Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

15 Sep, 2021

By Sanne Wass

Companies issuing green bonds continue to gain funding cost advantages compared to their vanilla debt, according to new research, and industry players do not foresee this so-called greenium going away anytime soon.

The green-bond premium is likely to remain particularly strong for U.S. dollar-denominated green bonds due to continued shortage of supply, said Caroline Harrison, senior research analyst at the Climate Bonds Initiative, or CBI, in an interview.

"The greenium is alive and well and has not yet evaporated," Harrison told the organization's 2021 conference last week, presenting a preview of its latest green bond pricing report, which was released Sept. 15.

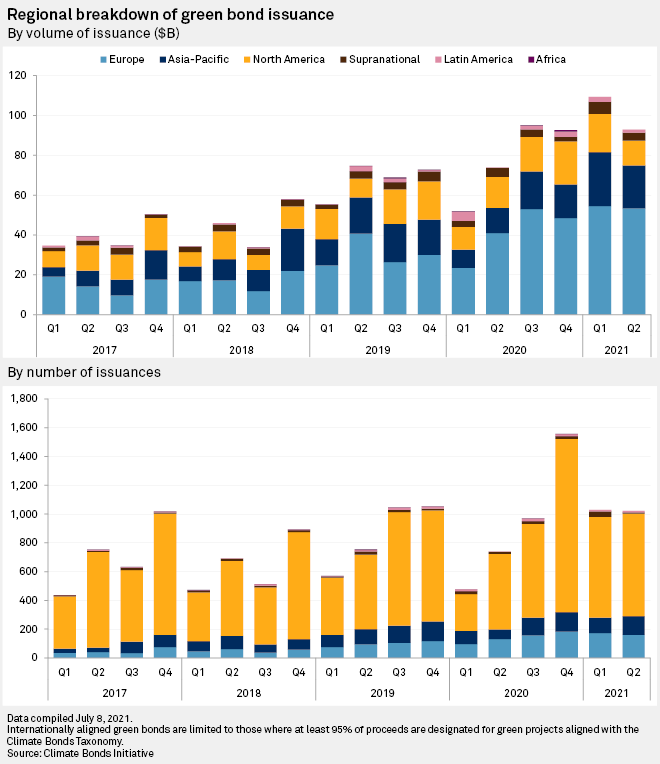

Supply of green bonds reached a record high in 2021, with companies globally issuing more than $200 billion worth of such debt in the first half of the year. Yet investor demand continued to outpace supply, driving a higher price on green bonds compared to conventional ones, according to Harrison.

Analyzing 75 green bonds issued in the first half of 2021, the CBI was able to build yield curves for 33 for them. The CBI is an international organization that aims to increase investments that contribute to the transition to a low-carbon and climate resilient economy. A yield curve shows the price at which an entity could obtain funding at different maturities. Of those, 11 were priced inside their yield curve, suggesting that the borrowing cost is lower than existing vanilla debt.

Another 15 bonds priced on their yield curve but still showed an absence of a new issue premium and were therefore positive for the issuer's cost of funding, according to the research.

On average, green bonds are still attracting more interest from investors than non-green bonds, while also exhibiting larger spread compression during the bookbuilding process, the research found.

U.S. dollar-denominated green bonds showed particularly strong pricing outcomes, according to the research. Average oversubscription for this category was 4.7x for green bonds and 2.5x for vanilla equivalents, while spread compression averaged 29.9 basis points for green bonds and 24.8 bps for vanilla bonds.

In comparison, average oversubscription for euro-denominated green bonds was 2.9x, and for vanilla equivalents 2.6x, while spread compression averaged 20.4 bps for green bonds and 19.6 bps for vanilla bonds.

The CBI only assesses whether the greenium is present or not and does not measure the average funding cost benefits, but recent research by ING has found that the savings on green issuance for borrowers range between 1 bps and 10 bps on a global basis.

Greenium will remain

Harrison said she is seeing evidence of a greenium continuing into the third quarter of 2021 and expects it to persist over time. "Until all the debt is sustainable, I do not envisage that we will find an equilibrium in this market," she told the conference.

Erik Bennike, head of credit at Danish pension fund PensionDanmark, said the greenium is visible both on the primary and secondary market, and hinted that it is unlikely to go away anytime soon.

"If green bonds are to converge in pricing compared to traditional bonds, then it would certainly require a lot more supply as the demand picture looks right now. And I think that will take years before that actually happens," Bennike said, also speaking at the CBI 2021 conference.

Giuseppe Cosulich, head of green debt capital markets at Credit Suisse, also expects the greenium to remain at it current levels due to growing investor demand, but told the conference that companies' decision to issue green bonds is not only about gaining pricing advantage, but an important strategic measure for them to signal their transition plans to the market.