S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

8 Jun, 2022

By Dylan Thomas and Annie Sabater

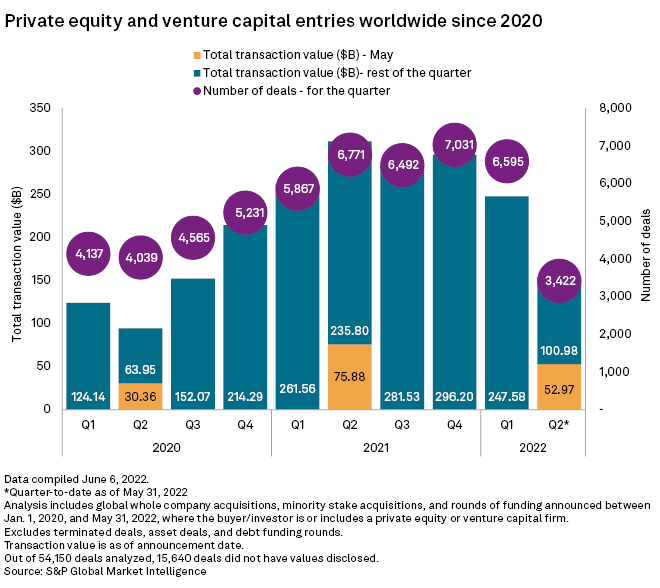

A tally of global private equity and venture capital entries for May shows deal volume and value both fell to their lowest monthly totals in at least a year.

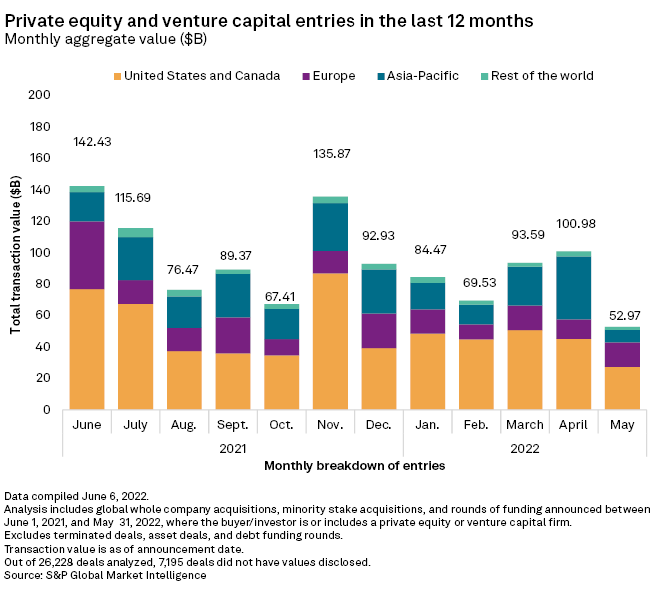

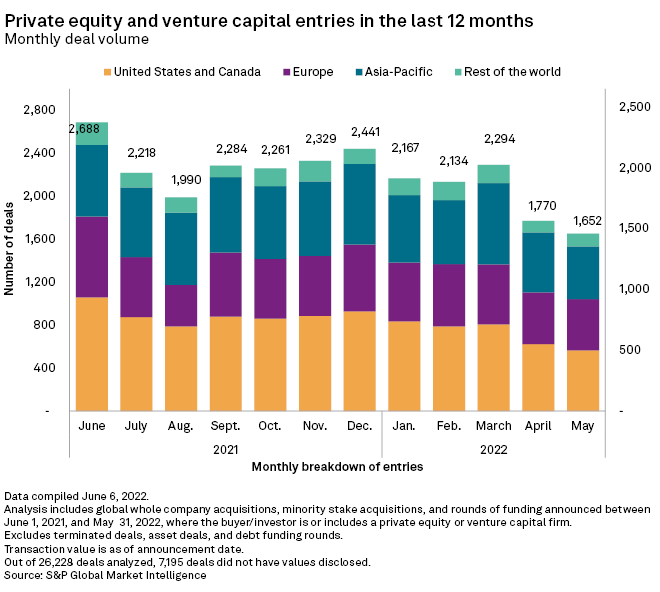

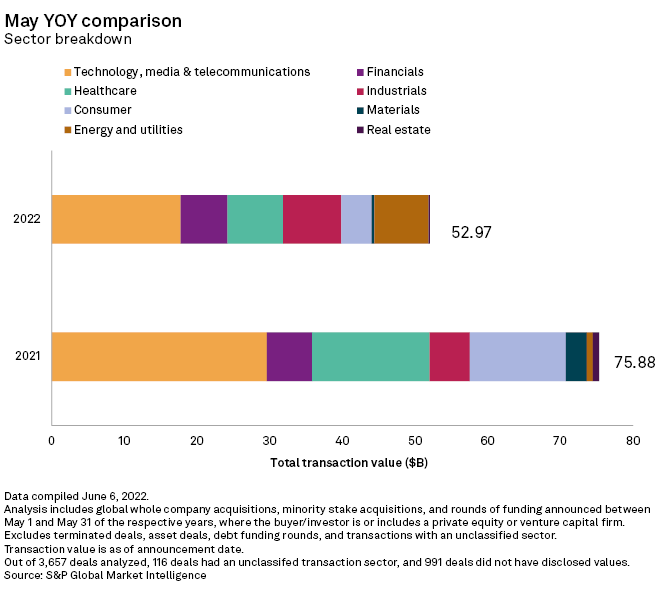

Private equity and venture capital firms recorded $52.97 billion in entries globally in May, a decline of more than 30% from the total for the same month a year ago, according to S&P Global Market Intelligence data. The total number of entries also fell nearly 18% year over year in May, to 1,652 from 2,005 for the same month in 2021.

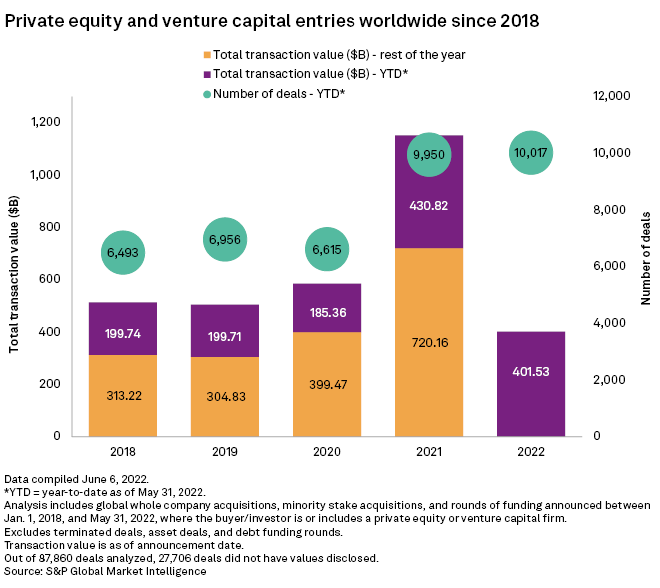

Entries year-to-date are maintaining the pace set in 2021, with the 10,017 deals announced between Jan. 1 and May 31 of this year just slightly ahead of the 9,950 deals recorded in the same five months of 2021. But the value of those deals has declined to $401.53 billion, off nearly 7% from the aggregate total for the first five months of 2021.

Most of the month's entry activity was in the U.S. and Canada, where firms announced 565 deals worth a combined $27.36 billion. In Europe, 477 deals were struck totaling $15.71 billion.

Firms active in Asia-Pacific tallied 493 deals totaling $7.92 billion.

The technology, media and telecommunications sector led in deal value, with $17.74 billion worth of deals announced in May. That's down more than 40% from the $29.6 billion worth of deals for that sector in May 2021.

*Click here to explore recent M&A activity.

*Click here for more private equity coverage.

*Read the day's top news and analysis from S&P Global Market Intelligence.

Next came the industrial sector, with $8 billion worth of deals in May, up over 44% from the same month a year ago. Deals announced in the healthcare sector totaled $7.62 billion in May, down nearly 53% year over year.

Among those deals with announced values, the biggest in May was a $300 million venture funding round for Enavate Sciences. A new portfolio company created by healthcare investment firm Patient Square Capital LP, Enavate was formed to invest in and provide support to companies developing novel therapeutics.

Next-largest was an approximately $74.9 million round of funding for Shandong Pet Products Co. Ltd. The investor group included Boyu Capital Consultancy Co. Ltd., Jiangsu Confitop Venture Capital Management Co. Ltd., Riverhead Capital Investment Management Co. Ltd. and Sino Pacific Capital Co. Ltd.