S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

14 Feb, 2022

By Rebecca Isjwara and Rehan Ahmad

|

|

View of a coal-fired power station in Shanghai, China |

Green bond sales in the Asia-Pacific region are likely to rise in 2022 as major economies lay out roadmaps to net-zero emissions and invest in projects to reduce carbon intensity.

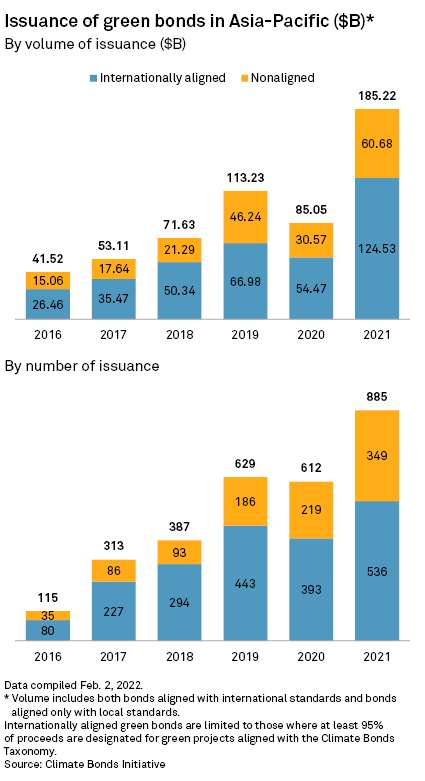

Major regional economies, including China, India and Australia, announced their net-zero targets in 2021. Their commitments to environment protection are already showing in green bonds issued last year. The region sold $185.22 billion of green debt in 2021, a 117% increase from 2020, according to Climate Bonds Initiative, or CBI, a U.K.-based green debt tracker. Green bonds are used to fund climate-related or environmental projects and are an important part of the net-zero journey, along with social and sustainability-linked debt.

Most emerging Asian countries will need to plan for a transition to greener energy to avoid straining their economies and creating hardships for their people as a sudden switch can cause energy shortages, said Clifford Lee, global head of fixed income at DBS Bank. "The transition process must also be sustainable," Lee said.

Green debt in Asia-Pacific can easily double in 2022, Lee said, noting that about $450 billion of bonds are not currently labeled as green by issuers, although they finance activities that would be considered climate-aligned, according to DBS-commissioned research released last year by CBI. "If a good proportion of these are refinanced as green bonds, the growth would be exponential," Lee said.

Planned transition

Power shortages last year in China and India, among the world's biggest polluters, underscored the importance of a planned transition to cleaner energy, especially as grids struggled to keep up with a sudden surge in demand caused by weather.

Instead of being a major deterrent for countries to achieve their carbon-neutrality targets, the power shortages coupled with higher coal prices may act as a catalyst for adoption of renewable energy over the medium term, said Love Sharma, head of India and Middle East credit at Lombard Odier Investment Managers.

"With more focus on renewable energy as well as associated grid infrastructure, we believe this will only be positive for further green and sustainability bond issuances from the region and in turn help the transition towards carbon-neutral Asia-Pacific economies," Sharma said.

Investments into smart and reliable grid infrastructure and renewable power that can be available round the clock via batteries or hybrid models are likely to grow as generation costs decline, Sharma said.

India's richest tycoons, Mukesh Ambani and Gautam Adani, who both owe their fortunes to carbon, have committed nearly $150 billion of planned investments in green energy projects including solar and wind power, battery storage and the so-called blue hydrogen, which is made from fossil fuel but captures the CO2 formed during its production. Indonesia’s largest power provider, Perusahaan Perseroan (Persero) PT Perusahaan Listrik Negara, has committed $35 billion for hydropower, solar and geothermal plants, according to an October 2021 Nikkei Asia report.

Corporates lead

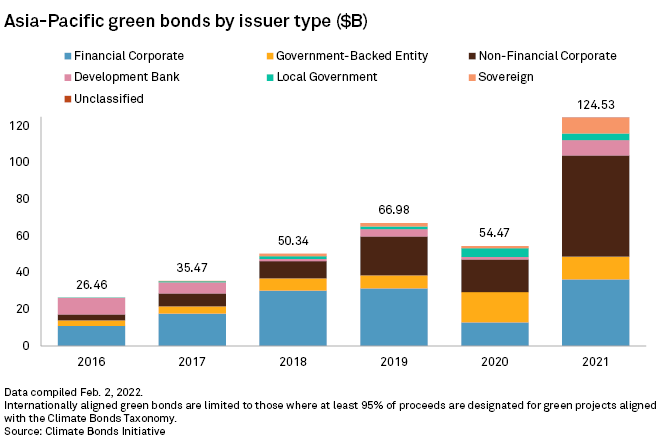

Corporates were the largest issuers of green bonds in 2021, reverting back to a pre-pandemic trend. Bonds issued by sovereigns also had a notable uptick, with governments issuing 6.83% of green bonds in 2021 compared with 2.08% in the prior year. India announced Feb. 1 it will issue sovereign green bonds for the first time to mobilize resources for green infrastructure, although the government did not specify the amount it may sell.

China was the largest issuer of green bonds in Asia-Pacific with $66.09 billion, followed distantly by South Korea at $12.57 billion. Japan, Singapore and India were the other major issuers. Asia-Pacific was the fastest-growing region for green bond sales globally in 2021, according to CBI data. The region issued 26.28% of the world's green debt by volume last year.

Countries in Asia-Pacific may also lean on innovative green finance instruments in their journey toward net-zero in the coming years. Transition bonds, which aim to fund issuers' efforts to improve or reduce environmental impact or cut carbon emissions, may emerge this year, said Jay Lee, a partner at law firm Simmons & Simmons.

"They are often issued by companies which would not normally qualify for green bonds," Simmons & Simmons' Lee said. "Good candidate companies would be large carbon-emitting industries such as oil and gas, iron and steel, chemicals, aviation and shipping."