S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

8 Jan, 2021

By Emmanuel Louis Bacani

Global corporate defaults surged by 91% in 2020, hitting an 11-year high, driven mostly by companies in the U.S. and Europe that were heavily affected by the coronavirus pandemic, according to S&P Global Ratings' latest tally.

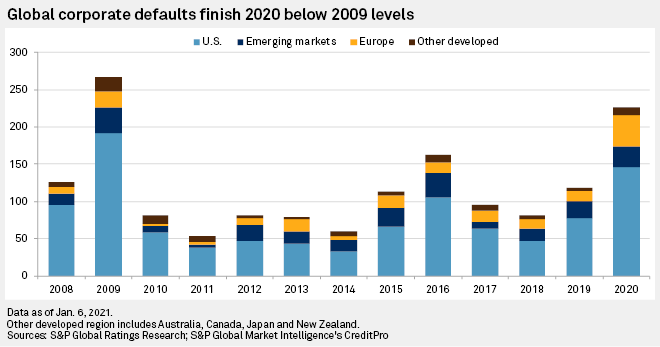

S&P Global Ratings said 226 rated issuers defaulted last year, up from 118 in 2019. The 2020 total was the highest number of defaults since the 266 recorded in 2009.

The U.S. led the default tally with 146, an increase from 78 in 2019. There were 192 U.S. corporate defaults in 2009.

In Europe, defaults hit a record of 42, up from 15 in 2019 and nearly doubling the previous all-time high of 22 defaults in 2009.

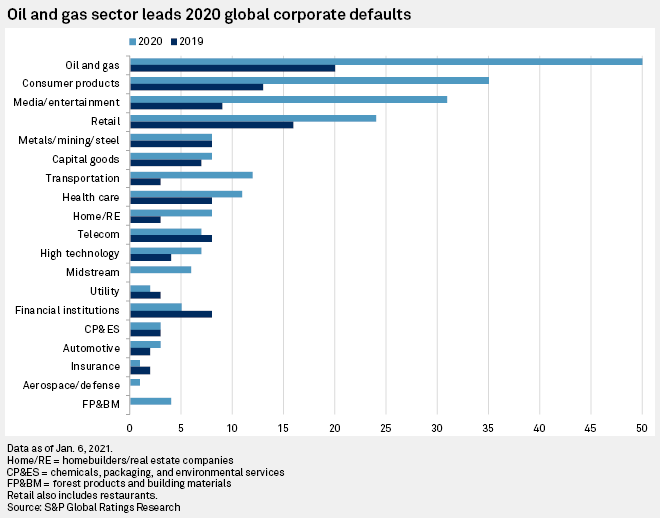

By sector, oil and gas led global defaults in 2020, with 50. Consumer products and media and entertainment came in next, with 35 and 31 defaults, respectively.

Distressed exchanges were the top cause of corporate defaults in 2020, with 78, followed by missed principal and interest payments, with 73. Bankruptcy-related defaults totaled 49.

In December 2020, the U.S. trailing-12-month speculative-grade default rate rose to 6.6% from 6.4% in the previous month. The European trailing-12-month speculative-grade default rate was unchanged at 5.3%.

Corporate defaults are expected to remain at elevated levels in 2021, according to S&P Global Ratings, which has tallied two defaults as of Jan. 6 due to distressed exchanges.