S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

15 Apr, 2021

By J. Holzman

|

Workers using steel rebar during the construction of a building May 17, 2019, in Miami. The Trump administration announced that day it would be lifting tariffs on Canadian and Mexican steel imports, nearly a year after imposing the duties. |

The Biden administration has not disclosed where it will go with steel and aluminum tariffs set under former President Donald Trump, but recent favorable reviews could buoy the trade measures through the immediate future.

Trump imposed 25% and 10% tariffs on steel and aluminum imports, respectively, in 2018. Over the course of the Trump term, allied countries of origin such as Australia, Canada and Mexico were excepted from the tariffs. These measures have been untouched since the beginning of the Biden administration in January 2021.

Biden has not said whether he plans to modify the tariffs, which roiled allies such as the EU, while Commerce Secretary Gina Raimondo gave the measures positive reviews during a recent TV interview.

"Those tariffs have worked in so far as they have leveled the playing field for American producers of steel and aluminum. I'm not saying they're perfect. They created other challenges, but the fact of the matter is, China doesn't play fair," Raimondo said during an April 1 appearance on Bloomberg.

All publicly available information indicates "the administration will keep the tariffs in place until ... it decides it's appropriate to jettison them," Daniel Cannistra, a trade attorney with the law firm Crowell & Moring LLP, said in an interview. It is not entirely clear what would warrant such a move, Cannistra added.

Addressing the coronavirus pandemic and concerns about domestic issues have been the primary focus of the Biden administration as opposed to trade, Cannistra said. "In terms of the talking points, it has not taken the grand stage that I think the trade did under the Trump administration."

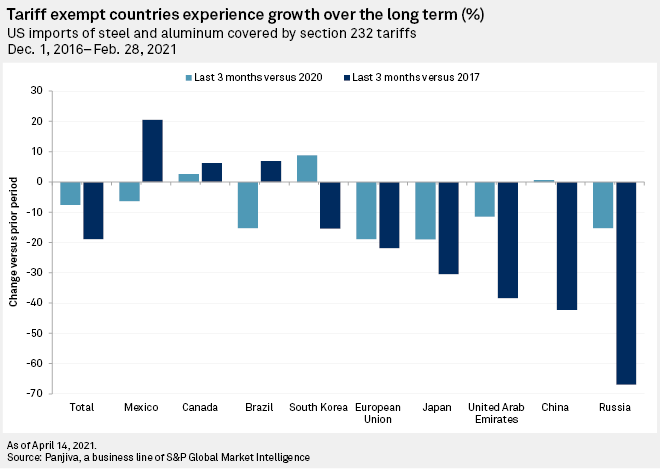

Data from Panjiva shows the steel and aluminum tariffs succeeded in depressing imports. Total U.S. imports of Section 232 steel and aluminum products dropped 18.9% in the three months to Feb. 28 compared to the same period of 2017. Shipments from EU nations fell 21.9% over the same time period, while imports from South Korea declined 15.4%, Panjiva found.

Producers have urged Biden to keep the steel tariff, and they found a new point of argument in a recent study. Left-leaning think tank the Economic Policy Institute found in a March 24 analysis that the steel tariffs delivered benefits in the near term, including drastic cuts to steel imports. The study was promoted after its release by the American Iron and Steel Institute, a nonprofit that represents U.S. steelmakers and iron producers.

The Section 232 actions had "no meaningful real-world impact" on the prices of steel-consuming products such as cars, and exclusions to the actions such as those instituted under Trump "mitigate positive economic impact," according to the study. After the measures were implemented in 2018 and prior to the widespread downturn in 2020, steel producers in the U.S. outlined plans to invest more than $15.76 billion in new or upgraded steel facilities and to create more than 3,200 new jobs in the country.

There is "no doubt" the trade actions boosted profitability in the U.S. steel sector, increased long-term investment within the space and led to some form of a recovery, according to Robert Scott, an economist who worked on the study. However, the tariffs alone were unable to stop the issue of excess steel production abroad.

"Until we get that problem under control, I don't think the need for the tariffs is going to go away," Scott said in an interview. "Other countries aren't going to be willing to make concessions without really tough international bargaining."

Panjiva is a business line of S&P Global Market Intelligence, a division of S&P Global Inc.