Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

16 Jan, 2024

By Karl Angelo Vidal and Annie Sabater

Global private equity and venture capital deal value and volume in 2023 were at their lowest in at least five years.

Transaction value declined 34.7% year over year to $474.14 billion, while deal count fell to 12,016 from 17,549, according to S&P Global Market Intelligence data.

Multiple factors including inflationary headwinds, rising interest rates and geopolitical unrest led many investors to step back from making deals in 2023, Pete Witte, lead analyst at EY Global Private Equity, said in a report. However, private equity remained active, with the asset class accounting for a quarter of the total M&A activity.

"Activity in the first half of the year was defined almost exclusively by larger take-privates and smaller bolt-ons. As the year progressed, announcements broadened to include a growing array of secondaries, carve-outs and private-to-privates," Witte said.

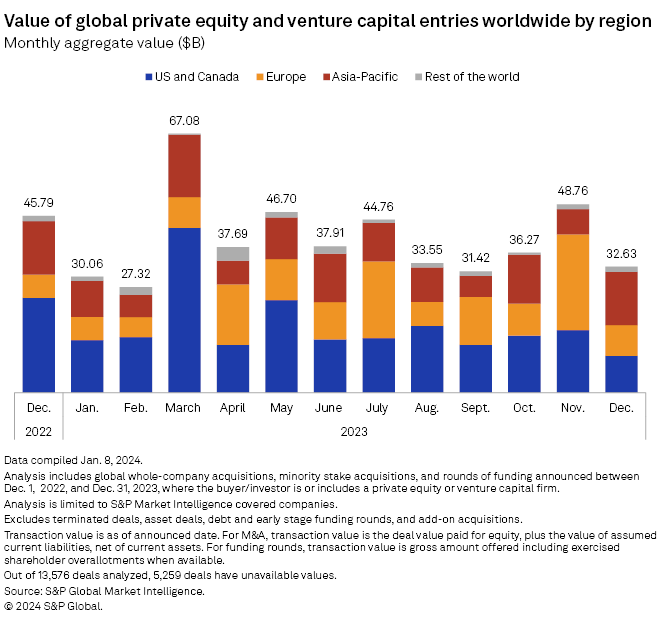

The December 2023 totals for private equity deal value and volume also recorded year-over-year declines.

Deal value stood at $32.63 billion for the month, down from $45.79 billion year over year. The number of deals dropped to 802 from 1,560 in December 2022.

For December's largest transaction, private equity firms Clearlake Capital Group LP and Insight Venture Management LLC agreed to buy Alteryx Inc. for $4.53 billion.

Qatalyst Partners is Alteryx's financial adviser on the announced transaction. Wilson Sonsini Goodrich & Rosati, Professional Corp. and Fenwick & West LLP are legal advisers.

Houlihan Lokey Inc., Goldman Sachs & Co. LLC, JP Morgan Securities LLC and Morgan Stanley & Co. LLC are financial advisers to Clearlake and Insight. Sidley Austin LLP is Clearlake's legal adviser, while Willkie Farr & Gallagher LLP serves as Insight's legal counsel.

In the biggest private equity-backed funding round of the month, Visma AS secured €3 billion from HgCapital LLP, Intermediate Capital Group PLC and TPG Capital LP.

Results for the fourth quarter of 2023 also showed a decrease in activity. The total transaction value for the quarter fell to $117.66 billion from $136.87 billion during the same period a year ago. The number of deals dropped to 2,761 from 4,006.

|

– Download a spreadsheet with data in this story. – Read about global private equity entries in November 2023. – Explore more private equity coverage. |

Asia-Pacific recorded the largest amount of private equity investment in December 2023, at $13.80 billion, down slightly from $13.84 billion in the year-ago period. The US and Canada came next with $9.55 billion, a 61.1% drop from $24.58 billion in the last month of 2022.

In Europe, the value of private equity entries jumped to $7.94 billion from $6 billion in December 2022.

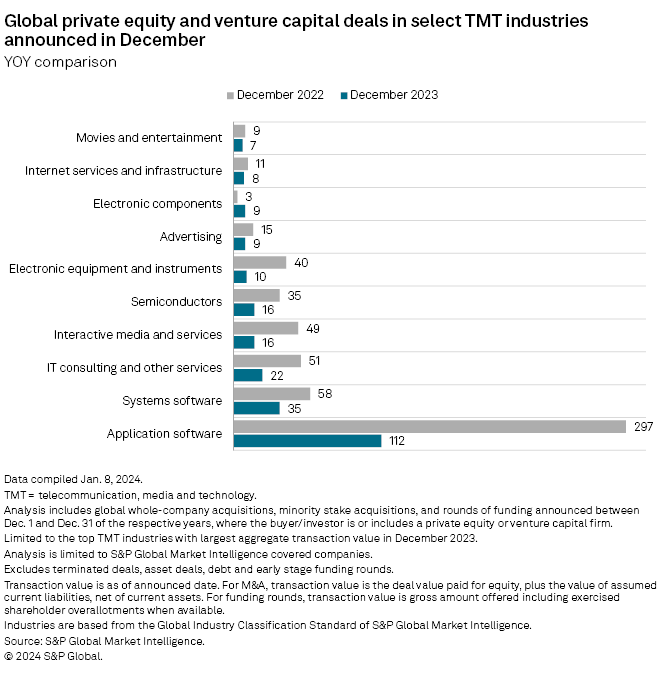

Technology, media and telecom remained the most invested sector in the last month of 2023 with 265 private equity-backed transactions. Within the sector, application software companies saw the highest number of deals, at 112, although deal count was way down from the 297 transactions in December 2022.

The systems software and IT consulting subsectors tallied 35 and 22 deals, respectively.