Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

1 Nov, 2022

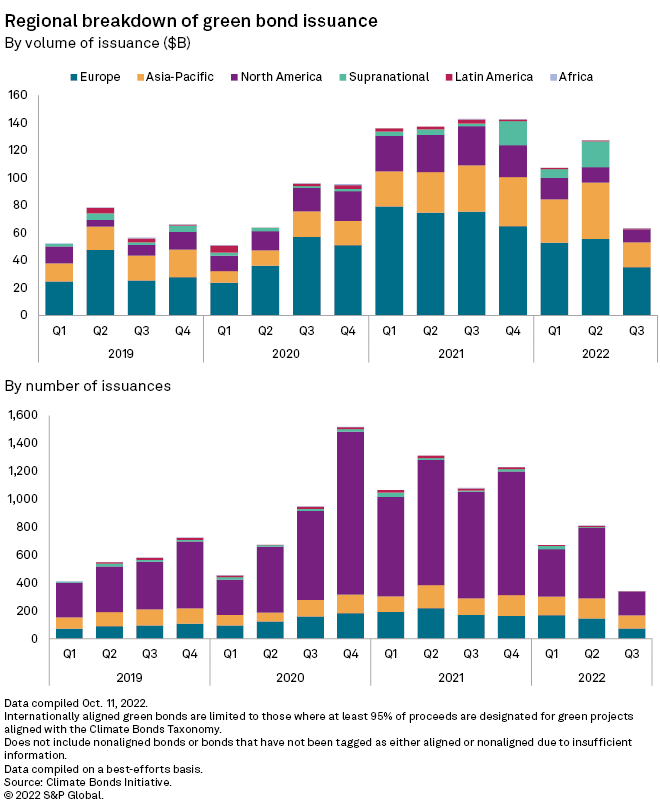

The global green bond market is set to slow further after issuances in the third quarter fell to the lowest level in more than two years.

The drag in green bond issuances will persist as long as markets remain in a risk-off mode and credit spreads continue to stay elevated, said Andrew Chew, director of ING's Asia-Pacific sustainable finance team. There is no timeline on when market conditions will rebound, Chew said.

The green bond market faces pressures from both the global debt market downturn and challenges in energy security. Rising interest rates and recessionary pressures in most parts of the world have sidelined debt issuers as they face higher borrowing costs. Volatile capital markets have also caused investors to be more cautious, resulting in relatively muted investment activity. Meanwhile, soaring energy prices due to Russia's invasion of Ukraine have caused economies such as China to prioritize coal production until its renewable energy capacity can keep up with the country's needs.

Germany regains top spot

|

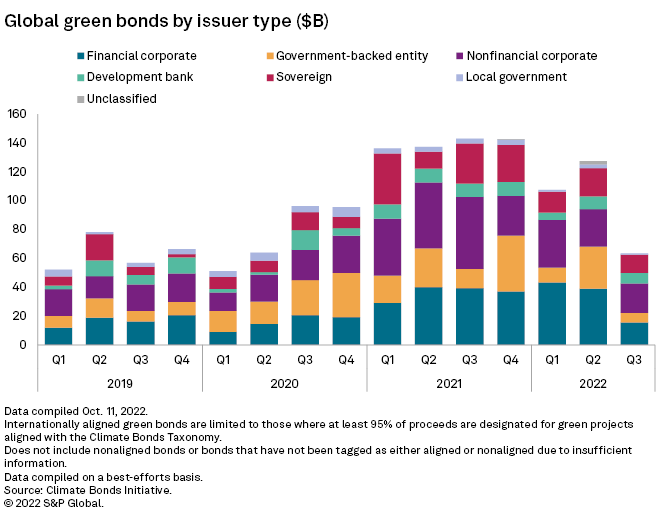

In the third quarter, Germany unseated China as the world's largest green bond issuer. Chinese issuers topped the global rankings in both the first and second quarter.

Volume from German issuers totaled US$15.89 billion during the quarter, down 7.6% from US$17.2 billion a year earlier but up 55% from $10.26 billion in the previous quarter.

The third-quarter strength was largely due to a €5 billion five-year sovereign green bond issued in late August, analysts said. "This surely looks as if issuance from Germany picked up for a special reason, which is not the case," said Daniel Karnaus, a portfolio manager at Vontobel Asset Management.

Over the medium term, Germany will likely remain a robust region for green bond issuance, said Trevor Allen, head of sustainability research at BNP Paribas Markets 360.

"Germany's track record can be explained by sustained sovereign volumes, exceeding that of France, strong showings from German banks, contrasting to other countries, and German corporates consistently exceeding 2021 volumes," Allen said.

In addition, green bonds issued by Italian entities also rose sharply to US$8.32 billion in the third quarter from US$600 million a year earlier. The country is the fourth-largest green bond issuer in the quarter ended Sept. 30.

No slowing progress

The current rout in global green bond issuances may not slow the progress for most economies in meeting their net-zero targets, economists said.

"Although sustainable debt issuance is a tool to assist economies achieve net-zero targets, we do not believe that the temporary drop in issuance observed in 2022 is likely to have a meaningful impact on the achievement of net-zero targets," said Sam Morton, head of European investment-grade research at Invesco.

S&P Global Ratings forecasts a 16% decline in global issuance of green, social, sustainability and sustainability-linked bonds in 2022 due to worsening credit conditions so far this year, it said in a Sept. 20 report. Still, the agency anticipates sustainability-linked bonds to maintain its streak as the fastest-growing asset class of the environmental, social and governance debt market, while it expects green bonds to remain the most popular bond type.

"But one thing I am 101% certain about, and that is green, social, sustainability, and sustainability-linked bond issuances ... will increasingly make up a larger proportion of total bond issuances in the months and years ahead as companies look to demonstrate their sustainability actions to their stakeholders," ING's Chew said.

Increasing regulations and industry-driven initiatives also continue to drive the sustainable finance market, experts said. In July, China introduced more stringent rules for green bonds, requiring 100% of proceeds to be channeled into green projects, up from 70% previously, according to a report from Reuters.

"The proliferation of sustainable finance products and asset classes can be seen as the creation of supply to meet this demand," said Xuan Jin, counsel at White & Case, a law firm.