Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

1 Apr, 2021

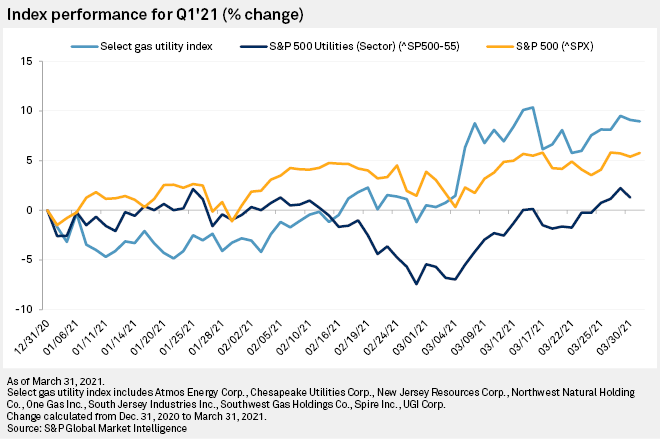

Natural gas utility stocks outperformed the broader market in the first quarter of 2021, as investors continued to gravitate to value after shunning the sector throughout much of 2020.

A select index of natural gas utility stocks rose about 9% during the period, beating out the S&P 500's 5.8% year-to-date gain. The gas distributors also outperformed the S&P 500 Utilities Sector, which gained 1.9%.

The results continued a reversal that started in the final quarter of 2020, when the select index surged nearly 11%. The group has continued to close the disparity in valuations in 2021, according to Hennessy Funds Chief Investment Officer Ryan Kelley, who manages the firm's gas utility fund.

Entering the year, utilities were trading at a roughly 35%-40% discount to the S&P 500, based on a comparison of estimated 2021 EPS, Kelley noted. More broadly, the market has been rotating out of the megacap tech stocks and other sectors that preoccupied investors throughout 2020, as dividend yields linked to utilities present attractive options at this point in the business cycle, the executive added.

"We're seeing a lot of the sectors that benefited most during the pandemic coming back in," Kelley said. "I think that people are moving more into value."

Cold winter weather provided another boost to the sector, followed by a solid string of earnings reports from gas utilities, he said.

The view that valuations are driving the rotation aligns with fund flows in the final quarter of 2020. Institutional investors scooped up shares of beaten-up gas utilities during the period.

That trend appeared to hold in the first quarter. With the exception of South Jersey Industries Inc., the bottom three performers in the select index were the top performers in 2020: One Gas Inc., Atmos Energy Corp. and Chesapeake Utilities Corp. Meanwhile, two of 2020's laggards — Northwest Natural Holding Co. and Spire Inc. — have been two of the group's leaders in 2021.

UGI Corp. matched Northwest Natural for the strongest performance this year, while Southwest Gas Holdings Inc. and New Jersey Resources Corp. ranked near the top of the pack with solid year-to-date gains of 13% and 12%, respectively. New Jersey Resources was the group's second-worst performer in the first three quarters of 2020.

Until mid-March, South Jersey Industries had been flying high, on track for a better than 30% year-to-date gain. However, shares tanked after the company announced an equity offering on March 16, plunging nearly 25% over a three-day period before clawing back some of their earlier gains.

Mizuho Securities USA LLC analyst Gabriel Moreen said the issuance solved South Jersey Industries' near-term balance sheet needs, but caught the market off guard, in part because executives could have better communicated with investors.

"We doubt the size of the issuance came as a real surprise to those close to the SJI story," Moreen said in a March 18 research note. "However, SJI has not offered a refreshed company outlook since 2018 and detailing equity needs may have spooked the Street just as SJI's story was building momentum."