Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

1 Feb, 2021

Greek banks, facing a potential "cliff-edge" effect once pandemic-related loan moratoriums come to an end, face a challenging 2021, according to analysts, but their predicament remains manageable since government subsidies will kick in where repayment holidays end to help otherwise creditworthy borrowers remain performing.

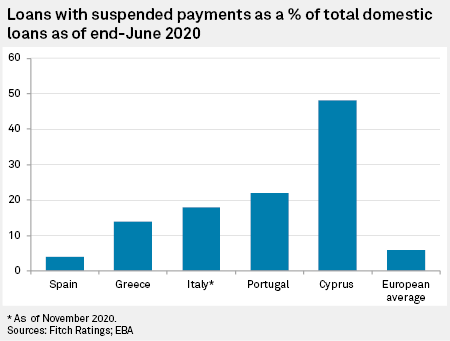

Like many banks in Europe, Greece's lenders had frozen repayments on some €30 billion of loans as of January 2021 in a bid to help struggling borrowers cope with the impact of the coronavirus, according to the Hellenic Bank Association, a trade body. But the hiatus cannot last forever, and the final deadline for tranche payments for most remaining borrowers is the end of March. The European Commission warned in November 2020 that while Greek lenders have been insulated from a wave of defaults because of these moratoriums, they could face a "cliff edge" effect once they end.

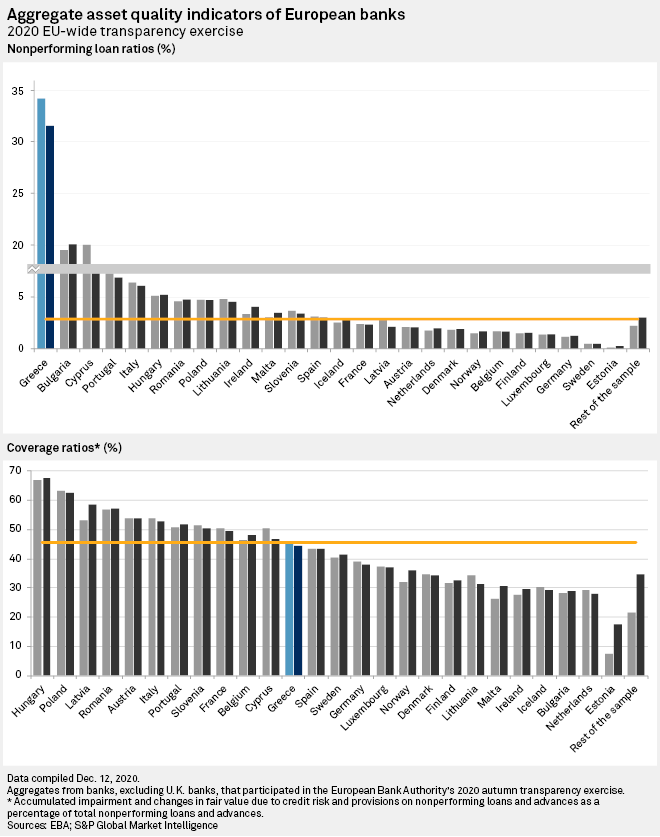

As of the end of the third quarter of 2020, Eurobank Ergasias Services and Holdings SA had €4.9 billion under moratoriums, and CFO Harris Kokologiannis told analysts during an earnings call that the bank intended to extend them for clients in the travel and tourism sector into 2021. Alpha Bank AE reported €5.4 billion of loans on ice at the end of the third quarter, while National Bank of Greece SA reported €3.6 billion as of the time of its Nov. 30, 2020, earnings call. Piraeus Bank SA had put €5.3 billion of loans under moratoriums between the start of the pandemic and its Nov. 23, 2020, earnings call. Some 14% of loans in the Greek banking system on aggregate were under moratoriums as of the end of June 2020, according to Fitch Ratings.

|

A bridge over troubled water?

"Greece is in a manageable but complex situation," Paul Hollingworth, global bank equity specialist, Creative Portfolios, and contributor to SmartKarma, an independent investment research platform, said in an email.

For retail banking, the Greek government's "GEFYRA" or Bridge program, which subsidizes mortgage borrowers on repayments on their primary residence, will provide some welcome support to banks once moratoriums end, he said. GEFYRA effectively replaces an earlier state support for the mortgage sector, the Katseli Law, which came into play in 2010 with the aim of protecting borrowers from the loss of their primary residence. This law received widespread criticism for alleged abuse by strategic defaulters, but Hollingworth believes the government has learned from these experiences.

"GEFYRA ... is a refinement in many ways of the moral hazard-ridden Katseli Law and is more efficient than the latter. The government is mindful of responding to authentic specific need rather than poorly structured and more expensive coverage," he said.

GEFYRA came into effect in November 2020 and is designed to support borrowers for a nine-month period. More than 160,000 borrowers had applied for subsidies under the program as of early January, a spokesperson from the Greek ministry of finance said in an email. In November and December, the ministry of finance paid out €23 million euros to 38,000 borrowers under the scheme.

Greek Finance Minister Christos Staikouras is in the process of devising a similar subsidy to support companies, and has already started discussions about this with European institutions, the spokesperson added.

In addition, banks may decide to make their own restructuring agreements with borrowers who fall outside the scope of state subsidies, Pau Labró Vila, director of financial institutions at Fitch Ratings, said in an interview.

Fitch also warned in a Dec. 11 note that loan moratoriums, while providing much-needed support to borrowers, run the risk of weakening an already-weak payment culture to the detriment of future asset quality.

|

|

Unavoidable damage

A degree of damage is inevitable. The Greek central bank said in December that it anticipates the pandemic will create between €8 billion and €10 billion of new nonperforming loans.

This is nowhere near the peak of the last credit cycle, when NPLs hit €107 billion. But CEOs are already bracing for the impact, with National Bank of Greece's Pavlos Mylonas saying in the bank's most recent earnings call that he expected 15% to 20% of loans under moratorium to default.

Goksenin Karagoez, credit analyst at S&P Global Ratings, said it is difficult to predict with any degree of accuracy how severe the level of defaults will be as much depends on the progress of vaccination and the speed of the rebound in the Greek economy.

"Defaults could be above banks' expectations," he said in an interview.

Jonas Floriani, director at investment banking boutique Axia Ventures, agreed that it is difficult to pin a number to potential defaults at this time.

"It will take a few months until we know exactly what is happening out there. Of course, this will also depend on the macro environment in the coming months," he said in an email, adding that the fourth-quarter 2020 results for the "big four" banks might show a clearer picture.