S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

25 May, 2023

Global public companies pushed share repurchases to a new high in 2022 following a pandemic lull, as big North American businesses drove the most activity.

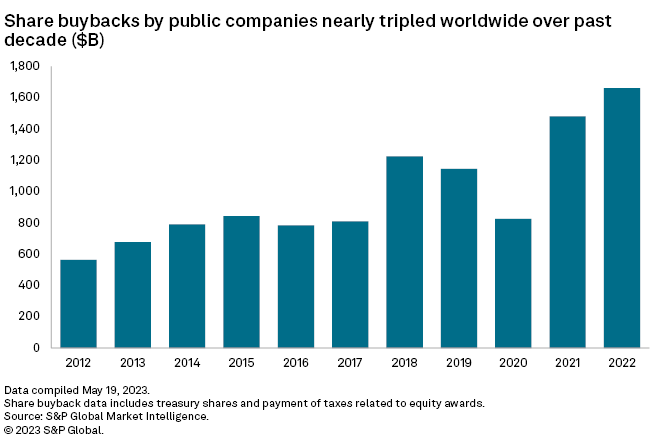

In 2022, public companies worldwide bought back $1.661 trillion of their own shares, up from 2020 when companies bought back $825 billion in stock and roughly triple from 2012 when $563 billion in shares were bought back, according to the latest S&P Global Market Intelligence data. The figures include treasury shares and payment of taxes related to equity awards.

Companies tend to repurchase shares when they have extra cash on hand and when management considers the stock undervalued. Equities broadly fell in 2022, with the S&P 500 dipping nearly 20%.

US, Canada drive activity

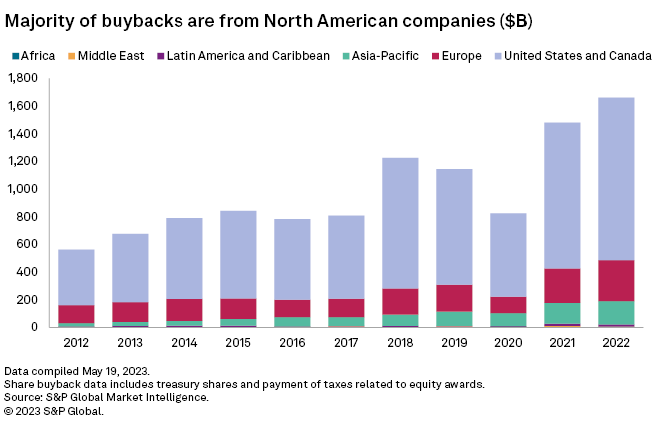

Nearly $1.173 trillion, or 71% of all buybacks, occurred in the US and Canada in 2022, the data shows. That was up from 2021, when nearly $1.053 trillion in buybacks were in North America, also accounting for about 71% of buybacks globally.

In 2020, there were $602.27 billion of buybacks in the US and Canada, about 73% of the worldwide total.

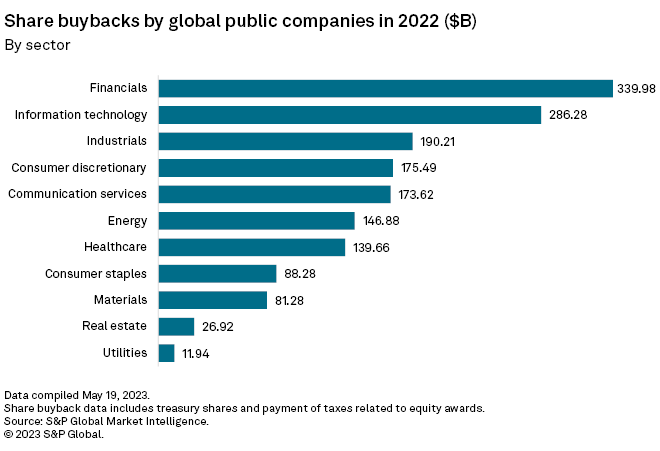

Financials and information technology combined for $626.26 billion, or about 38% of all buybacks in 2022.

S&P 500 activity mostly flat

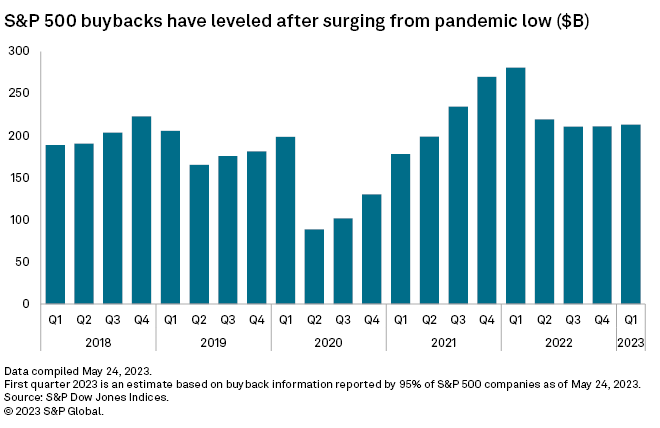

Buybacks in the S&P 500 appear to have leveled off. The large-cap index had nearly $211.19 billion of buybacks in the fourth quarter of 2022, up slightly from $210.84 billion in the third quarter of 2022 but well below the first quarter of 2022 when there were just over $281 billion in buybacks, according to S&P Dow Jones Indices data.

S&P 500 buybacks were at $213.23 billion for the first quarter of 2023, according to a May 24 estimate based on activity from 95% of companies on the index.

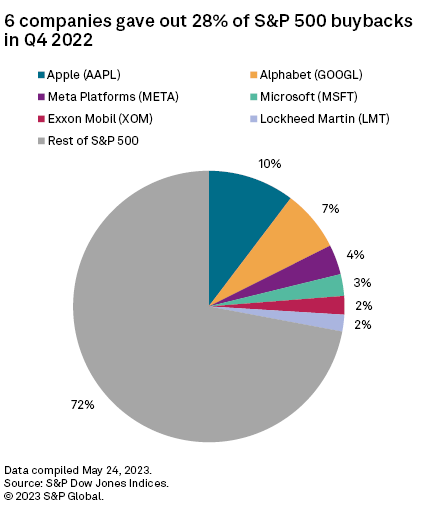

In the fourth quarter of 2022, Apple Inc. bought back $21.79 billion of its own stock, while Alphabet Inc. repurchased $15.41 billion of its own shares. Those two companies accounted for about 17% of all S&P 500 buybacks in the fourth quarter.

The large number of buybacks in the US comes as the Biden administration considers boosting taxes on the practice. A 1% tax on stock buybacks went into effect in January, and President Biden has proposed quadrupling that tax. On May 3, the SEC adopted new rules strengthening disclosure rules on stock buybacks.