Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

12 Mar, 2021

After largely wrapping up the selling of a $2 billion portfolio of limited partner interests at UBS at the end of 2003, Nigel Dawn — on the advice of UBS' head of the private funds group, Richard Allsopp — wrote a two-page business plan advising other limited partners on ways to get liquidity in the market.

"I put the business plan together and presented it to the then-head of investment banking at UBS. He said: "I don't really know what this is about, and I'm pretty sure it's going to fail, but why don't you go away have a go for six months and then come back and get a real job?" Dawn, now global head of private capital advisory at Evercore Inc., told listeners attending Super Return Europe Virtual on March 4.

In 2004, another adviser told Dawn: "the last thing the world needs is another secondary auctioneer," while a third, a well-known fundraiser working for a general partner who was also responsible for selling balance sheet positions for a bank into the secondary market, said it was "the single worst idea that he had heard that year."

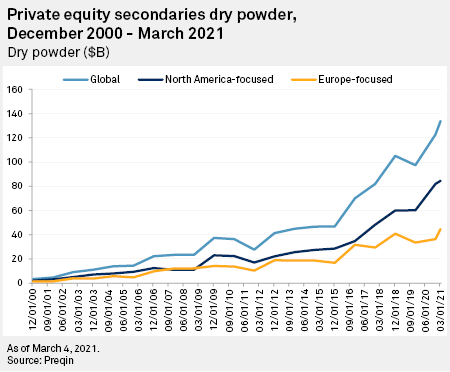

Years later, the secondaries veteran can feel vindicated. As of March 4, global secondaries dry powder sits at a record $133.8 billion, up 9% on 2020 year-end, according to Preqin data. This compares with $13.9 billion available to deploy at the end of 2004.

Although there was "a blip" in 2020 transaction volumes, Dawn anticipates another record year in 2021. "I would like to think there's a pretty good chance of having a $100 billion year," he said, adding he expects the majority to be driven by GPs, a trend he expects to continue into the future.

"I think there's a little bit of a sea change going on in terms of the groups driving the market, and part of that is, for the first time, high-quality GPs see the secondary market as a source of strategic capital that they haven't in the past," Dawn said. The single asset single purpose vehicle market has taken "quite a big bite out of the sponsor-to-sponsor market" as it is a more beneficial way of exiting a company for GPs and LPs alike, he added. "My sense is that it's a one-way journey right now in terms of the impact GPs will have on this market."

Given the opportunity on the GP side "is almost exponential," the amount of capital and specialists focused on that area "is insufficient, really, to meet the demand that we see right now." Dawn expects new specialists will enter the market. Evercore is also seeing large sponsors setting up dedicated secondary funds focused on GP transactions. "I think over the next few years, there will be a change in the market where there'll be more investors coming in, more funds created to address the imbalance that currently exists."

Transatlantic differences

The European secondaries market is more innovative than the U.S. market because its "smaller and less homogenous," Steve Nicholls, Partner & CIO at Hollyport Capital LLP told listeners. "Both on the GP-led and the LP portfolios, the transactions are smaller, the market is smaller, there's a lot more digging around for the opportunity, and therefore, you find some of the newer ideas developing in the European market."

The U.S. market has so much more volume that "once it gets going, the snowball effect in the U.S. just picks up so rapidly and suddenly every transaction is replicating the latest and greatest new idea wherever it came from. It just becomes standard practice," Nicholls said.

U.S. secondaries dry powder sat at $84.6 billion as of March 4, compared with the $44.7 billion available to deploy in Europe.

Europe is a more complex market — at the fund level, there are European waterfall considerations, and, compared with U.S. limited partnership advisory committees, European LPACs have got "more voices at the table, possibly more different voices [with a] different set of expectations," Nik Morandi, managing director at Blackstone Group Inc.'s Strategic Partners, said.

Valuation policies also differ. Quarterly valuations are the norm in the U.S., whereas "it's a bit more of a hybrid model in Europe, still some half yearly, some quarterly." There are spikes in secondaries transaction activity in Europe, while it is more consistent across the year in the U.S. "That can generate opportunities in Europe, if you are buying off a bit more of a legacy reference date, but that is a structural difference," Morandi said.

Currency must also be considered in Europe, and there are "a number of country specialists that obviously you don't have in U.S. on the secondary buy side," Morandi added. "That can generate opportunity if you happen to be particularly knowledgeable within those markets as an insider. But it is certainly a more complex landscape, and I suspect that is one of the reasons why we've seen more innovation" that has then been adapted and adopted in the U.S.

A European GP, even with an LP transaction, always has to consider U.S. factors, "whether they're regulatory or whether they're tax-wise," while on the U.S. side, "nobody really minds so much [about] what's going on in Europe in that respect," Campbell Lutyens & Co. Inc. Partner Immanuel Rubin said. "That's quite a structural element in our industry, that it is heavily dominated by U.S. considerations."