S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

24 Mar, 2021

A renewed focus on securitization in 2021 could see Greece's major banks cutting their bad loan ratios down to single digits. Analysts say that this could mark the start of a new era for the country's "big four" banks — Piraeus Financial Holdings SA, National Bank of Greece SA, Alpha Bank AE and Eurobank Ergasias Services and Holdings SA — all of which have grappled with stubbornly high levels of toxic debt in the decade following the global financial crisis.

Sunrise 1 and Mexico

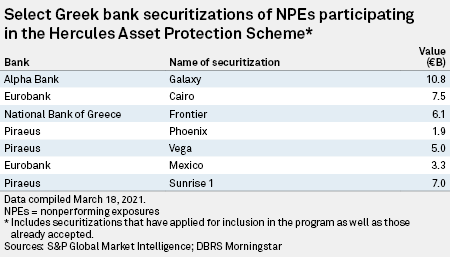

Greek banks have embraced securitization with enthusiasm, and March 2021 has seen the announcement of major new deals involving bundles of bad debt, including Eurobank's €3.3 billion Mexico securitization, and Piraeus's €7 billion Sunrise 1 securitization.

Eurobank said in its 2020 full-year earnings call that Mexico should bring its 14% nonperforming exposure, or NPE, ratio down to single digits by the end of 2021. The deal follows on from its earlier €7.5 billion bad-loan securitization, Cairo, which it completed in mid-2020.

Sunrise 1 forms part of a ramped-up bad loan reduction plan for Piraeus, which will enable the bank to bring its NPE ratio down to single digits within the next 12 months, and below 3% in the medium term, the company has said. The bank's pro forma NPE ratio stood at 35% at the end of 2020, taking into account two earlier securitization deals, Vega and Phoenix, which have already been signed.

Piraeus has another securitization, the €4 billion Sunrise 2, waiting in the wings and expects to launch it later this year. Analysts at Pantelakis Securities said its pledge to double down on bad loan reduction is part of a "clear roadmap to a new era."

"Overall, we believe the market will welcome Piraeus' accelerated drive towards completing de-risking," Paris Mantzavras, head of research, said in a March 17 analyst note.

Hercules to the rescue?

The coronavirus pandemic and accompanying economic strain could cause fresh problems for Greek banks. Executives have been candid about the fact that they expect to see new nonperforming loan inflows in 2021 as a result of the crisis. Eurobank CEO Fokion Karavias has said he anticipates net inflows of bad loans of roughly €250 million in the first quarter of 2021 and €900 million for the full year.

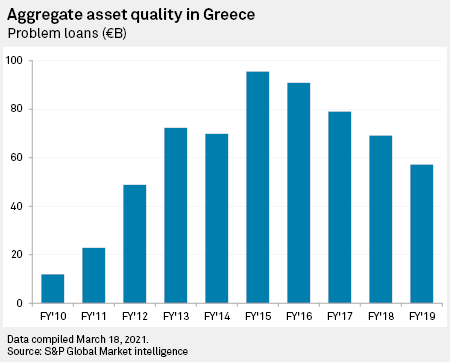

But the impact of the pandemic on Greek banks' balance sheets is likely to be considerably less severe than that of the global financial crisis. Problem loans of this vintage peaked at close to €100 billion in 2015, before falling to below €60 billion at the end of 2019.

The Greek Ministry of Finance said March 12 that it had applied to the government to renew the Hercules Asset Protection Scheme, or HAPS, an initiative that encourages banks to securitize bad debt by giving a state guarantee on the least risky tranche of notes for sale. This will help Greek banks to shake off an "unbearable" burden of nonperforming exposures, and leave them freer to lend to the productive economy, Deputy Finance Minister George Zavvos said in a statement.

The first iteration of HAPS was approved by the Greek government in December 2019 and helped banks shift bad loan portfolios totaling €32 billion in its first year, according to the Ministry of Finance.

HAPS is modelled on Italy's Fondo di Garanzia sulla Cartolarizzazione delle Sofferenze, or GACS, scheme, which also provides a state guarantee on senior notes in bad loan securitizations.

"We consider that the recently announced extension of the Hercules scheme paves the way for further de-risking of the Greek banks," Lito Chousiada, assistant vice president of European Financial Institutions at DBRS Morningstar, said in an email.

"Assuming normalized market conditions and continuous investor appetite for Greek distressed assets, we view that these recent developments are supportive towards the banks achieving their targets of single digit NPE ratios within 2022."

Alpha Bank is readying a €2.0 billion securitization of bad loans dubbed "Cosmos," which it hopes to include in the HAPS scheme.

Securitization will continue to be a useful tool for trimming bad loans, and government guarantee schemes such as HAPS and its Italian counterpart, GACS, will play an important role in smoothing the process for banks, according to structured finance professional Patrizia Canziani.

"Government guarantee schemes ... provide valuable and effective solutions when the market doesn't 'move' as it should and banks are caught in a corner between low profitability and growing nonperforming assets, and find it impossible to sell bad assets because of a large gap in bid-offer prices," Canziani said in an email.

Bad bank on the cards

In addition to HAPS, Greece is considering the creation of a national asset manager for bad debts. The country's central bank is understood to have submitted a plan to the national government in September 2020 for the creation of an asset manager or bad bank, according to a report from local newspaper eKathimerini.

The two initiatives should complement each other, and will help Greek banks to get to a position where they can shift their focus from battling bad loans to ramping up new lending as the country emerges from the coronavirus pandemic, according to Dimitrios Vlachos, founder and CEO of DV01 Asset Management, a company that provides services for corporate nonperforming loans in Greece.

"Both HAPS and the asset management scheme are very important for the economy. The need for fresh cash will be very significant in the way that the economy recovers from the pandemic. It's important that banks are focused on that, and not on thinking about how to manage nonperforming loans," he said.

Vlachos was speaking at the NPL Days conference, an event organized by DD Talks, in February.

Other countries that have used bad banks to help the financial system work out toxic assets include Ireland and Spain.

Theme

Products & Offerings

Segment