Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

9 Mar, 2022

Google LLC's proposed acquisition of a cyber defense services provider may spur a further surge of M&A activity in the cloud cybersecurity sector.

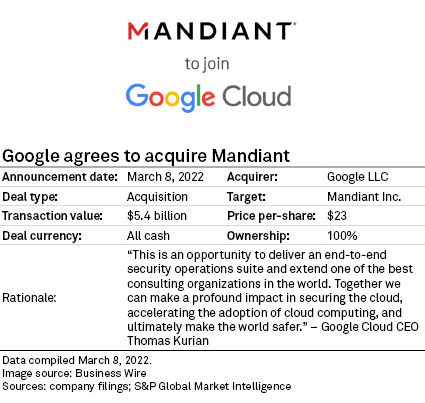

The Alphabet Inc. unit on March 8 agreed to acquire cybersecurity company Mandiant Inc. for $23 per share. The all-cash transaction is worth about $5.4 billion, inclusive of Mandiant's net cash, with a gross transaction value of about $7.3 billion.

Google hopes the Mandiant deal, expected to close later this year, will enhance the range of security operations and advisory services offered by Google Cloud, which remains a key market player amid robust demand for cloud services. About 52% of companies expected to begin operating in public cloud work environments in 2022, a 451 Research survey revealed.

Google Cloud's market share currently ranks far behind that of sector leaders Amazon.com Inc.'s Amazon Web Services Inc. and Microsoft Corp. According to recent data from Synergy Research Group, Amazon attracted about one-third of worldwide cloud spending in the fourth quarter of 2021, while Microsoft followed at 21%. Google held the No. 3 spot at almost 10%.

With the Mandiant buy, Google seeks to differentiate its cloud portfolio from those of its rivals by concentrating on its cybersecurity footprint at a time of increasing threats of cyberattacks, including those from Russian operatives or organizations amid the conflict in Ukraine, Wedbush Securities analyst Dan Ives said in a research note.

"In a nutshell, this deal was a shot across the bow from Google to Microsoft and Amazon with this flagship cyber security acquisition," Ives said.

The Google-Mandiant deal could also pressure Amazon and Microsoft to improve their cloud portfolios by acquiring any of several players in the cybersecurity sector, Ives added, calling the Mandiant transaction "the tip of the iceberg to a massive phase of consolidation potentially ahead for the cloud space."

In terms of potential future targets, Ives pointed to CyberArk Software Ltd., Varonis Systems Inc., Tenable Holdings Inc., Rapid7 Inc., Qualys Inc., SailPoint Technologies Holdings Inc. and Ping Identity Holding Corp.

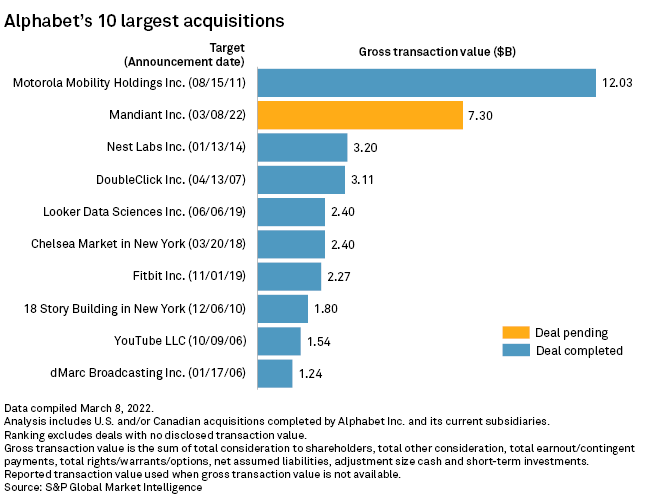

The acquisition is Google's second-largest, after its $12.03 billion purchase of smartphone-maker Motorola Mobility Holdings Inc. in 2012. Google subsequently sold off most of its Motorola holdings, including selling the Motorola Home unit, focused on set-top boxes, to ARRIS Group, maker of networking equipment, for $2.38 billion. Google also sold Motorola Mobility to Chinese computer manufacturer Lenovo Group Ltd. in a cash-and-stock deal valued at approximately $2.91 billion.

Following Mandiant, Google's third-largest acquisition is its $3.20 billion buy of smart thermostats maker Nest Labs Inc.

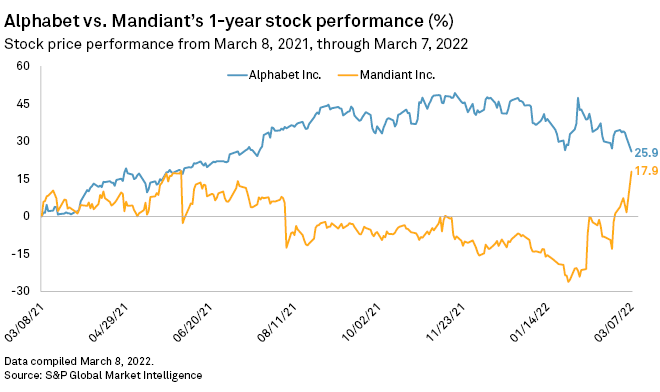

Mandiant's stock price has been buoyed in recent months by reports suggesting the company was an M&A target, with Microsoft cited as a potential suitor. Microsoft earlier purchased cybersecurity companies RiskIQ Inc. and CloudKnox Security Inc. in the second half of 2021.

Alphabet's shares increased 25.9% between March 8, 2021, and March 7, 2022. Mandiant's shares went up 17.9% over the same period, with much of that spike occurring in February amid deal rumors.

451 Research is part of S&P Global Market Intelligence.