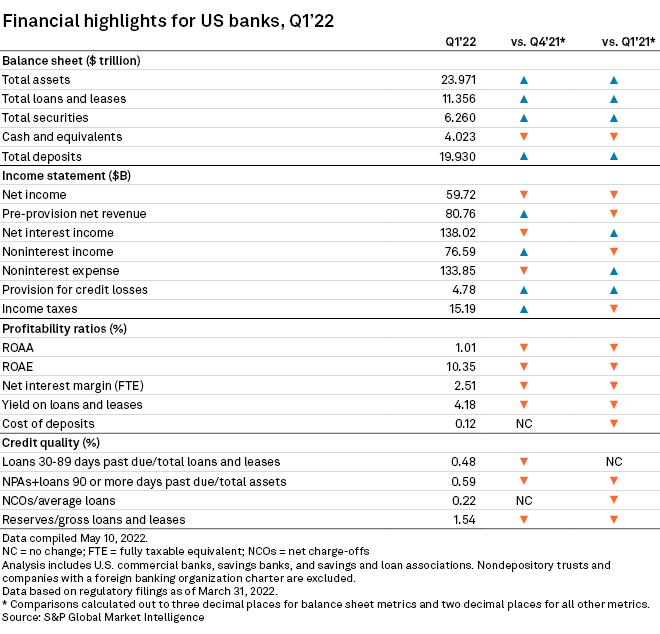

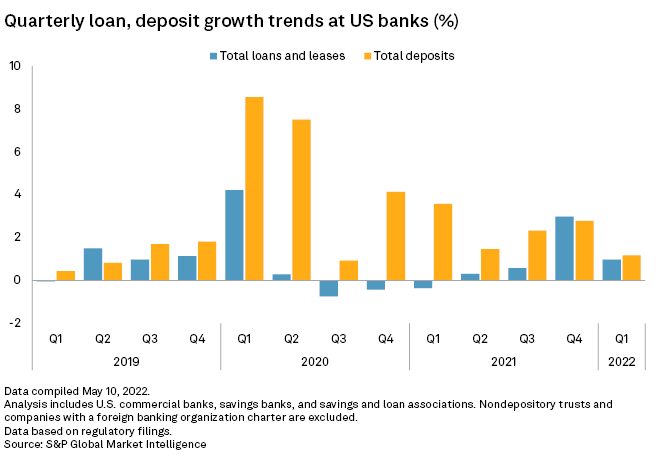

After ramping up their balance sheets in the last quarter of 2021, U.S. commercial banks, savings banks, and savings and loan associations experienced a more tepid growth rate in the first quarter of 2022.

Banks reported slower growth on both sides of the balance sheet, according to S&P Global Market Intelligence data. Total deposits across the industry were up 1.2% quarter over quarter, which was the weakest growth since the third quarter of 2020. Total loans and leases increased 1.0% in the first quarter, down from the 3.0% growth rate in the previous quarter. Also notable was growth in total securities falling to a three-year low of 0.2%.

Among the seven banks with more than $500 billion in total assets at March 31, JPMorgan Chase & Co. unit JPMorgan Chase Bank NA had the highest growth rate for deposits at 3.3% and was the lone bank with a negative change in loans and leases. PNC Financial Services Group Inc. unit PNC Bank NA grew loans and leases the most at 1.8% and decreased deposits the most at negative 2.0%.

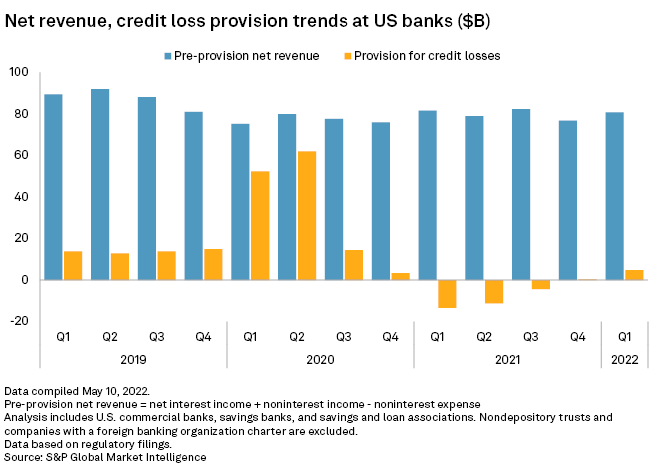

Credit loss provision increasing

The provision for credit losses has substantially impacted bottom-line profitability during the last two years. After three-quarters of negative provisioning, banks returned to a positive provision in the fourth quarter of 2021. The provision increased again in the first quarter this year to $4.78 billion, the highest amount since the third quarter of 2020.

JPMorgan Chase Bank recorded the largest provision at $1.34 billion, up $2.55 billion from the previous quarter. Several large banks continued to book a negative provision, including Wells Fargo & Co. unit Wells Fargo Bank NA and Truist Financial Corp. unit Truist Bank.

Excluding the provision, profitability was up. Pre-provision net revenue, which is net interest income plus noninterest income minus noninterest expense, rose to $80.76 billion from $76.81 billion on a linked-quarter basis. The slight decrease in net interest income was more than offset by the 5.0% jump in noninterest income and the 0.3% improvement in noninterest expense.

Sterling credit quality

Despite ominous economic indicators such as declining labor productivity and accelerating consumer inflation, credit quality data at banks remains undisturbed. The ratios for nonperforming assets and early-stage delinquencies improved on a quarterly basis, while the net charge-offs-to-average loans ratio was the same at 0.22%.