S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

15 Jul, 2021

By Rebecca Isjwara, Yuzo Yamaguchi, and Rehan Ahmad

Global green bond sales are expected to recover and may set a new record this year led by Europe, which on July 14 announced an ambitious plan to reduce its net greenhouse gas emissions by at least 55% over 1990 levels within this decade.

Europe aims to become carbon neutral by 2050 and its latest "Fit for 55" emissions reduction plan touches almost every sector of the economy. Earlier, on July 6, the European Commission proposed a new European Green Bond Standard, a voluntary framework to form a "gold standard" for companies and authorities to raise funds for environmental projects to reduce emissions. The guidelines are aimed at preventing "greenwashing," where issuers make environmental claims without justification.

The new European standard and decarbonization efforts across the world will attract more investors to sustainable finance, analysts say.

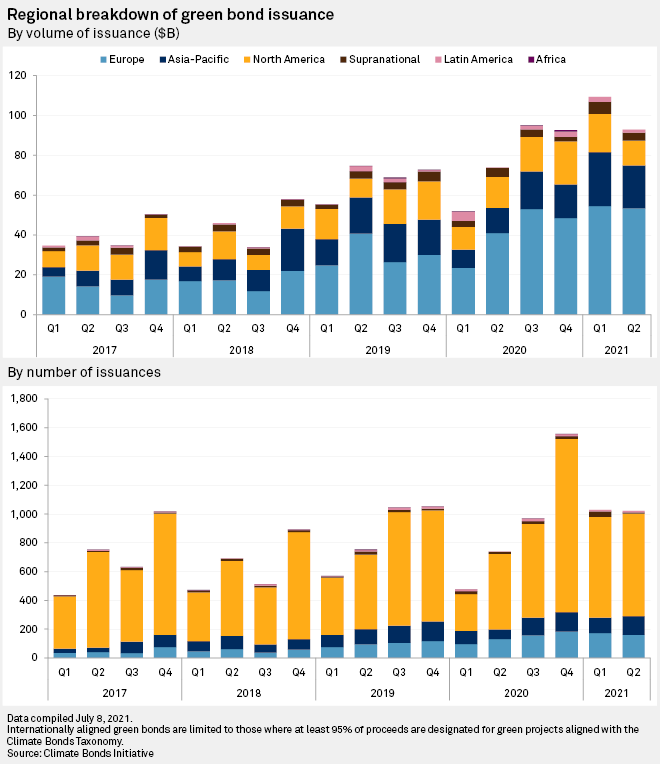

Global green bond sales dropped to a total of $92.8 billion in the April-to-June period, from a revised $109.29 billion

However, the momentum of green bond issuance for the rest of the year will likely increase following Europe's new standard, said Mana Nakazora, ESG analyst at BNP Paribas. The United Nations Climate Change Conference of the Parties, COP26, that takes place in Glasgow, Scotland from Oct. 31, will also be a booster. The EU's issuance standard will "enhance the reliability of green bonds," while the world will "move toward further issuance of green bonds for the COP26 to show green efforts," Nakazora said. She expects global green bond issuance for this year to surpass $450 billion.

European standard

Companies in Europe sold $53.37 billion of green bonds in the second quarter, up 30% over the same period of the previous year. That helped push global issuance in the first

The European standard will help "issuers earn trust from investors" on their green bond issuance, leading to further growth, said Yoshihiro Fujii, the executive director at Tokyo-based Research Institute for Environmental Finance.

"This could also help set standards [for green bonds] in other countries," Fujii said. He also expects global green bond issuance for 2021 to exceed the previous year's level.

"The European model for sustainable and green financing, led by a robust, forward-looking regulatory framework and strong support from governments, provides a successful and important template for other jurisdictions to follow to catalyze growth in their respective geographical regions," said Rong Ren Goh, a portfolio manager at Eastspring Investments in Singapore.

European countries are expected to continue to lead the green bond space in terms of innovation, regulation and taxonomy, according to Nelson Ribeirinho, a Paris-based senior fixed income analyst at Mirova, a sustainable investment management company affiliated with Natixis Investment Managers.

"Europe in terms of diversification in green bonds will remain ahead of the curve for a couple years more," Ribeirinho said. "The emerging countries are one of the serious candidates to contend with Europe, not to forget giants like China and the U.S. are awakening."

All hands on deck

While U.S. President Joe Biden pushes ahead with programs to fight climate change, Asian countries such as China, Japan and South Korea aim to achieve their zero-emissions targets by 2050 or 2060. Global investments required for zero emissions will reach between $100 trillion and $150 trillion in the 30 years through 2050, or $3 trillion to $5 trillion per year, according to a forecast by Boston Consulting Group in April.

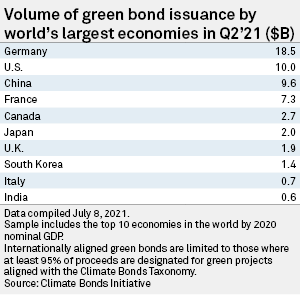

Germany was the largest issuer with $18.5 billion of green bonds sold in the second quarter, followed by $10 billion in the U.S., China at $9.6 billion and France at $7.3 billion. Led by China, the Asia-Pacific came in second by region, with an issuance of $21.58 billion of green bonds, higher than the $12.54 billion a year ago. The data includes only green bonds that comply with international standards.

According to Eastspring's Goh, there were 139 green issues out of China in 2021 alone. "This is a marked acceleration over previous years' issuances, and this is evidence corporates are proactively responding to the central government's green priorities," Goh said.

Mirova's Ribeirinho said that China's role in environmental transition will continue to attract investors' capital, and "a growing number" of those will also engage with China to put more emphasis on social and governance issues.