S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

28 Apr, 2022

By Rebecca Isjwara, Erin Tanchico, and Rehan Ahmad

|

|

Funding for energy transition projects faced a lull in the first quarter of 2022. |

The global green bond market faces a lull, as rising interest rates sidelined issuers and investors in the first quarter of 2022.

As most central banks hike interest rates to tame inflationary pressures, financing costs for green bond issuers have increased and created uncertainties for investors, analysts said.

"The rising-rate environment impairs bond returns and primary issuance, and because the higher credit quality of the green bond market renders it very sensitive to changes in interest rates, the green bond market is down," said Mitch Reznick, head of sustainable fixed income for Federated Hermes, an investment manager.

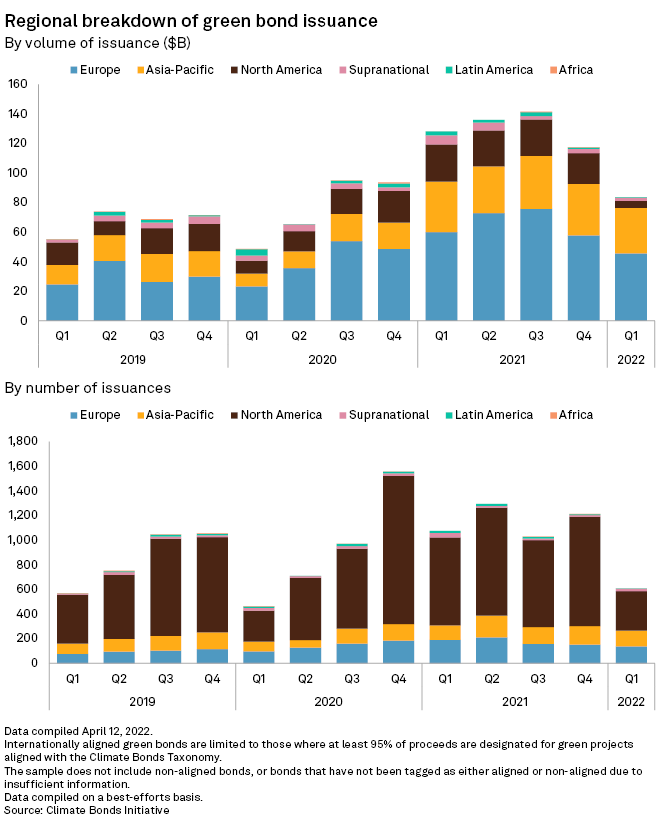

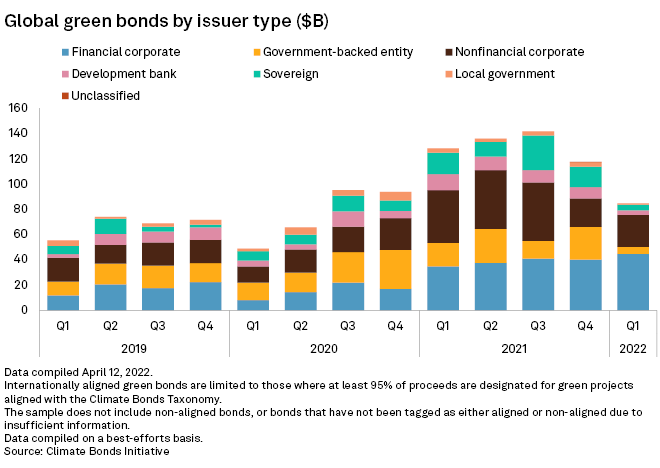

The issuance of green bonds globally in the three months ended March 31 fell 34.63% year over year to $83.8 billion, according to Climate Bonds Initiative, or CBI.

The data covers bonds aligned with CBI definitions. Another $21.29 billion of green bonds issued globally in the first quarter of 2022 were reported by CBI as non-aligned, while $28.26 billion have not yet been categorized.

The weak first quarter ended a multiyear growth streak for the global green bond market, propelled by net-zero commitments from many countries. Uncertainty over the global economic outlook due to rising inflationary pressures and the impact of Russia's invasion of Ukraine have affected funding for energy transition projects. Interest rates are set to firm up after unprecedented easing by many central banks to support economies battered by the pandemic.

Europe prefers

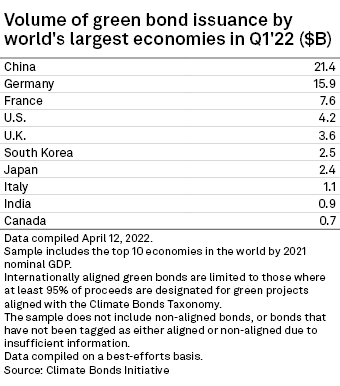

Europe, the highest-contributing region to green debt globally, sold $45.8 billion of green bonds in the first quarter, down from $60.16 billion in the year-ago period, CBI data shows. Germany and France led, with $15.9 billion and $7.6 billion of green bond issuances, respectively.

As green bond issuance starts to decline, European issuers have started preferring sustainability-linked bonds, analysts said. Unlike traditional green bonds, these are not ring-fenced for specific environmental or social projects, thus providing more flexibility for issuers.

"The growth of sustainable debt issuance is broad-based, but France, Germany and Italy have led the way in 2022," Sam Morton, head of European investment-grade research at Invesco Fixed Income, told S&P Global Market Intelligence.

Corporate sustainable debt issuance, which is expected to rise in 2022, will be driven by increased supply of sustainability-linked bonds, Morton said.

S&P Global Ratings expects sustainability-linked bonds to be the fastest-growing subset of environmental, social and governance bonds. In 2021, $92 billion of sustainability-linked bonds were issued, marking a 989% increase over the previous year, according to Ratings. Green bonds, at $532 billion in 2021, were up 87%.

Still, analysts expect Europe to remain the key region driving growth of the green bond market globally.

"Europe has been the key driver in development and the growth of the green bond market, and we do not see that changing in 2022," said Trevor Allen, head of sustainability research at Markets 360, BNP Paribas Corporate and Institutional Banking. Markets 360 is BNP Paribas' market strategy and economics division.

Demand outweighs supply in Asia-Pacific

In the Asia-Pacific region, demand outweighs supply for green bonds, said Clifford Lee, DBS Bank's global head of fixed income. Asian investors usually consume bonds issued out of the region and the supply is not enough to leak into the U.S. and European markets most of the time, Lee said.

Asia-Pacific, the biggest growth region for green debt in 2021, sold $30.63 billion green bonds in the first quarter, down from $34.23 billion in the same period last year, CBI data shows.

The second quarter could see more green bond issuances in Asia-Pacific after some issuance projects were postponed at the end of first quarter due to market conditions, said Antoine Rose, Crédit Agricole Corporate and Investment Banking's head of sustainable banking for Asia-Pacific and the Middle East.

Central banks' rate hikes make it tougher for issuers and investors to understand when to issue bonds, and when to invest, DBS Bank's Lee said.

"Once the market can accept the more stable, new normal [economy], then we can continue to the pace of growth," Lee said.

China was the leading issuer for green debt in the first quarter of 2022 with $21.4 billion green bonds issued, followed by Germany and France, according to CBI. China is the only major global economy still looking at more easing as growth slows, dragged by a high number of COVID-19 infections.

"China continues to be the main source of issuance [of green bonds], but we're seeing more activities, more in depth discussions of green bond issuances of social bond issuances coming out of Southeast Asia," Lee said.

Issuance of green bonds in Japan, ranked seventh in the global market in the first quarter, could lose momentum in upcoming months amid soaring interest rates and Russia's continued invasion of Ukraine, analysts said.

"The outlook for the interest rates is deeply uncertain," said Mana Nakazora, chief ESG strategist at BNP Paribas in Japan. "Issuers are taking a wait-and-see stance" toward issuance.

Nakazora expects the 2022 green bond issuance in Japan to be under last year's levels.