S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

9 Feb, 2023

By Muhammad Hammad Asif and Annie Sabater

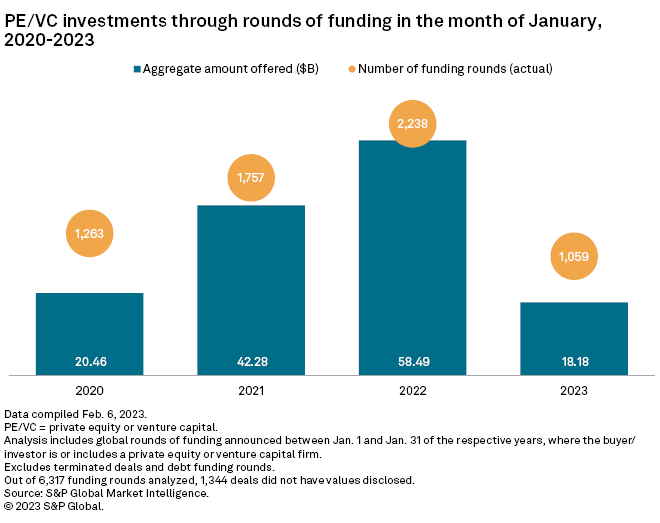

Global venture capital investment fell 68.9% year over year in January to $18.18 billion from $58.49 billion, according to S&P Global Market Intelligence data.

The number of funding rounds with venture capital participation was down 52.6% to 1,059 rounds, from 2,238 rounds in January 2022. The total amount raised declined from $19.71 billion in December 2022 via 1,104 rounds.

|

* |

Largest funding rounds

Digital payment applications developer PhonePe Private Ltd. raised the largest funding round in January with a transaction value of $1 billion. New investor General Atlantic Service Co. LP led the first tranche of $350 million, and PhonePe plans to use the proceeds to develop infrastructure, scale UPI payments in India and invest in new businesses.

Hawthorne, Calif.-based Space Exploration Technologies Corp., which designs, manufactures and launches rockets and spacecraft, secured $750 million. Andreessen Horowitz LLC participated in the mature stage funding round that placed the company's pre-money valuation at $137 billion.

Solar power company Silicon Ranch Corp. ranked third among the largest funding rounds in January. Manulife Investment Management was the lead returning investor in the $600 million funding round. Other investors included Mountain Group Capital LLC, TD Asset Management Inc. and The TD Greystone Infrastructure Fund.

Investments by sector

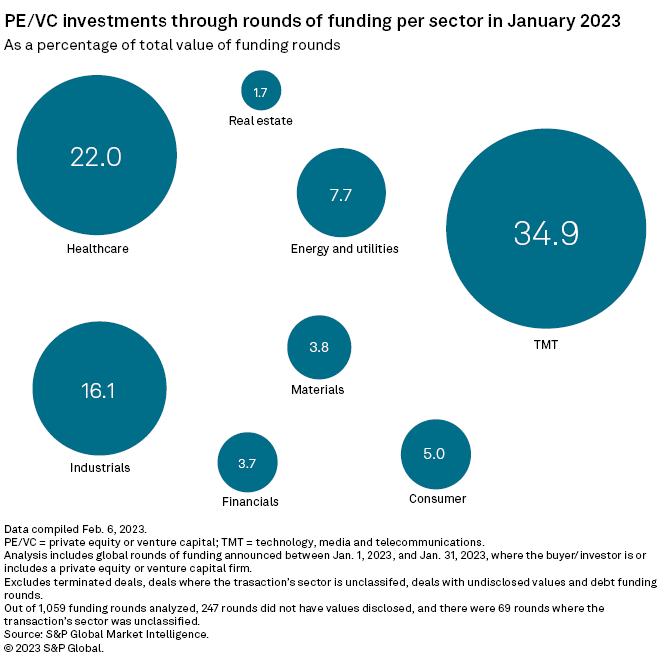

The technology, media and telecommunications industry continued to lead other sectors in venture capital investment by attracting 34.9% of the total funding raised during January. It was followed by the healthcare sector at 22% and the industrials sector at 16.1%.