Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

24 May, 2022

By Karin Rives

China maintained its vast dominance in the global electric vehicle market by selling a record 3.3 million cars in 2021, while the U.S. ended a two-year slump to see EV sales double, according to newly released data.

Worldwide EV sales doubled year over year in 2021 to 6.6 million, the International Energy Agency reported in its Global EV Outlook for 2022 on May 23. Some 630,000 plug-in battery and hybrid electric cars were sold in the U.S. in 2021, twice as many as the year before. In Europe, 2.3 million EVs were sold.

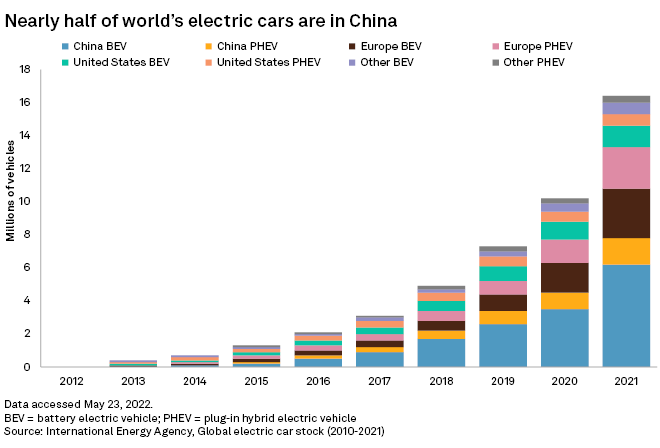

In all, there were 16.5 million electric cars on the road worldwide in 2021, three times more than in 2018, the agency reported. The IEA and many nations are looking to EVs to replace combustion engines to slow climate change. In the U.S, transportation is the largest source of carbon dioxide emissions, accounting for 33% in 2020.

The National Oceanic and Atmospheric Administration reported separately on May 23 that greenhouse gas emissions from human activities trapped 49% more heat in 2021 than in 1990, the baseline year for the initial Kyoto climate protocol.

But so far, EV production and uptake have been dominated by China and the EU. Those two regions accounted for 85% of the world's sales in 2021, the IEA said.

European governments plowed the equivalent of $12.5 billion into EV subsidies and tax waivers in 2021, and China $12 billion, the agency's report found.

In the U.S., government spending tripled to $2 billion in 2021. Per car, that comes to about $3,200, more than the $2,300 the government offered in 2020, but less than in 2019.

"Wow, U.S., what have you been doing?" tweeted Dave Jones, an electricity analyst with the advocacy group Ember in London, adding images of three snails to his comment.

Joel Levin, executive director of the EV advocacy group Plug-In America, said the U.S. EV market has been hampered by uneven state policies and American drivers' preference for large pickup trucks and SUVs. Such vehicles are only now entering the electric space in greater numbers, he said.

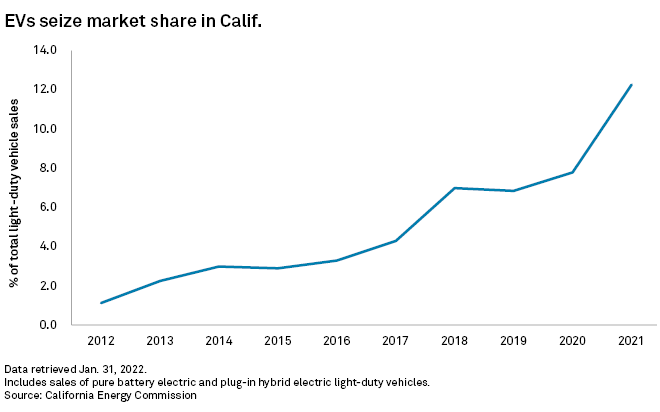

"California has been pushing hard on EV policies for close to 20 years and the result is that California sells as many of these as the rest of the country combined," Levin said. "And the selection of EV pickup trucks has been really thin until now. But we'll get there."

In the next three to four years, EVs will reach price parity with gasoline-fueled cars, and then after that they will be cheaper than gas cars, he said. IHS Markit estimated in 2021 that EVs could reach parity with gasoline cars by 2027.

Looming lithium shortage

IEA Executive Director Fatih Birol warned countries not to become complacent about the record EV sales, amid a shortage of lithium and other components needed for rechargeable EV batteries. Lithium prices were more than seven times higher in May 2022 than in early 2021. That could result in a 15% increase in EV battery prices and make EVs less affordable, the IEA said.

"Policymakers, industry executives and investors need to be highly vigilant and resourceful in order to reduce the risks of supply disruptions and ensure sustainable supplies of critical minerals," Birol said in a statement.

California, which has set a goal of selling only emissions-free cars and trucks by 2035, is leading EV uptake in the U.S. The state registered its millionth light-duty electric vehicle in 2021 and is grappling with how to accommodate a surge in electric demand as EV sales ramp up.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro. IHS Markit is now part of S&P Global.