Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

9 Nov, 2023

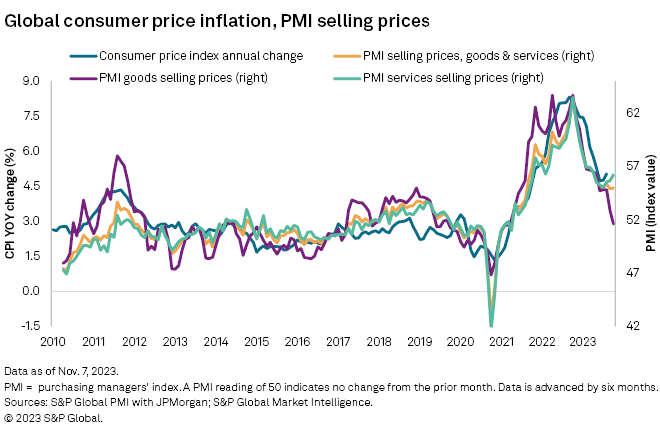

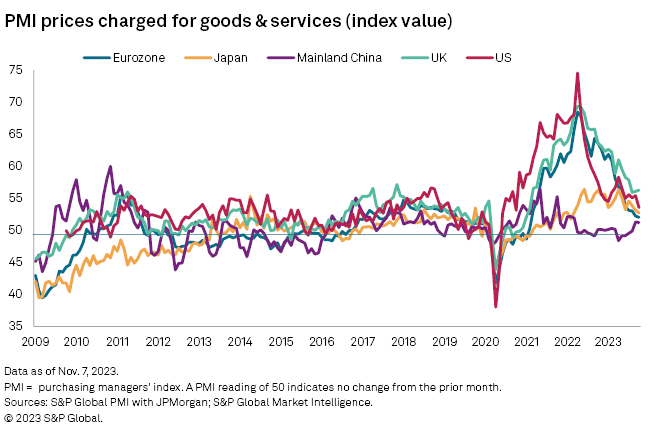

Global inflationary pressures moderated in October to their lowest level since late 2020, according to Purchasing Managers' Index (PMI) data compiled by S&P Global across over 40 economies and sponsored by JPMorgan.

Although the overall rate of inflation of selling prices for goods and services remains above its pre-pandemic average amid some stickiness of services inflation and a modest upturn in goods prices, there is encouraging news on underlying price pressures cooling further in the coming months. In particular, wage pressures have moderated markedly in recent months, and companies' pricing power has been hit by reduced demand. Demand-pull price pressures — wherein rising aggregate demand accelerates inflation — are reverting to their long-run average.

Central bank inflation targets have now come into view in the US and eurozone. Some price stickiness is more evident in the UK, though even here the rate of inflation looks set to moderate sharply in the coming months.

PMI selling price index falls further in October

Average prices charged for goods and services rose globally at the slowest rate for nearly three years in October. The global PMI selling price index — compiled by S&P Global and covering prices charged for both goods and services in all major developed and emerging markets — fell from 53.6 in September to 53.0 in October, its lowest since December 2020.

The further decline in the selling price index from its all-time high recorded in April 2022 has brought global inflationary pressures closer to the survey's long-run average of 52.2 and closer to the five-year pre-pandemic five-year average of 51.6.

The leading indicator properties of the PMI mean that global inflation is set to cool further from the 5.0% annual rate estimated from various national sources for July, potentially dropping to around 3.5% early in the new year.

Although a 3.5% rate remains somewhat elevated by historical standards — in the decade prior to the pandemic, global consumer price inflation averaged 2.7% — there are good reasons to believe underlying price pressures will continue to moderate even further in the months ahead.

Looking at sector divergences, recent months have seen some firming of goods prices, linked in part to higher oil prices, as well as the waning deflationary impact of healing supply chains. Service sector prices, which provided a major lift to global inflation earlier in the year as demand for consumer services surged, continued to show a slower rate of increase in October. The overall global rise in services prices at the start of the fourth quarter was the smallest since February 2021.

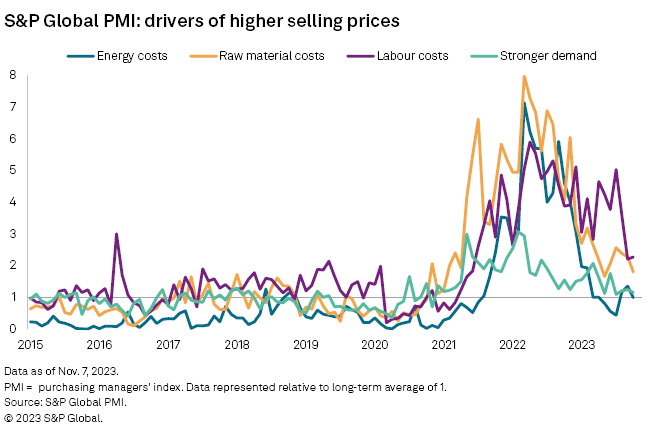

Energy cost pressures up only modestly from recent lows

One of the big uncertainties facing the inflation outlook is the impact of changing oil prices, notably in response to geopolitical risks. Yet there seems to be some good news in this respect. Analyzing the reasons for changing selling prices cited by PMI survey respondents around the world, the impact of higher energy prices remains in line with its long-run average, albeit with this representing higher pressures than seen before the recent oil price rise.

Upward pressure from broader raw material inputs, meanwhile, has fallen to its second-lowest level since January 2021.

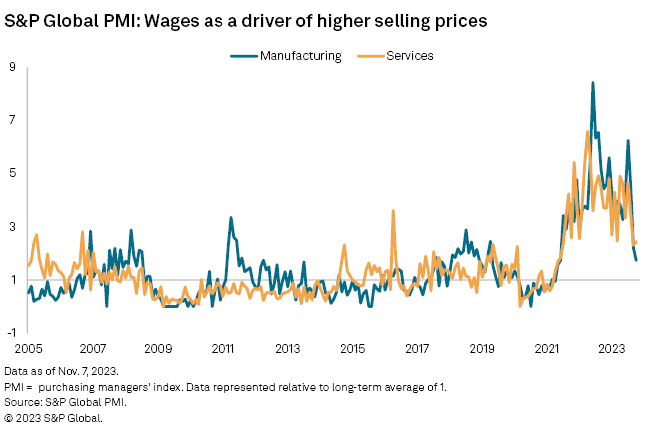

Lower wage pressures

There has also been a considerable reduction in upward pressure from wages. The inflationary impact of wages on average prices charged for goods and services has fallen to its second-lowest since June 2021. While the easing inflationary impact of wage pressures was most marked in the manufacturing sector in October, pressures have also clearly cooled substantially in services compared with levels recorded over the past two years.

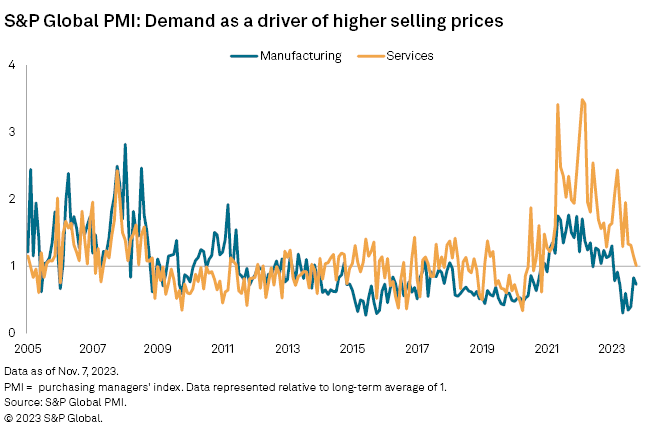

Demand-pull price effect evaporates

Perhaps the most interesting development is the degree to which demand-pull inflationary forces have moderated. Lower demand has removed pricing power from manufacturers over the past nine months — as proxied by price pressures dropping below their long-run average. Additionally, upward demand pressures on prices in the service sector have now also fallen to a level in line with their long-run average amid a weakened demand environment.

The overall demand-pull effect on prices consequently evaporated at the start of the fourth quarter, boding well for a further easing of inflationary pressures around the world.

US, European inflation targets in sight

Looking at price trend variations around the world, the steepest decline in inflationary pressures has been seen in the eurozone, where the PMI's selling price index covering goods and services has fallen to its lowest since February 2021 and is now only 1.6 index points above its pre-pandemic long-run average. At this level, the PMI index is signaling consumer price index inflation to fall further from 2.9% in October closer to the European Central Bank's target of 2% at the turn of the year.

The US Federal Reserve's 2% target has also come into sight after the PMI's selling price index across the US dropped to its lowest since October 2020 to a level just 1.2 points above its pre-pandemic decade average.

Inflation looks stickier in the UK, however, as the PMI's selling price index rose 0.2 points in October, and remains 4.1 points above its pre-pandemic 10-year average. The latest readings are nevertheless consistent with UK annual consumer price inflation, moderating from its current 6.7% rate to a range closer to 4% as we move into 2024.

In Asia, the PMI hints at inflation dipping below 2% in Japan in the coming months, while in mainland China the recent ground gained by the PMI selling price index has helped allay fears of deflation.

Purchasing Managers' Index data is compiled by S&P Global for more than 40 economies worldwide. The monthly data is derived from surveys of senior executives at private sector companies and is available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data is used by financial and corporate professionals to better understand where economies and markets are headed and to uncover opportunities.

Full PMI data are available only via subscription. For more information or to express your interest, please contact your S&P Global relationship manager.

Data and insights for this article were compiled by Chris Williamson, chief business economist for S&P Global Market Intelligence.

09 Nov, 2023

Global inflationary pressures moderated in October to their lowest level since late 2020, according to Purchasing Managers' Index (PMI) data compiled by S&P Global across over 40 economies and sponsored by JPMorgan.

Although the overall rate of inflation of selling prices for goods and services remains above its pre-pandemic average amid some stickiness of services inflation and a modest upturn in goods prices, there is encouraging news on underlying price pressures cooling further in the coming months. In particular, wage pressures have moderated markedly in recent months, and companies' pricing power has been hit by reduced demand. Demand-pull price pressures — wherein rising aggregate demand accelerates inflation — are reverting to their long-run average.

Central bank inflation targets have now come into view in the US and eurozone. Some price stickiness is more evident in the UK, though even here the rate of inflation looks set to moderate sharply in the coming months.

PMI selling price index falls further in October

Average prices charged for goods and services rose globally at the slowest rate for nearly three years in October. The global PMI selling price index — compiled by S&P Global and covering prices charged for both goods and services in all major developed and emerging markets — fell from 53.6 in September to 53.0 in October, its lowest since December 2020.

The further decline in the selling price index from its all-time high recorded in April 2022 has brought global inflationary pressures closer to the survey's long-run average of 52.2 and closer to the five-year pre-pandemic five-year average of 51.6.

The leading indicator properties of the PMI mean that global inflation is set to cool further from the 5.0% annual rate estimated from various national sources for July, potentially dropping to around 3.5% early in the new year.

– Set email alerts for future PMI articles.

– Read more PMI research on Capital IQ Pro.

Although a 3.5% rate remains somewhat elevated by historical standards — in the decade prior to the pandemic, global consumer price inflation averaged 2.7% — there are good reasons to believe underlying price pressures will continue to moderate even further in the months ahead.

Looking at sector divergences, recent months have seen some firming of goods prices, linked in part to higher oil prices, as well as the waning deflationary impact of healing supply chains. Service sector prices, which provided a major lift to global inflation earlier in the year as demand for consumer services surged, continued to show a slower rate of increase in October. The overall global rise in services prices at the start of the fourth quarter was the smallest since February 2021.

Energy cost pressures up only modestly from recent lows

One of the big uncertainties facing the inflation outlook is the impact of changing oil prices, notably in response to geopolitical risks. Yet there seems to be some good news in this respect. Analyzing the reasons for changing selling prices cited by PMI survey respondents around the world, the impact of higher energy prices remains in line with its long-run average, albeit with this representing higher pressures than seen before the recent oil price rise.

Upward pressure from broader raw material inputs, meanwhile, has fallen to its second-lowest level since January 2021.

Lower wage pressures

There has also been a considerable reduction in upward pressure from wages. The inflationary impact of wages on average prices charged for goods and services has fallen to its second-lowest since June 2021. While the easing inflationary impact of wage pressures was most marked in the manufacturing sector in October, pressures have also clearly cooled substantially in services compared with levels recorded over the past two years.

Demand-pull price effect evaporates

Perhaps the most interesting development is the degree to which demand-pull inflationary forces have moderated. Lower demand has removed pricing power from manufacturers over the past nine months — as proxied by price pressures dropping below their long-run average. Additionally, upward demand pressures on prices in the service sector have now also fallen to a level in line with their long-run average amid a weakened demand environment.

The overall demand-pull effect on prices consequently evaporated at the start of the fourth quarter, boding well for a further easing of inflationary pressures around the world.

US, European inflation targets in sight

Looking at price trend variations around the world, the steepest decline in inflationary pressures has been seen in the eurozone, where the PMI's selling price index covering goods and services has fallen to its lowest since February 2021 and is now only 1.6 index points above its pre-pandemic long-run average. At this level, the PMI index is signaling consumer price index inflation to fall further from 2.9% in October closer to the European Central Bank's target of 2% at the turn of the year.

The US Federal Reserve's 2% target has also come into sight after the PMI's selling price index across the US dropped to its lowest since October 2020 to a level just 1.2 points above its pre-pandemic decade average.

Inflation looks stickier in the UK, however, as the PMI's selling price index rose 0.2 points in October, and remains 4.1 points above its pre-pandemic 10-year average. The latest readings are nevertheless consistent with UK annual consumer price inflation, moderating from its current 6.7% rate to a range closer to 4% as we move into 2024.

In Asia, the PMI hints at inflation dipping below 2% in Japan in the coming months, while in mainland China the recent ground gained by the PMI selling price index has helped allay fears of deflation.

Purchasing Managers' Index data is compiled by S&P Global for more than 40 economies worldwide. The monthly data is derived from surveys of senior executives at private sector companies and is available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data is used by financial and corporate professionals to better understand where economies and markets are headed and to uncover opportunities.

Full PMI data are available only via subscription. For more information or to express your interest, please contact your S&P Global relationship manager.

Data and insights for this article were compiled by Chris Williamson, chief business economist for S&P Global Market Intelligence.