S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

24 Mar, 2021

By Kip Keen and Taylor Kuykendall

After floating the idea of a megamerger between three South African gold producers in early March, Sibanye Stillwater Ltd. CEO Neal Froneman told S&P Global Market Intelligence that such a combination is just one approach to growth the company is considering as it seeks to throw more weight around the market.

"You will not be relevant if you are less than something like $20 billion [in market capitalization]," Froneman said in a recent interview. "You're not going to appeal to funds. You're not going to feature in the indices."

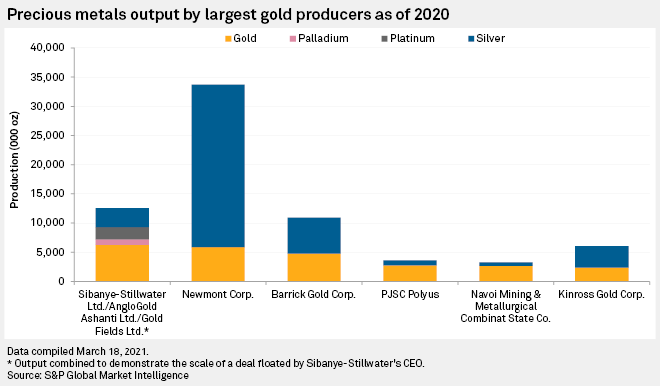

Combined, attributable 2020 gold production from Sibanye, Gold Fields Ltd. and AngloGold Ashanti Ltd. would be higher than gold supermajors Newmont Corp. and Barrick Gold Corp. According to a Market Intelligence analysis, a three-way merger of the South African miners would create the largest gold company in the world, with 2020 output of 6.3 million ounces. U.S.-based Newmont produced 5.9 million ounces of gold and Canada-based Barrick produced 4.8 million ounces of gold in 2020.

Charl Malan, a senior metals and mining analyst with VanEck, said a merger of the three companies would significantly reduce costs as it would combine effectively contiguous assets. "There's a big strategic advantage for them to do that," Malan said. "From that point of view, I think it's a great idea."

Malan also flagged potential obstacles to such a deal. One question is whether investors might think the combination would create an asset portfolio too heavily weighted in South Africa. Regulators in the country could also raise concerns about the consolidation of gold producers in the country.

"[It is a] good idea from a cost point of view. Good idea from a regulatory point of view? Questionable," Malan said.

When asked about the potential merger, AngloGold said the company has outlined a growth plan to unlock value from its assets and is focused on delivering that strategy. Gold Fields declined to comment, labeling talk of a combined business "speculation."

During a special Jan. 21 call, incoming Gold Fields CEO Chris Griffith said chasing consolidation sometimes makes sense, but not just for the sake of getting larger. Too many mining companies have linked up without adding any value, Griffith said.

"If there are good deals out there, then I guess the board will be willing to listen to management if there's an opportunity," Griffith said. "There are times when it's good, and there are times it's really bad."

Froneman noted that certain assets within the combined portfolio of the three companies do not fit Sibanye's profile. However, he said he is thinking that "either we are going to get consolidated, or we are going to do the consolidating."

"There's a need for all companies to become more relevant, and that's what's driving consolidation in general, and this is just one example of possible consolidation," Froneman said.

Barrick CEO Mark Bristow also recently called for further consolidation in the gold sector and said in late 2020 that the industry faces a crisis in declining gold reserves.

|

|

Sibanye is assessing acquisitions of companies with annual gold production exceeding 1 million ounces, spokesperson James Wellsted recently told Bloomberg News. Companies that fit the criteria include PJSC Polyus, Navoi Mining & Metallurgical Combinat State Co., Kinross Gold Corp., Newcrest Mining Ltd., Agnico Eagle Mines Ltd., Harmony Gold Mining Co. Ltd., Kirkland Lake Gold Ltd., Shandong Gold Mining Co. Ltd., Zijin Mining Group Co. Ltd. and Nord Gold UK Societas.

Froneman said the lack of large mergers in the gold sector stems from an "unrealistic" overvaluation of assets, in part due to the rising gold price. "Social issues" and egos at the board or management level are often obstacles to larger mergers, Froneman added, lauding those that pushed to make mergers work between Randgold and Barrick in 2018 and between Newmont and Goldcorp Inc. in 2019.

"They've actually got around social issues," Froneman said. "They got around valuations, and they clearly didn't have a distorted view of their own businesses."

VanEck gold portfolio manager and strategist Joe Foster said in an interview that too many recent buys have proven to be bad deals, with shareholders losing out.

"Companies are, first of all, very reluctant to do an acquisition at a premium right now," Foster said. "If they do, then they're being very cautious and making sure that there's some synergy, some true value, that can be added through that acquisition."

Froneman said striking deals with junior and midtier companies might be easier. He added that Sibanye has development projects and is focused on acquiring cash flow rather than earlier-stage projects the way Newmont is with its bid for GT Gold Corp. and its Tatogga copper-gold project in western Canada.

"That doesn't mean it's not a good business model; it's just not our business model," Froneman said. "We generally don't develop mines."

|

Foster said companies are also having success developing existing assets rather than building up new projects. With a higher gold price boosting the economics of some of the projects already on the shelf, companies are less eager about mergers and acquisitions.

Froneman also reiterated that Sibanye is planning to acquire battery metals assets, including lithium, cobalt, nickel and copper. Compared to the company's gold strategy, it would likely make multiple acquisition announcements over the next two to three years that are smaller, more strategic and involve partners, Froneman said.