Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

2 Aug, 2021

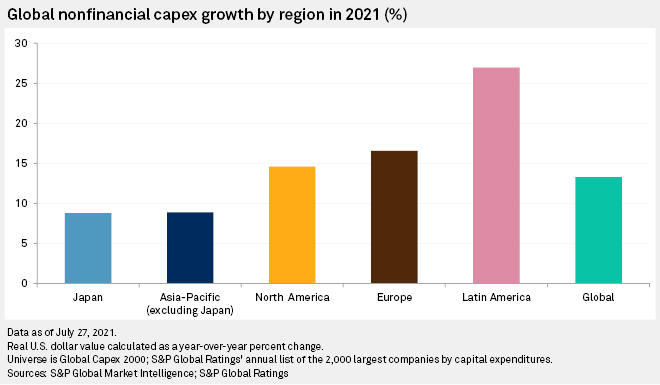

Global corporate capital expenditure is set to grow 13.3% this year, the biggest annual rise since 2007, as bulging cash piles and an economic recovery revive spending after last year's pandemic upheavals.

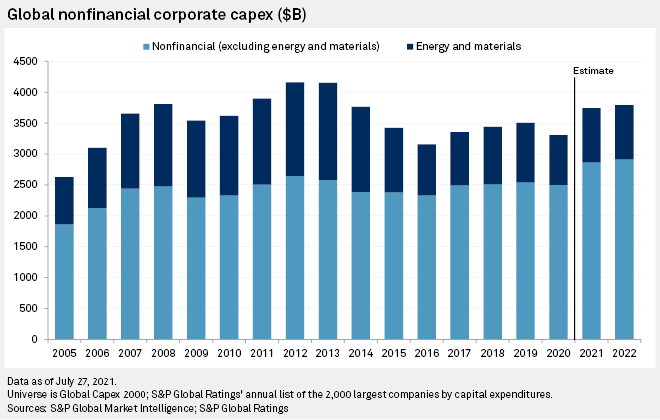

The world's 2,000 largest nonfinancial companies by capex will spend $3.7 trillion in 2021, with growth in all regions and almost all industries, according to a forecast by S&P Global Ratings. Excluding the hard-hit energy and materials sectors, capex will jump 15% to a record $2.8 trillion with the information technology and utilities sectors leading the growth.

The strong economic recovery and record levels of borrowing has armed the companies with a record $7.9 trillion of cash on their balance sheets to fund the splurge. Post-pandemic shifts in working and spending patterns, new technology, drives to lower carbon emissions, and rebounding commodity prices are among the incentives for companies to invest.

The rebound reflects "a broader story about corporate confidence, positioning about growth and structural drivers," Gareth Williams, head of corporate credit research at Ratings and author of the agency's forecast, said in an interview, noting, "even companies focused on the tech economy need an element of physical infrastructure."

The volume of capex was not hit as hard by COVID-19 in 2020 as other areas of business activity, owing to the dominance of Chinese companies, which rebounded quickly from the COVID-19 disruption. Companies including Amazon.com Inc. and Alphabet Inc. also led the spending charge last year, deploying tens of billions each to build out ever more capacity and secure their dominance.

Global corporate capex fell by just 2% year over year in 2020 when energy and materials companies are excluded. The drop was 6% when energy and materials were included, owing largely to the oil & gas sector, which had to cut to the bone as energy prices collapsed.

The Asia-Pacific region — excluding Japan — accounts for 46% of global corporate capex, with China contributing about 700 of the 2000 companies included in S&P's global capex list. By contrast, fewer than 400 U.S. groups make the cut, and North America and Europe lag Asia-Pacific's contribution to global expenditure at 21% and 18% respectively.

Williams noted global utilities and telecommunications sectors were the "bedrock" of global capex as well as the Asia-Pacific region — particularly China.

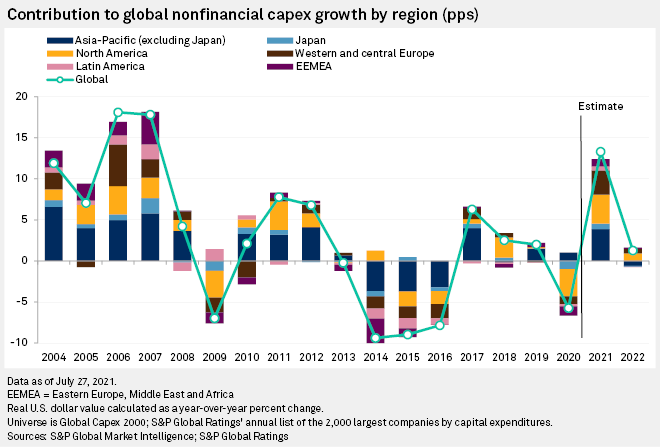

The growth in the Asia-Pacific region will be slower in 2021 as a result of its higher base.

Companies in China and Hong Kong are projected to grow their total capex spending by 8% in 2021 after an increase of 3% in 2020. By contrast, capex in North America slumped by 13% in 2020.

"[China] came through the pandemic first and were able to use their old stimulus playbook. One of the conclusions is that Asia-Pacific kept growing but they're not seeing the same magnitude of upswing," Williams said.

Corporate capex in Latin America is projected to grow by 27% year over year, owing to a sharp projected upswing in expenditure in the materials, energy and industrial sectors. The region will be followed by Europe at 16.6% growth and North America at 14.6%, with companies in the semiconductors, retail, software and transportation sectors increasing capex the most, as the global economy bounces back from COVID-19.

"It is fair to assume that with markets gradually recovering, and expectations that despite the challenging delta variant situation, overall economic environment will not be as bad as it was in 2020, that those companies that have cut capex, will slowly deploy it again," said Sergey Dergachev, senior portfolio manager at German asset manager Union Investment.

Cash-rich companies have money to burn

Distribution, logistics and data centers require companies to invest in physical infrastructure even as the global economy increasingly shifts to the digital world and away from the traditional, capex-intensive industrial economy.

E-commerce retailer Amazon was the fourth-largest global corporate investor in capex in 2020, spending $40.1 billion to build out logistics and solidify their market position, Williams said.

The information technology sector is forecast to grow global capex by 22.3%, led by a 27.5% uptick in North America and 23.7% in Japan. South Korea's Samsung Electronics Co. Ltd. was the sector's biggest spender in 2020 at $34.5 billion.

Williams noted the semiconductor sector is investing "aggressively" after finding that there is undercapacity, boosted by the growth in electric vehicles.

ESG-related investment is another driver of capex, with improving safety on production sites and attempts to decrease carbon footprints a key theme for companies.

"We will see more ESG-related capex going forward," Dergachev said.

Whatever companies choose to do, they will have plenty of cash to do it with.

Low interest rates supported record levels of borrowing in the U.S. in 2020 that have left companies with ample cash to spend in areas such as capex and mergers and acquisitions. The median cash ratio — a key gauge of liquidity — of investment-grade U.S. companies was 29.4% in the first quarter of 2021, far higher than the pre-pandemic level of 19.3%

|

"Real interest rates will remain negative for the next couple of years and this can support interest rate-sensitive sectors, such as capex and housing, in the quarters to come," Mark Dowding, chief information officer at BlueBay Asset Management, said in an email.

Other sectors that are struggling to meet demand are also expected to invest in increasing capacity.

Ratings forecasts the metals and mining sector will grow capex by 18% this year — the best since 2012 — as part of the reaction to strong commodity prices.

The oil and gas sector will be subdued with growth of just 5% after a 21% decline in 2020, though Williams noted that if oil prices remain high, it is easier for shale producers to respond quickly with investments, whereas developing mines takes years.

"Both [metals and mining and oil and gas] sectors have a very cautious mindset focused on capital discipline — reacting but not precipitously — which is good from a credit point of view," Williams said.