S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

9 Jun, 2022

By Avery Chen and Anna Duquiatan

| Salt lakes in China's northwestern Qinghai province preserve lithium-rich brines. Source: TPG/Getty Images AsiaPac via Getty Images |

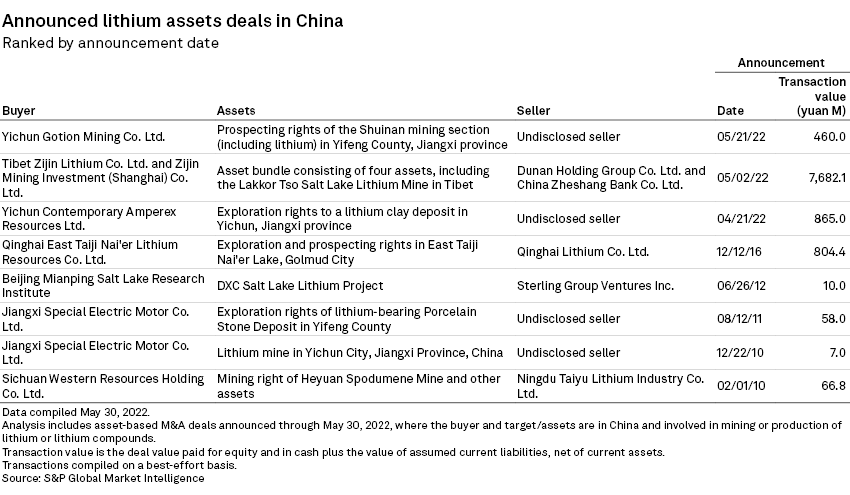

The transaction value of Chinese domestic lithium deals reached 16

China-based companies, hoping to cash in on high lithium prices and establish domestic supply for electric vehicle manufacturing, have poured billions of dollars into overseas lithium projects. Despite domestic costs for acquisitions and operations being far higher than overseas, Chinese companies are now rushing to acquire lithium at home to reduce geopolitical risk. The unprecedented M&A frenzy also came as lithium prices hit a new record in China amid a global lithium shortage. S&P Global Commodity Insights expects a 40,000-tonne deficit of lithium carbonate equivalent by 2026.

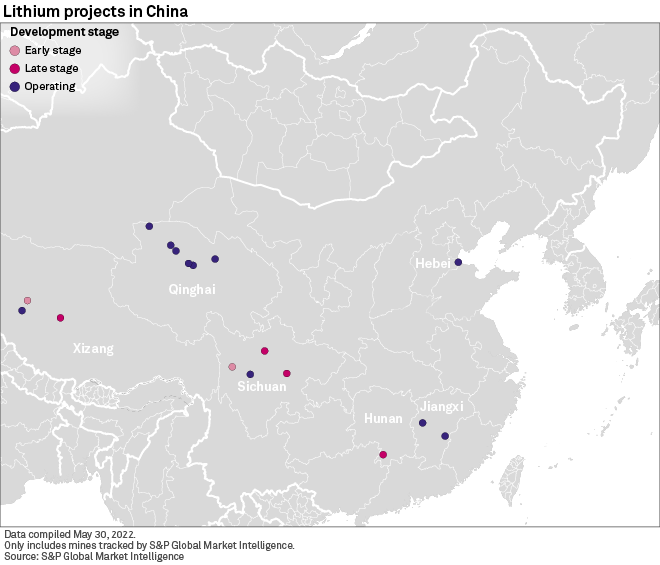

Chinese companies have also been responding to a directive from the government. China's Ministry of Industry and Information Technology announced Jan. 12 it would increase support for the local governments of Qinghai, Sichuan and Jiangxi, the country's major lithium-producing provinces.

"The acceleration in lithium mining is a response to surging prices from market tightness," said Alice Yu, a senior analyst at Commodity Insights. "Lithium companies in China and globally are trying to consolidate and expand their resource basis, in order to meet customer demand and as much as possible, to maintain market share."

The daily Chinese price for battery-grade lithium carbonate reached a record 503,000 yuan per tonne in late March, according to consultancy Shanghai Metals Market.

"For now, there is no nonferrous metal [except lithium] that has more than 30% of compound annual growth rate for domestic demand," Chen Guanghui, senior analyst at Beijing Antaike Information Development Co., said in an interview. Meanwhile, acquiring domestic projects is aimed at diversification, as "overseas M&A involves a lot of problems, especially political, economic and legal risks in the host country," Chen said.

"Uneconomical" deals

Battery makers sought to acquire their own sources of lithium to hold down costs, joining the lithium M&A race. Transaction prices of lithium projects went through the roof and hit record highs.

China's biggest battery giant, Contemporary Amperex Technology Co. Ltd., acquired exploration rights to a lithium clay project in Jiangxi province's Yichun for 865 million yuan on April 20. The lithium clay is estimated to contain 2.6 million tonnes of lithium reserves, equivalent to about 6.6 Mt of lithium carbonate.

One month later, Gotion High-tech Co. Ltd. won a bid for prospecting rights for a lithium mine in Jiangxi, with an estimated 181,750 tonnes of lithium hydroxide, for 460 million yuan.

The price is equivalent to 2,031 yuan per tonne of lithium resources, as compared to only 203 yuan per tonne for the Contemporary Amperex Technology deal, Chen said.

"If the market price of lithium carbonate is too high, the company will strive to increase the proportion of self-supply materials," Jiang Li, vice president of Contemporary Amperex Technology, told investors on a May 5 earnings call. The battery major reported a 23.6% decline in first-quarter net profits, while operating costs surged 198.7%.

The most eye-catching deal recently was the equity auction of Yajiang Snowway Mining Development. A 54.3% stake in the bankrupt company, which owns the Dechenongba lithium mine in Sichuan province, was auctioned off for around 2 billion yuan, compared to the starting price of 3.4 million yuan, according to the online auction platform run by e-commerce giant JD.com Inc. However, the auction may fail because the winner, private investor Tan Wei, did not finish the payment in time, Chinese media outlet Cailianshe reported June 6, citing unnamed sources.

"The [acquisition] cost comes too high and uneconomical," Mo Ke, CEO and chief analyst at RealLi Research, a research institute,

Considering the payback period, Snowway's transaction price could convert to a lithium carbonate price of 350,000 yuan per tonne.

"Even if everything goes smoothly, it will take two or three years [to produce lithium carbonate]," Mo said. "Would the lithium carbonate prices still be above 350,000 [yuan per tonne] at that time?"

Geopolitical woes

Chinese companies are ready to pay high prices in an effort to protect themselves against geopolitical instability.

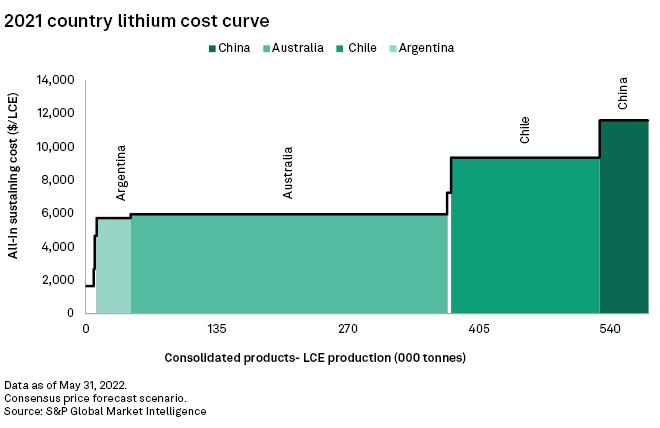

From 2020 to the end of 2021, the acquisition price of domestic lithium projects averaged 1,500 yuan per tonne of lithium resources, compared to 500 yuan overseas, and domestic prices continued to surge in 2022, according to Antaike's Chen.

Many Chinese companies are avoiding buying lithium projects in Australia and turning to South America and Africa, on concerns that the Australian Foreign Investment Review Board might restrict Chinese investment in the country, Chen said.

"The various difficulties encountered in multinational operations" has become one of Ganfeng Lithium Co. Ltd.'s biggest challenges, Chairman Li Hongbin told investors on an April 8 call. Mexico is planning to establish a state lithium company and might cancel the permit for Ganfeng's Sonora mine in the country.

Ganfeng is aiming to "develop as [many] domestic and foreign lithium resources as possible to meet the growth of market demand," Li said.

On May 17, the company's Xinyu Ganfeng Mining Co. Ltd. subsidiary spent 1.08 billion yuan for Shanghai Zhongcheng Deji Mining Investment Co. Ltd. to obtain exploration rights for the Songshugang tantalum-niobium mine. Songshugang resources also include 603,813 tonnes of lithium oxide grading an average 0.2%.

Difficult to cut reliance

China controls global lithium processing and refining, however 65% of its lithium resources rely on imports, Commodity Insights reported in mid-April, citing the China Association of Automobile Manufacturers. Chinese officials have been calling for self-reliance on lithium and companies are rushing to comply. But increasing lithium investments will not wean the country from foreign supply, analysts said.

"We expect a slower increase in Chinese lithium raw material production compared with demand," Commodity Insights' Yu said. Commodity Insights expects the Chinese lithium raw material supply to rise 25.6% between 2021 and 2026, from 61,930 tonnes of lithium carbonate equivalent, or

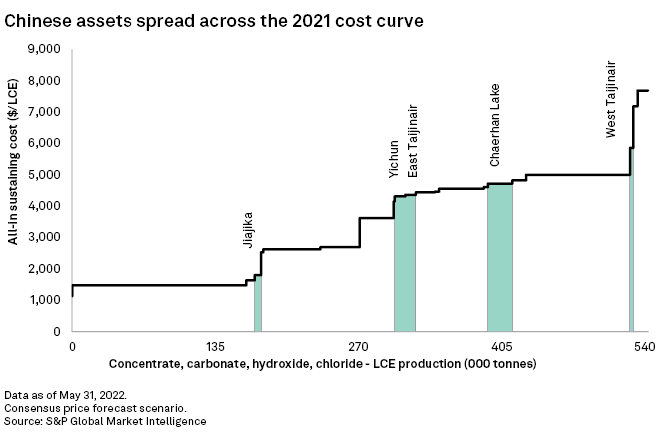

Chinese production has its own cost struggles, as many domestic projects are located in remote locations amid rugged terrain, and the chemistry of its brine makes processing more expensive than brine from certain other places. And despite China having rich lithium resources in places like the salt lakes in Qinghai province, the local government cannot afford infrastructure investment for building electrical grids, roads and rails.

Mining spodumene resources in Sichuan province has been opposed by local Tibetan communities.

"There isn't a significant difference between individual Chinese lithium operations and the rest of the world, but as a country, China is currently the highest cost," said Commodity Insights analyst Yao Shunyu.

But the Chinese government may begin to step in to finance more infrastructure to help develop domestic resources.

"Chinese lithium grades are low, but miners still can generate profit at the current price level," RealLi Research's Mo said. "So from this point of view, it is actually very good timing [to launch policies to encourage domestic lithium investment and mining]."

As of June 8, US$1 was equivalent to 6.68 Chinese yuan.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.