Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

3 Sep, 2023

Global green bond sales are likely to accelerate further, helped by supportive policy in Europe and a more stable interest rate environment.

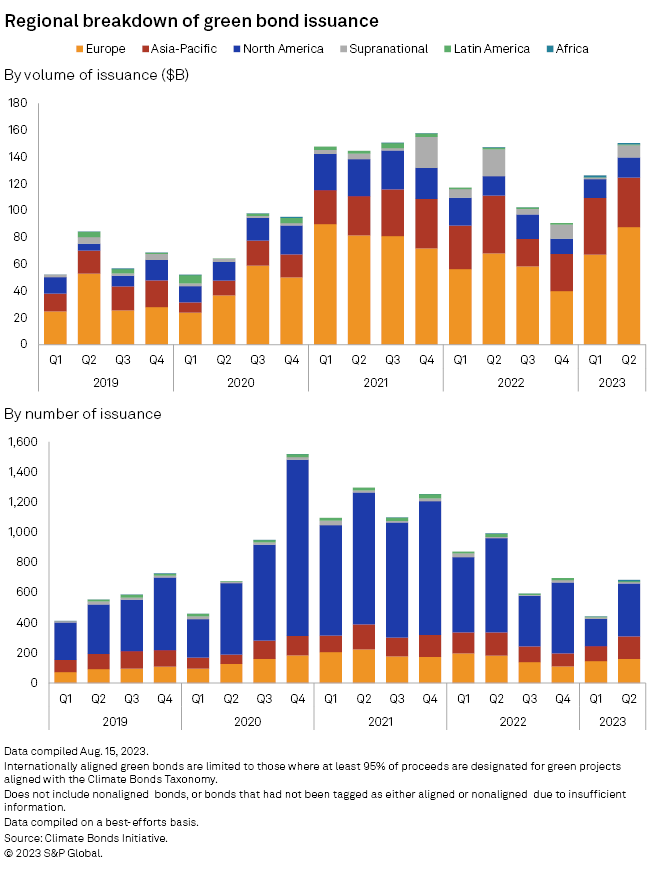

A new green bond standard is expected to be adopted in Europe later this year, boosting demand in the region that leads the world in green bond issuance. European entities issued $87.67 billion of green bonds in the April-June quarter, up 30% on the previous three months, according to data from the nonprofit Climate Bonds Initiative.

The European Union Green Bond Standard aims to improve the transparency, comparability and credibility of the green bond market, helping investors more closely assess the environmental, social and governance stance of issuers. Global interest rates are near their peak according to most analysts, which would stem a decline in bond prices and stabilize costs for issuers.

"The urgency of the climate transition has given increased impetus to both corporates in relation to their energy transitions and the global banking sector which continues to finance an increasing number of green projects," Amelia Rice, capital markets managing associate at Linklaters, an international law firm, told S&P Global Market Intelligence via email.

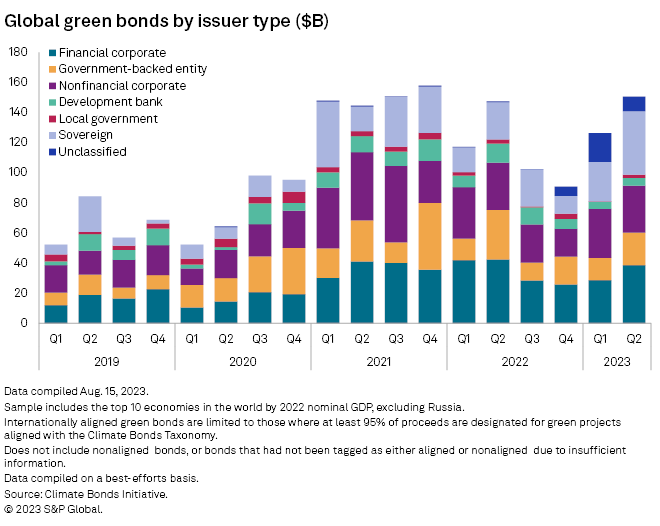

Banks, sovereigns lead

Banks issued the biggest proportion of green bonds in the first half of 2023, and the level was much higher than in previous years, Rice said. Green bond issuance is supported by 'high investor demand, the fact that issuers are embracing green bonds to demonstrate their commitment to climate initiatives and the global footprint of the product," Rice said.

Global green bonds sales in the June quarter rose 20% from the previous three months to $144.38 billion. The Asia-Pacific region was the second largest issuer with $30.82 billion in the second quarter, although issuance there did fall short of the $36.28 billion in the first quarter, the data showed.

Interest in Europe is driven by the higher adoption of ESG investing principles," Alan Siow, co-portfolio manager at Ninety One Hong Kong. "We expect that Europe will continue to be the leading market for green bonds."

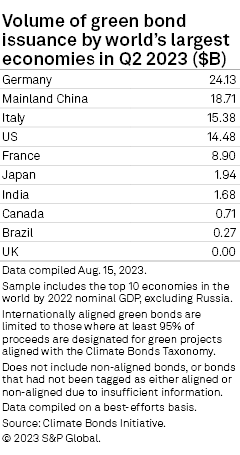

Germany and Italy each priced in excess of $10 billion in sovereign green bonds in the second quarter, according to Climate Bonds Initiative.

"European governments have made a clear commitment to support the climate agenda, and the green bond market is ready to finance the required expenditures," Climate Bonds Initiative said in comments emailed to Market Intelligence. "It is feasible that we could see more issuance in H2 as new countries join the market and debt management offices prioritize funding for green expenditures.

Top issuers

By country, Germany was the top issuer in the June quarter, with $24.13 billion, followed by China with $18.71 billion then Italy at $15.38 billion. The US, which was the third-largest issuer in the first quarter, ranked fourth with $14.48 billion.

China issues green bonds on both global and domestic standards. Its internationally aligned debt increased 24% from $15.12 billion in the first three months of 2023, while its nonaligned green bonds more than doubled to $16.30 billion from $7.75 billion.

"Unlike some other jurisdictions, China is large and developed enough to support its own domestic investors, and therefore does not have to rely heavily on the support of foreign investors who might only participate in internationally aligned issuance," Siow said. "As time progresses, we would expect Chinese green bond issuance to become more aligned to global standards and to enjoy broader participation from global investors," Siow said.

New standard

The EU's new green bond standard will dictate that 85% of funds raised are used for activities that align with the group's taxonomy regulation, while issuers will have to meet requirements around disclosures and external reviews.

The stringent criteria, data unavailability, high costs and potentially heightened liability risk may mean many issuers will find it tough to adopt the new rules.

"For an issuer, the new standard could be a pain," said Tamami Ota, a senior researcher at Daiwa Institute of Research. "But that could help to make investors feel more comfortable in investing in the bonds. After all, investor demand would drive growth of the market."

The European Central Bank in late July raised interest rates for the ninth consecutive time and the Bank of England has made its 14th consecutive hike, bringing its main interest rate to a 15-year high of 5.25%.

In the same month, the Federal Reserve boosted the benchmark federal funds rate by 25 basis points to a range of 5.25% to 5.5% for the 11th rate hike since the U.S. central bank began its inflation fight in March 2022.

"With signs that inflationary pressures are easing, central banks are nearing their final rises of the cycle," said Takahide Kiuchi, executive economist at Nomura Research Institute. "And the interest rates should be brought own next year after peaking out after the autumn, prompting investors to snap up the bonds on the primary market," Kiuchi said.