Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

5 Sep, 2022

| Aerial view of AVZ Minerals' Manono lithium-tin project in the Democratic Republic of Congo. |

Globally significant discoveries tantalizingly close to production highlight sub-Saharan Africa's potential to be a major lithium production hub amid experts' caution over vast infrastructure and sovereign risk challenges.

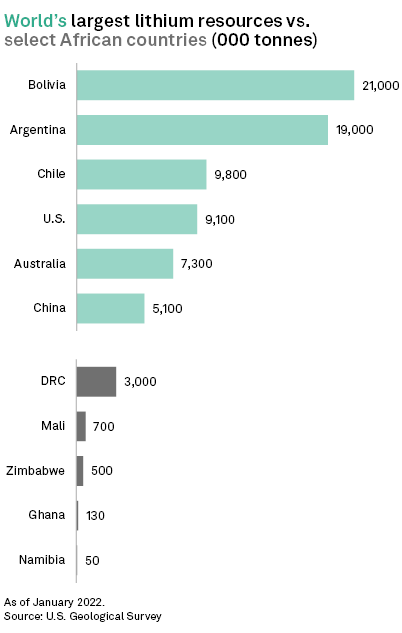

Zimbabwe, the Democratic Republic of Congo, Ghana, Namibia and Mali — which a British Geological Survey report classifies as "major countries in Africa's lithium supply chain" — have a combined 4.38 million tonnes in lithium resources, according to U.S. Geological Survey data.

This combined figure lags behind heavy hitters Argentina, Chile and Australia, but ahead of critical minerals aspirants Canada and Germany, which have 2.9 Mt and 2.7 Mt, respectively.

"Africa hosts some of the most geologically prospective regions in the world, not only for battery metals but natural resources more broadly. Africa is the next frontier for lithium and offers projects with near-term production of battery raw material, which has the supply chain placing a focus on the region," Prospect Resources Ltd.'s head of corporate development Nicholas Rathjen told S&P Global Commodity Insights. Prospect sold its 87% stake in the Arcadia lithium project to Zhejiang Huayou Cobalt Co. Ltd. for US$377.8 million in December 2021.

London-listed Atlantic Lithium Ltd., which also started trading on the Australian Securities Exchange Aug. 23 due to the strong investment interest in critical minerals projects in Australia, hopes to start construction on its Ewoyaa project in Ghana in 2024.

Western Australia "just keeps on giving," from its China demand-driven iron ore boom to its responsibility for Australia being the world's largest lithium producer; Atlantic interim CEO Len Kolff believes the same could happen in West Africa.

"Now lithium is the new wonder-metal, and lo and behold all these new lithium pegmatites have been discovered [in Western Australia]. The Birimian rocks of West Africa could potentially see that same story unfold," Kolff told Commodity Insights.

Kolff said growing production and discoveries should support further investment in the region, particularly once Ewoyaa is online, and with the resource growth of the Goulamina project in Mali. Goulamina is a 50/50 joint venture between China's Ganfeng Lithium Co. Ltd. and Leo Lithium Ltd., which demerged from Firefinch Ltd. in June in a A$738 million transaction.

Eyes on AVZ's Manono

Congo's significant resources are largely due to the Manono project, which is host to one of the world's largest undeveloped hard rock lithium deposits. Experts will be observing how long it takes AVZ Minerals Ltd. to obtain a mining license as an indicator of how easy lithium projects are to permit.

Kolff described Manono as "the elephant in the room" for African lithium investment, given its 401 million-tonne resource at 1.65% lithium oxide and an exploration target of up to 1.2 billion tonnes.

"It's like everything in the Congo has been hit with this magic meteorite that makes it the biggest and highest-grade deposit anywhere [in] the world," Kolff said.

Though Congo's minister of mines signed the ministerial decree to award the mining license to AVZ's 75%-owned unit Dathcom Mining SA on May 4, AVZ is still in talks with the government over the mining license and exploration rights.

"We're waiting to see what happens with AVZ," stockbroker Curran & Co mining analyst Doug Smith told Commodity Insights.

AVZ's issues demonstrate "Africa doesn't come without risk," particularly Congo's "jurisdictional risk which is rearing its head ... but from conversations we've had they're trying to work through it in a professional way and get the best outcome for the company," Smith said.

Amid the extended trading halt of AVZ securities that has dragged on since May, the backing of Suzhou CATH Energy Technologies Co. Ltd. is "validation that lithium converters and battery-makers need the material," Smith said. Suzhou CATH Energy Technologies is jointly owned by Contemporary Amperex Technology Co. Ltd., or CATL, and major CATL shareholder Pei Zhenhua.

The success of Ivanhoe Mines Ltd. and Zijin Mining Group Co. Ltd. in building the Kamoa-Kakula copper mine "just up the road" from Manono shows it is possible to build "big, modern mines" in the Congo, but it does come with the risk of "being landlocked in the middle of Africa," Smith said.

Infrastructure, skills challenges

While cheap labor is attractive for miners, things are not that simple, according to Michael Blakiston, a partner in law firm Gilbert + Tobin's energy and resources group who negotiated with Chinese parties for the Goulamina project. Leo Lithium plans Goulamina to be West Africa's first spodumene project, operational in the first half of 2024.

"You need a very, very significant lithium project to make it viable there [in Africa]," particularly given the transport challenges due to the landlocked nature of some deposits in African regions that often lack well-developed infrastructure, Blakiston told Commodity Insights.

"Spodumene is effectively a bulk commodity, so you have a lot of vehicle movements, so it's hard to justify for a smaller project," Blakiston said.

Although Leo Lithium may need more than one discharge port given the amount of material it needs to move from Goulamina, which is 1,000 kilometers from the nearest port, the project's 108 Mt resource at 1.45% lithium oxide puts it in the top tier of hard rock projects globally, managing director Simon Hay told an Aug. 31 industry conference in Western Australia.

Kolff also believes the unique geological characteristics, proximity to operational infrastructure such as grid power, port and road make Atlantic's discovery at Ewoyaa attractive for investment. The Ghanaian government is also keen to get many explorers — who moved to Mali and Burkina Faso, where more gold discoveries are at the surface and easier to find — back into the country to look for lithium, given that its goldfields are more mature.

Yet a downstream lithium industry is a distant dream for Africa, given power issues, the complex technology and the requisite skill needed for lithium processing, which has proven a challenge even in a "highly skilled environment" such as Australia, Blakiston added.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.