S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

13 Sep, 2023

By Muhammad Hammad Asif and Annie Sabater

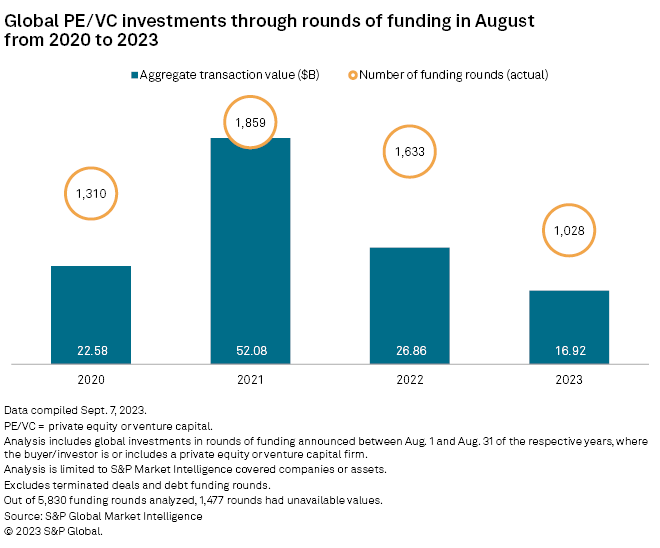

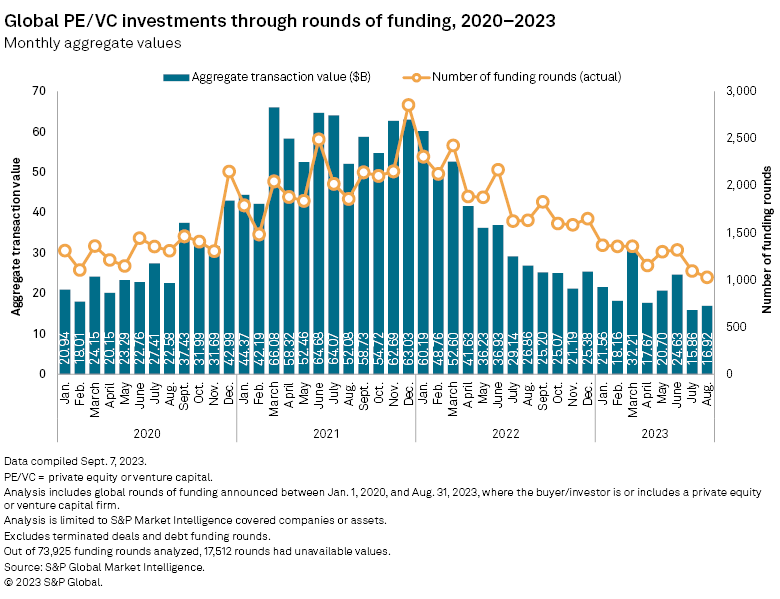

The value of venture capital investments worldwide dropped 37% year over year to $16.92 billion in August.

The aggregate investment value was the lowest August total since at least 2020. The number of funding rounds also declined 37% from a year earlier to 1,028, according to S&P Global Market Intelligence data.

– Download a spreadsheet with data featured in the story.

– Click here to read about biotechnology funding rounds.

– Explore more private equity coverage.

Largest funding rounds

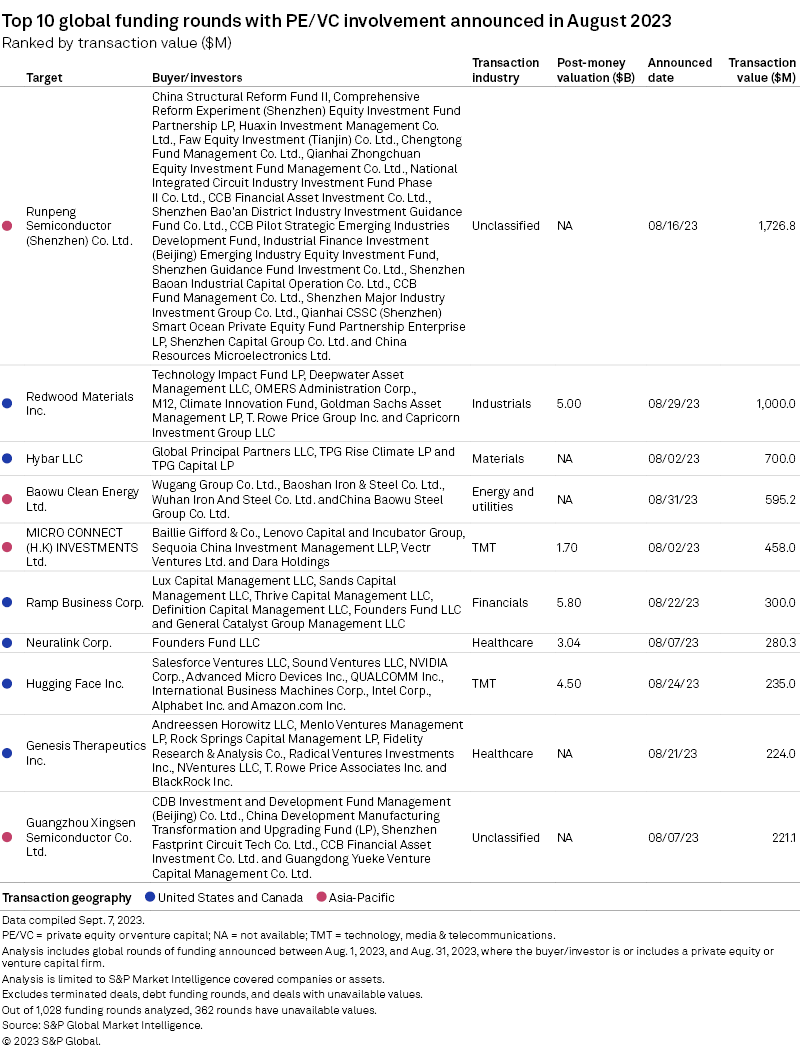

China-based Runpeng Semiconductor (Shenzhen) Co. Ltd., which develops integrated circuits and chips, raised about $1.73 billion in the largest funding round globally in August.

Private equity firms participating in the round included Chengtong Fund Management Co. Ltd., Faw Equity Investment (Tianjin) Co. Ltd., Huaxin Investment Management Co. Ltd., Qianhai Zhongchuan Equity Investment Fund Management Co. Ltd. and Shenzhen Bao'an District Industry Investment Guidance Fund Co. Ltd.

However, six of the 10 largest funding rounds were raised by companies in North America. The largest was by electronic waste recycling and processing services company Redwood Materials Inc., which raised $1 billion in its series D funding round.

The round was co-led by Goldman Sachs Asset Management LP, Capricorn Investment Group LLC's Technology Impact Fund LP and funds advised by T. Rowe Price Group Inc. Deepwater Asset Management LLC, M12, OMERS Administration Corp., OMERS Ventures Management Inc. were among the other investors participating in the round.

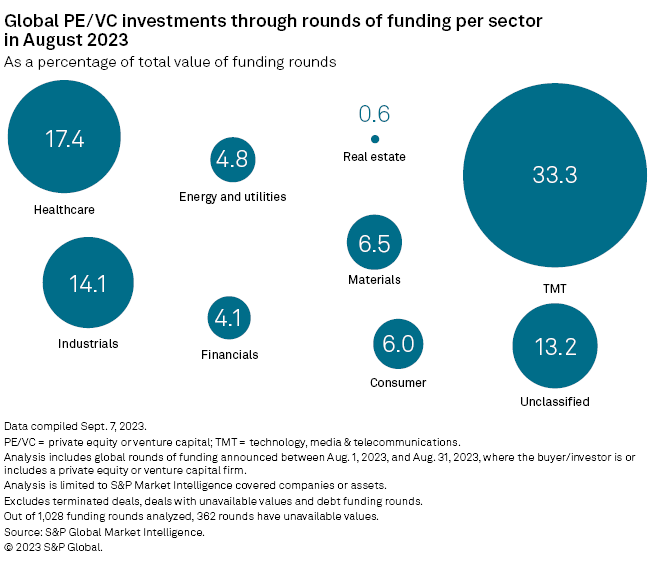

Investments by sector

The technology, media and telecommunications industry dominated global venture capital investments in August, attracting 33.3% of the total. It was followed by healthcare and industrials with shares of 17.4% and 14.1% of the total investments, respectively.