S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

7 Jun, 2021

By RJ Dumaual and Husain Rupawala

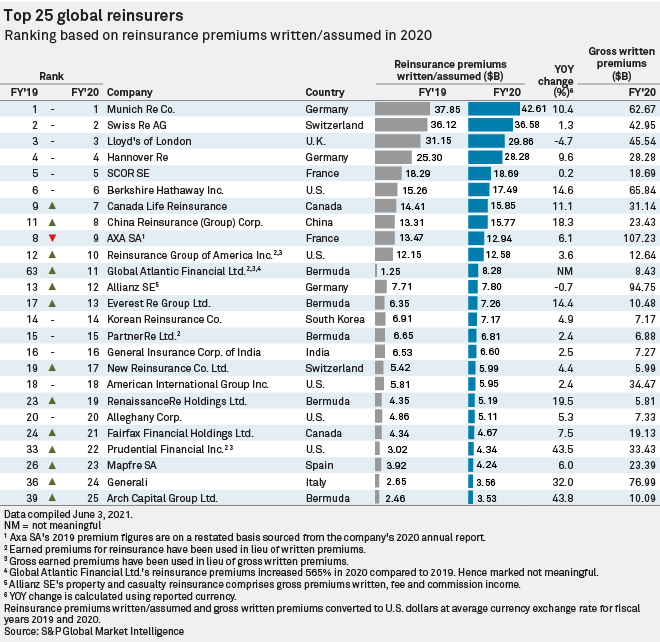

Private equity-backed Global Atlantic Financial Group Ltd. recorded a massive gain in reinsurance premiums while the 10 biggest global reinsurers were mostly unchanged in 2020, according to an S&P Global Market Intelligence analysis.

Previously well outside the top 25, the KKR & Co. Inc. subsidiary jumped to 11th place after its reinsurance premiums soared to $8.28 billion from $1.25 billion in 2019, thanks to the impact of several large block reinsurance transactions, including notably an $8.5 billion reinsurance transaction with Unum Group.

Global Atlantic also executed a $5.7 billion fixed and fixed-indexed annuity reinsurance transaction with Great American Life Insurance Co. and reinsured approximately C$3.4 billion of policy liabilities related to John Hancock's legacy U.S. bank-owned life insurance business. The transaction closed Sept. 30, 2020.

KKR CFO Rob Lewin on a call to discuss fourth-quarter 2020 results said Global Atlantic's fundamentals "remain compelling," citing, among other factors, the three reinsurance deals and embedded relationships with more than 200 banks and brokers/dealers.

Munich Re remains the world's biggest reinsurer by as it totaled $42.61 billion in reinsurance premiums in 2020, up 10.4% from $37.85 billion a year earlier. Swiss Re AG was second after its reinsurance premiums rose 1.3% year over year to $36.58 billion from $36.12 billion.

Lloyd's of London rounded out the top three after seeing its reinsurance premiums decline to $29.86 billion from $31.15 billion in 2019. S&P Global Ratings expects Lloyd's premium base to return to growth in 2021, although growth will be "measured."

"The trend of improving rates and reduced volumes is likely to continue into 2021, although we do not expect the same drops in volume [12%] we saw in 2020," the rating agency said in an analysis. "Lloyd's continues to take a hard line with poorly performing syndicates, but improving rates in many lines mean that it will allow syndicates with strong underwriting performance to take advantage of conditions."

China Reinsurance (Group) Corp. was the lone Asia-based reinsurer in the top 10 with reinsurance premiums of $15.77 billion, up 18.3% from $13.31 billion in 2019. Executives speaking during the company's 2020 annual results press conference said premiums grew steadily and major businesses showed robust premium growth rates.

This S&P Global Market Intelligence news article may contain information about credit ratings issued by S&P Global Ratings. Descriptions in this news article were not prepared by S&P Global Ratings.