Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

22 Feb, 2021

Genworth Financial Inc. received several approvals to increase in-force long-term care rates on a newer product series during the fourth quarter of 2020.

Toward the middle of 2020, Genworth's management team noted that it started requesting rate increases on newer products not previously included in prior rate-hike requests. The newer products series have lower attained ages for their policyholders, which would allow the insurer to collect the additional premiums for a longer period of time.

"This allows for smaller, more manageable premium increases for our policyholders, but a higher net present value benefit for the approved premium increase," Genworth CFO Daniel Sheehan said on a fourth-quarter 2020 earnings call.

A review of public rate filings collected by S&P Global Market Intelligence shows that the product in question is series 7052, also known as the Privileged Choice Flex policy. The policy was first launched in 2011 and last sold in 2016, according to the regulatory filings. Genworth reported earned premiums of $237.0 million and $16.2 million in incurred claims in 2019 for that series, with a total of about 96,000 policies in-force at the end of that year.

Of the rate filings reviewed, Genworth is generally requesting to raise rates by 66.3%. In Wyoming and Washington, D.C., the insurer is seeking increases of 44.3% and 10%, respectively. The increase for policyholders in the nation's capital is lower due to its department of insurance prescribing a 10% maximum rate increase for in-force long-term care, or LTC, rate actions.

Regulators in at least eight states approved rate increases for the new product series in the final quarter of 2020, though some approvals came in lower than what Genworth was initially seeking.

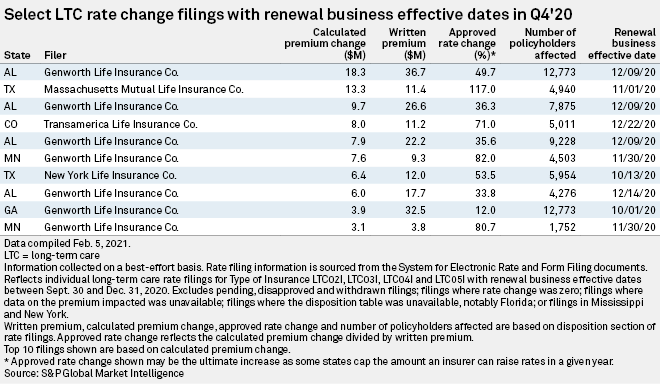

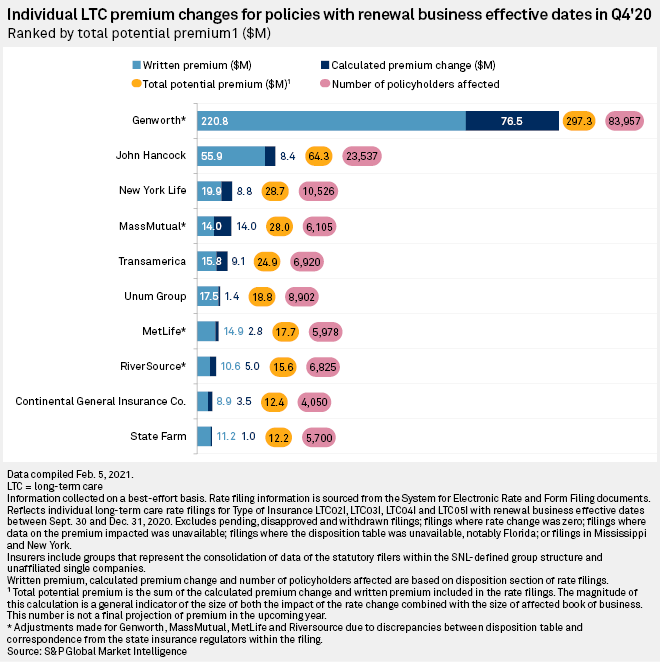

In total, Genworth received approvals to raise LTC rates for various types of policies in at least 12 states during the fourth quarter of 2020, which could increase calculated annual premiums by $76.5 million. The most impactful increase was in Alabama, where regulators approved a 49.7% increase that could boost the insurer's annual LTC premiums by $18.3 million once fully enacted. The state also approved four additional filings during the quarter.

A filing approved in Texas could lead to annual premiums for Massachusetts Mutual Life Insurance Co. increasing by $13.3 million. The increase will impact about 4,900 policyholders.

Aegon NV's Transamerica Life Insurance Co. and New York Life Insurance Co. were also among the insurers to have submitted rate changes among the top 10 most impactful LTC increases in the fourth quarter of 2020.