Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

13 Jun, 2022

By Avery Chen

| China's gold consumption fell nearly 10% year over year in the first quarter as a COVID-19 outbreak dampened demand, according to the China Gold Association. Source: Jie Zhao/Corbis via Getty Images |

While gold prices are supported by safe-haven and asset-diversification demand, some analysts are warning of downside risks for the second half of 2022 due to a widening physical surplus.

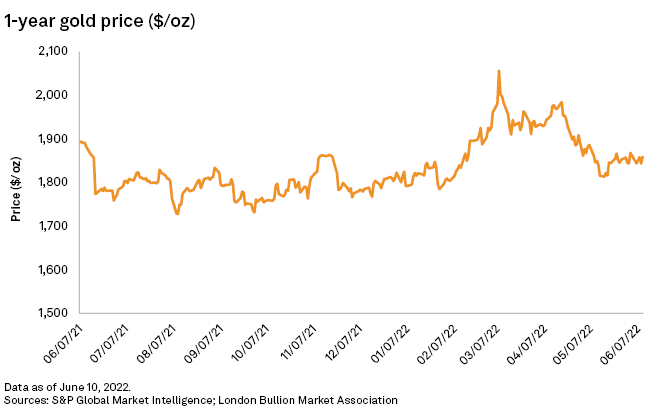

The gold price has been hovering around $1,800 to $1,850 per ounce since mid-May, down from a 19-month high of $2,039/oz in early March, after the U.S. Federal Reserve announced its sharpest rate increase since 2000.

"Hawkish central banks, rising real rates and a stronger U.S. dollar have taken the shine off the gold market," ANZ Bank commodity strategists Daniel Hynes and Soni Kumari said in a June 10 note. "Withdrawal of unprecedented fiscal and monetary support is also weighing on sentiment."

Still, gold could reassert its safe-haven status due to mounting geopolitical and economic risks amid the Russia-Ukraine war.

"Supply shock-driven inflation could offset the impact of rising rates, limiting a rotation back to yielding assets. Fears are rising that economic growth will fall if central banks hold their tightening stance," Hynes and Kumari wrote. "With such an uncertain economic backdrop, investors may look for a safe store of value. That said, if haven buying abates, we could see a sharp correction in gold prices."

Gold prices could fall as low as $1,670/oz in late 2022, according to Neil Meader, director of gold and silver at consultancy Metals Focus. "As policy rates rise and inflation declines, we expect that real rates and yields will rise materially during the second half, putting pressure on the gold price," Meader said in a June 8 note.

Metals Focus has forecast a 37% increase in the structural physical gold surplus in 2022. The consultancy also estimated gold demand will decrease 2% this year, constrained by diminished jewelry sales and retail investment in China, the biggest gold consumer, due to COVID-19 lockdowns.

While COVID-19-related restrictions were gradually easing in some areas of China in May, local gold demand was still under pressure, and the average trading volumes of Au9999, considered a proxy of Chinese wholesale gold demand, recorded the weakest May since 2013, the World Gold Council said in a June 7 note

Meanwhile, Metals Focus projected total gold supply will rise 2% year over year thanks to increased mine production and recycling. In comparison, S&P Global Commodity Insights maintained its forecast of global gold mined supply increasing about 4.9% year over year in 2022, as of late May.

Investors holding gold as a long-term hedge should not add or build up additional exposure, according to UBS analysts. "We believe the yellow metal will continue to add insurance and diversification benefits in a portfolio context, but at the same time, we advise managing the downside risks ahead," analysts Dominic Schnider, Giovanni Staunovo and Wayne Gordon wrote in a May 26 note.

Limited downside

However, analysts expect the downside for gold to be limited with the precious metal likely to continue to outperform other risky assets.

Metals Focus expects gold prices to fall 9% in late 2022 from end-2021 while predicting double-digit declines for equities, high yield bonds and possibly investment-grade bonds, Meader said. The consultancy expects gold prices to average $1,830/oz in 2022, its highest full-year average price forecast for the commodity.

Investors are expected to keep diversifying assets into gold due to slowing economies, high inflation, growing risks of stagflation and other systemic risks, Metals Focus said.

Saxo Bank maintained a bullish view on gold and silver, mainly because of "the rising risk of a central bank policy mistake raising interest to the point where economic growth stalls," head of commodity strategy Ole Hansen wrote in a June 10 note.

"For now, gold remains stuck in a range with leveraged traders in futures and investors in ETF's currently showing no clear conviction with positions in both having been rangebound for the past month," Hansen said. "For that to change, we need to see a clear break above $1,870 — the key level of resistance."

Analysts upgraded their gold price forecasts for 2022-24 while downgrading the outlook for 2025 and 2026, for an overall average annual decrease of 0.3%, according to consensus estimates compiled by S&P Global Market Intelligence. Gold prices are expected to rise to $1,900.29/oz in the second quarter, with the full-year price for 2022 estimated at $1,864.31/oz, according to the analysis.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.