S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

7 Dec, 2021

By Rehan Ahmad

China's top four banks are likely to increase their global systemic importance, while Japan's megabanks are set to see their global influence decline in coming years as their overseas strategies diverge.

Chinese banks are set to become more connected with the world's financial system in the medium term, driven by cross-border investment flows and offshore use of the Chinese yuan, analysts said.

In contrast, Japanese megabanks, which are also global systemically important banks, or G-SIBs, are set to further scale back their overseas operations as they seek to contain capital and credit costs.

"More Chinese banks are likely to enter and move up on the G-SIB list, especially with the growing financial linkages with the world," said Gary Ng, senior economist at Natixis CIB Asia-Pacific.

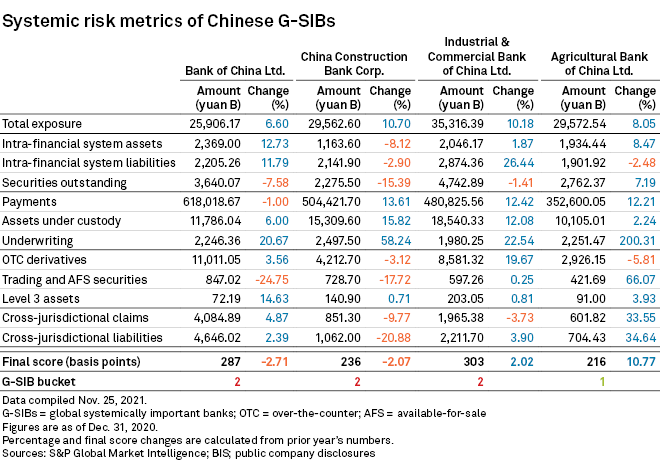

The end-2020 scores of all Chinese G-SIBs were higher than six years ago, suggesting an increase in the impact on the world's financial system in the event of distress or bank failure, according to the Financial Stability Board and S&P Global Market Intelligence. The G-SIB score of Industrial & Commercial Bank of China Ltd., the world's largest bank by assets, increased for the sixth consecutive year to 303, according to the latest list of 30 G-SIBs based on end-2020 data. Agricultural Bank of China's score grew for the third year to 216, while the scores of Bank of China Ltd. and China Construction Bank Corp. fell marginally to 287 and 236, respectively, after years of increase, according to the list released Nov. 23.

Apart from the four largest Chinese lenders, Bank of Communications is close to entering the G-SIB list. Its end-2020 score is only five points below the minimum threshold of 130 required to be identified as a G-SIB.

The annual assessment came amid growing concerns over China's slowing economic growth and potential contagion to the global financial system following debt problems at large companies such as China Huarong Asset Management Co. Ltd.and China Evergrande Group.

The overall G-SIB score takes five indicators into account: complexity, cross-jurisdictional activity, interconnectedness, size and substitutability. The higher the score, the higher the additional capital and leverage requirements to prevent banks from being too big to fail.

China's trajectory

While the use of the yuan outside mainland China is still limited partly due to capital controls, the internationalization of the currency is high on Beijing’s agenda. The authorities have been widening yuan access to more foreign institutions by opening its financial markets. China is also one of the largest creditors for many less developed countries under the nation's so-called belt-and-road diplomatic initiative.

A bank's importance in the global financial system will generally increase due to more cross-border activity or linkages, said Daryl Liew, chief investment officer at Reyl Singapore, a wealth and asset management firm. "I would expect that once geopolitical issues ease, Chinese banks will likely grow in importance, especially with wider adoption of the [yuan]," Liew said.

The announced value of China's overseas acquisitions stood at US$48.3 billion in 2020, down from US$79.4 billion a year earlier, according to an August report by EY. Outbound deals were slowed by geopolitics, such as increased scrutiny by regulators in the U.S. and EU, as well as the pandemic, the report said.

China is set to retain its role as one of the world's largest manufacturers, consumers and trading partners, so it is likely that Chinese banks will continue to be systemically important, analysts said. China's economy is projected to expand 5.3% while the global economy is expected to grow by 3.1% in 2023, according to a World Bank forecast in June.

For now, the Chinese G-SIBs' impact on the global financial system is still lower than that of other G-SIBs from the U.S. and Europe due to their predominantly domestic footprint. China's four largest lenders all grew in size in 2020. However, banks had their scores docked by factors such as cross-jurisdictional activity and trading and available-for-sale securities.

At the end of 2020, China Construction Bank, Bank of China and Agricultural Bank of China had less than 8% of their total assets outside mainland China, while ICBC had about 12%, according to their annual reports.

Japan's systemic importance

Japanese megabanks' global systemic importance may fall in the coming years as they ease up on their overseas expansion.

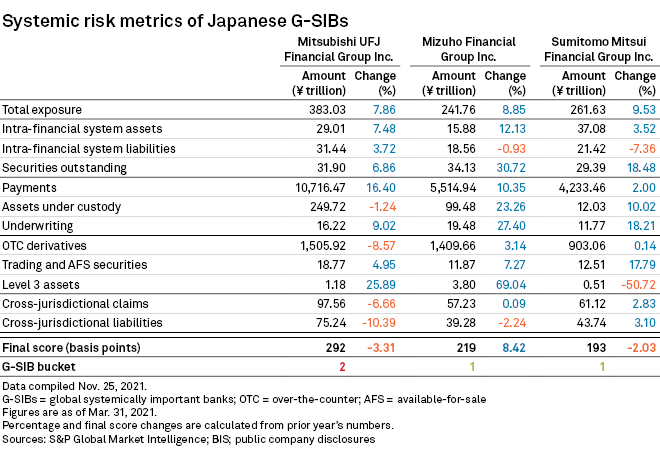

The G-SIB score of Mitsubishi UFJ Financial Group Inc. and Sumitomo Mitsui Financial Group Inc. fell to 292 and 193, respectively, while that of Mizuho Financial Group Inc. increased 17 points to 219 as of end-2020 from a year earlier.

"[Japanese megabanks] won't expand their balance sheets as they rely on operations at home and they intend to cut risk assets," said Takahide Kiuchi, executive economist at Nomura Research Institute.

MUFG's G-SIB score is likely to drop the most among the trio, following its plan to divest its U.S. retail operations to cut costs and stabilize risk-weighted assets, said Michael Makdad, an analyst at Morningstar.

The U.S. operations had end-June assets totaling $105.4 billion. The sale will help reduce MUFG's risk-weighted assets, a major factor in the calculation of the G-SIB score, Makdad added.

Sumitomo, the second largest Japanese megabank, will likely slow its overseas acquisition strategy as pressure on its capital and risk profile increased after it committed more than $4 billion on deals in just four months following April 2021, analysts said.

Meanwhile, Mizuho cut its overseas lending, mainly in Europe and Asia, by 12% in the fiscal first half through September from a year earlier due to the pandemic.

"I wouldn't be surprised if the [systemic] importance of Japanese banks [is] downgraded," said Yasuyuki Kuratsu, CEO of Research and Pricing Technology, an independent think tank in Japan.