S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

13 Sep, 2021

By Jake Mooney and Chris Hudgins

Green bond offerings represent an increasing share of U.S. real estate investment trusts' debt capital raises as property owners move to earmark proceeds to environmentally sustainable projects.

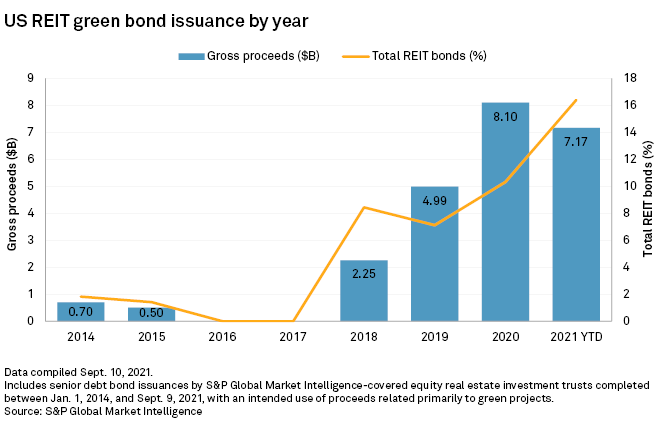

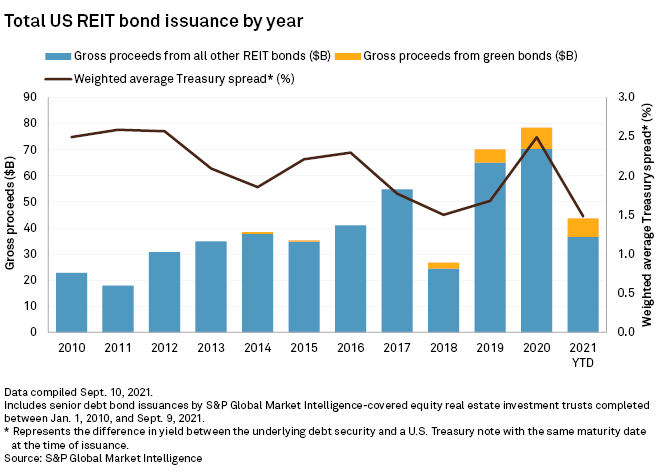

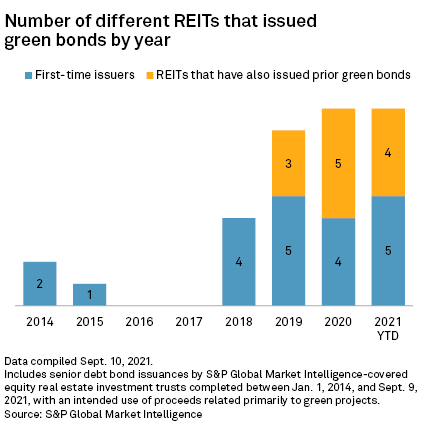

The REIT green bond market, dormant as recently as 2017, has attracted a steady stream of new issuers in the years since. Green bond offering proceeds represent 16.4% of the capital raised through U.S. REIT debt offerings so far in 2021, putting the segment on track for an all-time, full-year high, up from 10.3% of total debt capital raises in 2020.

As of Sept. 9, the count of REIT green bond issuers for the year already equals 2020's total. There are five new entrants to the market, including AvalonBay Communities Inc. in the apartment sector, Healthpeak Properties Inc. in healthcare and life science, and Realty Income Corp. in single-tenant retail and industrial. Repeat green bond issuers include office landlord Vornado Realty Trust and data center owner Equinix Inc.

"Green bonds are really on track to become much more of a mainstream financing vehicle for many of these companies," Ana Lai, a senior director and real estate sector lead at S&P Global Ratings, said in an interview, adding that a growing pool of sustainability-oriented debt investors could soon create demand for green bonds that allows companies to price them more cheaply than standard debt securities.

With interest rates still relatively low, a pricing differential between green and conventional bonds is unlikely, Lai said. But if rates rise toward the end of the year, issuers may be able to secure a pricing advantage for green bonds, especially if they can tap a relatively robust market of green European investors, she added.

Realty Income, which owns properties in the U.K., completed its first green bond offering in July, offering notes denominated in British pounds. In an Aug. 3 conference call, company executives said issuing in the more favorable U.K. debt market likely saved the company roughly 30 to 40 basis points on pricing compared to a U.S. offering.

CFO Christie Kelly said green bonds also allowed the company to issue debt more cheaply.

"There is some slight, if you will, favorability associated with the overall rate," Kelly said. "Based on our research and tracking, it's about 10 basis points, but it's really more than that. It's really about making a statement as it relates to our ESG initiatives and as well, putting a framework out there that really allows us to partner with our clients and doing the right thing as we focus on reducing our carbon footprint."

REIT green bond proceeds typically are earmarked for future or recently completed development of sustainably certified buildings that have office and apartment property tenants, Lai said.

Healthpeak planned to allocate proceeds from its $450 million green bond offering, completed June 30, to fund its acquisition of Cambridge Discovery Park, a Boston-area LEED Gold certified life science property.

Vornado, which completed a two-tranche $750 million green bond offering in May, used some of the proceeds to pay off its loan on theMART — the former Chicago Merchandise Mart — a LEED-certified property that the company refinanced in 2016.

Even warehouse and data center tenants are showing a growing interest in sustainability, Lai said, adding, "A data center consumes a lot of water, a lot of power, so having other aspects of the story that kind of mitigate those things will be important."

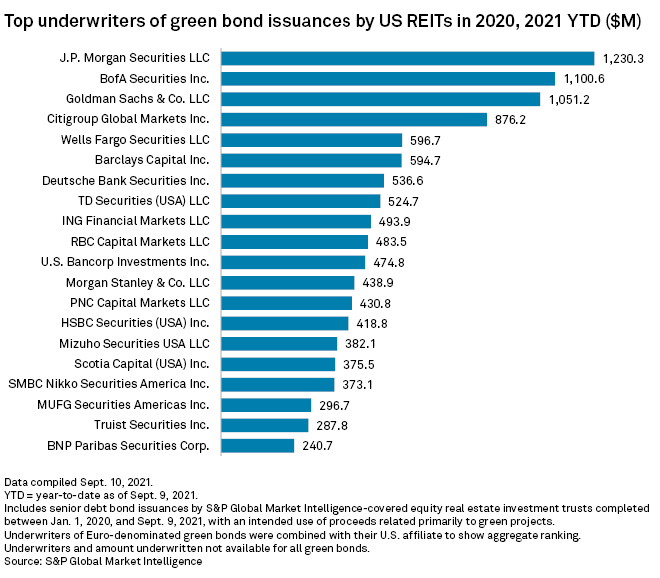

Since the start of 2020, the leading underwriter of U.S. REIT green bonds is J.P. Morgan Securities LLC, which is also the top underwriter of REIT bonds overall for the same period. BofA Securities Inc., the third-most active REIT debt underwriter for the period, is second among underwriters of REIT green bonds.

Goldman Sachs & Co. LLC underwrote $1.05 billion in U.S. REIT green bonds in 2020 and 2021, placing much higher in the category than it did as an underwriter of overall U.S. REIT debt for the same period. The firm finished third among REIT green bond underwriters for the period and No. 13 in the broader REIT debt rankings.