Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

4 Feb, 2024

By Yuzo Yamaguchi and Marissa Ramos

Global green bond issuance will likely gain further momentum in 2024, with interest rates in the US and Europe expected to fall, creating favorable debt market conditions for investors and issuers alike.

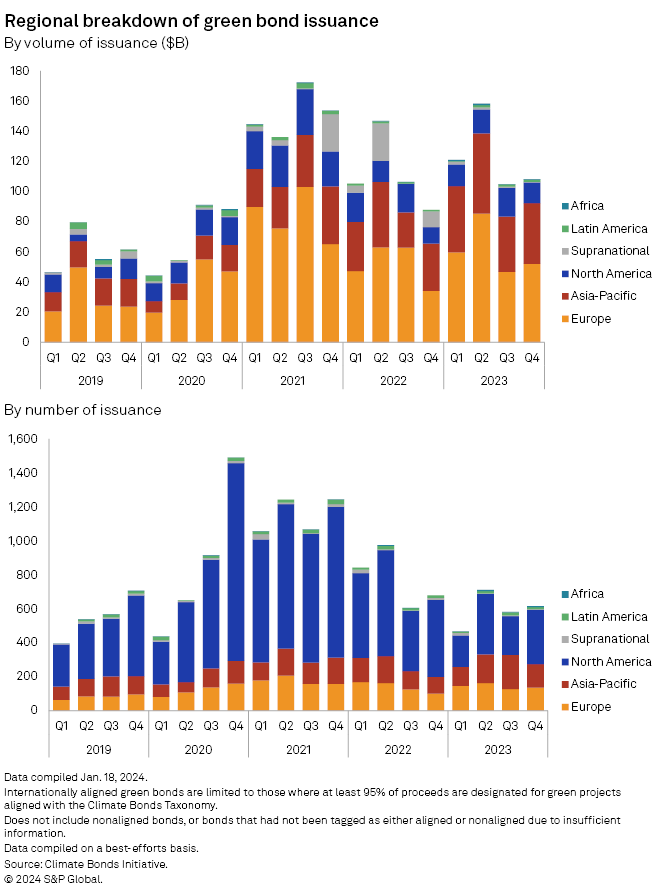

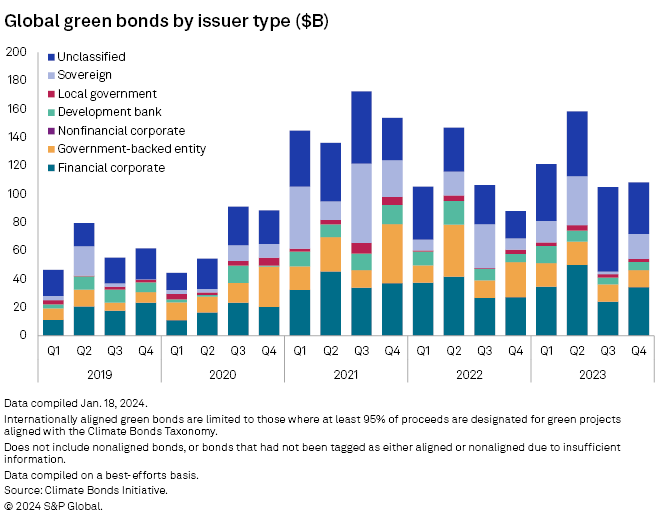

2023 green debt sales grew to $492.30 billion in 2023 from $446.18 billion the previous year, led by Europe, which made up nearly half of the global market, according to Climate Bonds Initiative data. The increase came even as most global central banks tightened monetary policy.

"Cutting interest rates should be a tailwind for the green bond market," said Takahide Kiuchi, executive economist at the Nomura Research Institute. "Particularly, the US policy shift to cut rates, if realized, should have [a] strong impact on the market as the economy will remain in good shape, posing little credit risk."

Policy tailwinds

Inflationary pressures are abating in several large global economies, setting the stage for central banks to loosen monetary policy to support growth. The International Monetary Fund now expects the world economy to grow 3.1% in 2024, according to its January "World Economic Outlook" report, from the 2.9% it predicted in October 2023. "Inflation is falling faster than expected in most regions, in the midst of unwinding supply-side issues and restrictive monetary policy," the IMF said.

"Investors [of green bonds] were in a wait-and-see mode in the autumn of last year when the long-term US interest rates soared," said Hiroshi Kubotani, a senior economist at the NLI Research Institute. A potential policy shift by the Fed this year "could revive the debt market," Kubotani added.

New EU rules

In addition to a potential rate cut by the European Central Bank this year, new European Union standards for green bonds issuance — which take effect in January 2025 — will add additional support to the debt market, said analysts. The new norms aim to improve the transparency, comparability and credibility of the green bond market, helping investors assess the environmental, social and governance stance of issuers more closely.

The rules require deals to be 85% aligned with the EU's green taxonomy as a minimum. The remaining "flexibility pocket," which accounts for the remaining 15% and includes economic activity that contributes to the EU environmental objectives but is outside of the scope of the taxonomy, will be reconsidered in the coming years.

The new regulations in Europe "should be a plus to the market," said Yoshiki Tsurumaki, partner at law firm King & Wood Mallesons. The move will "improve transparency and reliability [of environmental projects] by wiping out greenwashing," Tsurumaki said, referring to the practice of seeking to capitalize on the growing demand for environmentally sound products.

Europe ended 2024 with $243.75 billion of green bond issuance, compared with $174.23 billion in the Asia-Pacific region and $62.96 billion in North America, Climate Bonds Initiative data shows.

China leapfrogs

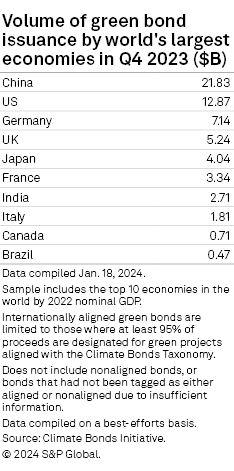

Global green bond sales increased to $108.24 billion in the fourth quarter of 2023 from $104.76 billion in the previous quarter. China leapfrogged the US and Germany to become the top issuer, with $21.83 billion in the October-to-December period.

The green bonds momentum in China may be maintained in 2024 as the world's second-biggest economy leans on green financing for its sustainability goals, said John Hai, head of global debt finance, CITIC CLSA.

Germany slipped into third place with $7.14 billion in green bond sales, less than half the $15.12 billion earned a year earlier that helped the country claim first place.

In contrast with Europe and the US, Japan’s green bond market will likely face headwinds this year, coming under pressure from a potential end to its minus interest rate policy in April, analysts said.

As opposed to Japan’s stock rally from January, the country’s 10-year yields have been soaring, putting the price of the debt under downward pressure. "Investors will be further increasing a sense of caution about the debt market when the rates are raised," Kiuchi said.