Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

14 Apr, 2022

By Asma Rafique and Jason Woleben

GEICO Corp. and The Progressive Corp. reduced their advertising expenditure in 2021 — their first annual reduction in five years.

In fact, three of the four biggest US auto insurers reduced their advertising expenses last year, according to analysis of regulatory data by S&P Global Market Intelligence.

Given that many of the top auto insurers were hit by bad claims trends and inflation, it is no surprise to see widespread reductions in advertising spending, said CFRA Research analyst Cathy Seifert. She expects spending to remain "muted" in 2022 and 2023 as well.

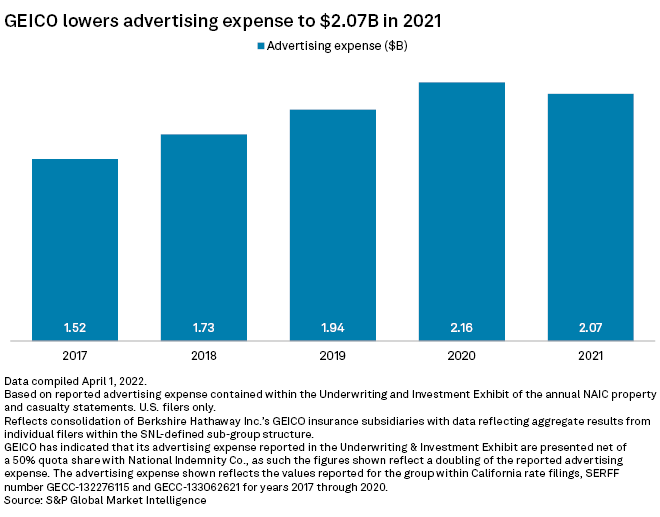

GEICO remains largest ad spender in 2021

Despite cutting its advertising expenses by 4.4% year over year, GEICO was still the biggest spender on ads in 2021 and the only one to spend more than $2 billion. The Berkshire Hathaway Inc. company reported $2.07 billion in advertising expenditures in 2021, down from $2.16 billion in 2020.

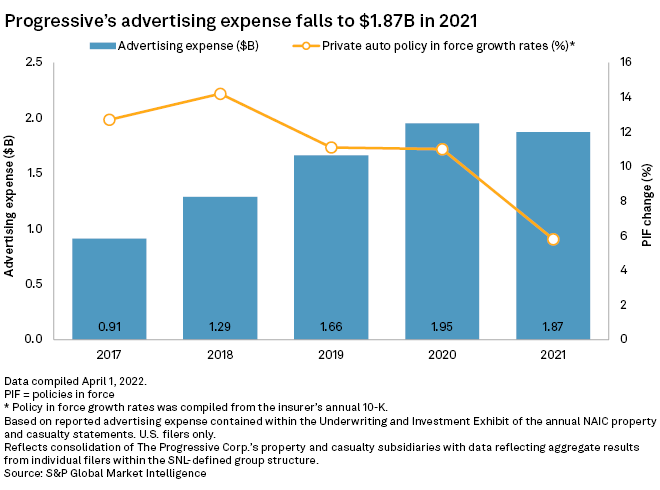

Progressive logged $1.87 billion in advertising expenses in 2021, representing a 4.1% decline from the $1.95 billion it reported in 2020. The insurer in its most recent 10-K said it is cutting advertising spending in an effort to improve profitability and hit its goal of a combined ratio of 96%.

In addition to reducing its advertising expenses, Progressive also slowed its policy growth. The insurer's auto policy count grew 5.8% to about 17.4 million in force as of the end of 2021. That trend continued into the first quarter of 2022. For the month of March, for instance, total personal auto policies grew by only about 1% year over year; agency auto policies in force actually declined.

State Farm Mutual Automobile Insurance Co. and its affiliates spent roughly $1.07 billion on advertising in 2021, down from $1.17 billion in 2020 and off the five-year peak of $1.21 billion in 2019. The 8.5% year-over-year decline in ad spending by State Farm was the biggest reduction among the largest U.S. private auto insurers.

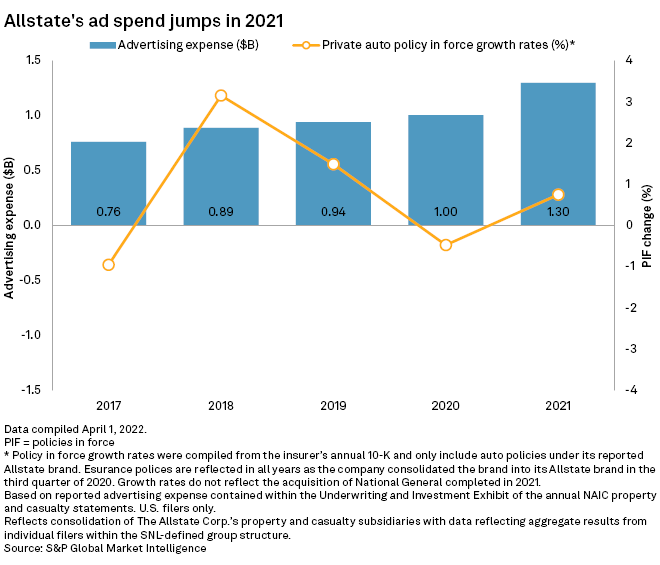

Allstate's spending continues to rise

The Allstate Corp., on the other hand, kept increasing the amount of money it puts into advertising, spending $1.30 billion in 2021, up from $1.00 billion in 2020. The company spent just $760 million on ads in 2017.

Allstate started to ramp up its advertising expenditures in the third quarter of 2020, when the insurer launched a new campaign aimed at repositioning its brand.

The insurer's Allstate-branded private auto policies grew to almost 22.0 million at the close of 2021, a year-over-year increase of 0.7%. Its National General brand, which includes Encompass policies, added an additional 3.9 million in private auto policies.