| Private buyers still have appetite for gas distribution assets, while some investor-owned utilities continue to seek opportunities to grow their meter counts through M&A, according to analysts and executives. Source: strickke/E+ via Getty Images |

A muted market for gas utility mergers and acquisitions could see signs of life as two large multi-utilities are reportedly considering selling all or part of their natural gas distribution businesses.

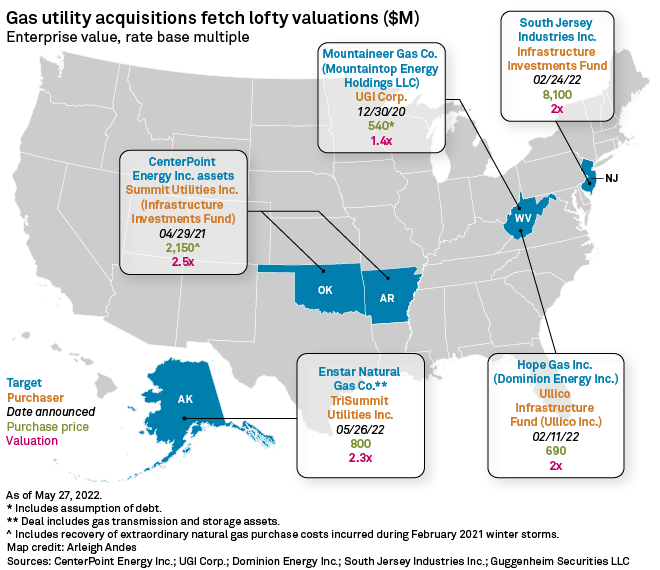

Dealmaking tapered off in the second half of 2022 after a string of lofty valuations in gas utility acquisitions earlier in the year. But on April 6, The Wall Street Journal reported that Dominion Energy Inc. could put its Ohio, North Carolina and Western US gas utilities on the auction block and that National Grid PLC was mulling a stake sale in its Northeast distribution companies.

Recent commentary from utility executives and analysts suggests there is still interest in gas utility M&A. However, transactions could hinge on asset size, and investor-owned utilities seeking to grow through dealmaking could face hurdles in a higher interest rate environment.

Additionally, some anticipated gas utility deals have recently failed to materialize, casting uncertainty over future M&A as companies grapple with a turbulent market.

Strategic deals are the exception

There have been few strategic gas utility deals since UGI Corp.'s 2020 purchase of Mountaineer Gas Co., yet some operators are still on the hunt.

In May 2022, National Fuel Gas Co. CEO David Bauer told S&P Global Commodity Insights that he would like to acquire a gas utility to rebalance the company's business mix, which includes gas production and midstream transportation. There is no indication from National Fuel that it would pursue Dominion's assets, though the Ohio utility checks some boxes.

Bauer's preference was for a contiguous service territory, and Dominion's Ohio asset borders National Fuel's Pennsylvania and Western New York gas utility footprints, as well as its shale production fields and midstream infrastructure. Bauer confirmed that National Fuel had explored purchasing West Virginia assets, including Hope Gas Inc., which Dominion sold for $690 million in 2022.

More recently, Bauer said the ideal asset would allow National Fuel to fund a transaction chiefly through its balance sheet with only modest equity financing. "That puts it in a kind of more modest-sized transaction," Bauer said during a Feb. 3 conference call. "To the extent that we were to look to go bigger than that, we have to be more creative in how we finance it, either with a partner or some other means."

The Wall Street Journal's sources said Dominion's assets could fetch $13 billion, though they did not expect Dominion to sell them as a package. Dominion distributes gas to 1.3 million customers in Ohio. Its customer counts in its three-state Western US region and its Carolinas service territories are about 1 million each.

Interest in moderately sized utilities

In the 2022 interview, Bauer said he did not expect much competition for assets among other investor-owned gas utilities. Infrastructure investment funds and other financial players have dominated dealmaking over the past two years.

Infrastructure funds, private buyers and non-US acquirers might continue to pay a premium for gas utilities because these suitors are less price-sensitive and more agnostic on issues of environmental, social and governance, Guggenheim Securities said in its 2023 outlook. However, company-specific factors will likely drive deals, rather than sector-wide themes such as ESG preferences, Guggenheim said in the Jan. 23 note.

In 2021, CenterPoint Energy Inc. reset the market with the blockbuster sale of its Oklahoma and Arkansas gas utilities to an infrastructure fund. Even though the company does not plan to divest additional gas utilities, the assets continue to attract "significant" inbound inquiries, CenterPoint President, COO and CFO Jason Wells said during a Feb. 17 conference call.

In Wells' view, assets need to be at least a moderate size to attract strong interest from a wide pool of buyers. CenterPoint's Arkansas and Oklahoma assets served 525,000 customers at the time of their sale and fetched $2.15 billion.

"I would say there remains tremendous interest in, I think, moderately sized utility systems, like the gas" utilities, Wells said. "We operate in a constructive set of states, in places where it either gets very cold during the winter or states that are incredibly supportive of natural gas."

Mixed signals on stake sales

Wells also said there is a benefit to selling gas utilities outright. "There's a control premium that often gets lost as maybe some of our peer utilities pursue minority interest sales," he said.

According to The Wall Street Journal, National Grid is considering selling a minority stake in its Northeast gas utilities. As recently as December 2022, Ben Wilson of National Grid told Commodity Insights that the company sees gas infrastructure as core to its plan to transport low-carbon fuels as policymakers seek to develop a Northeast hydrogen hub.

"We call it networks plus, right?" Wilson, the chief strategy and external affairs officer, said during an interview. "So our strategy is 90% regulated networks. That's where we focus. We think networks is absolutely a sweet spot to be focused on."

Several utilities have recently opted for stake sales to avoid issuing equity as they seek to shore up their balance sheets and fund capital plans. In November 2022, NiSource Inc. surprised some market watchers by announcing it would seek to sell a 19.9% stake in its Indiana multi-utility, rather than divest one or more of its five pure-play gas utilities, despite the company seeing "serious demand" for the assets.

In February, Black Hills Corp. announced it would suspend its effort to sell a minority stake in its six-state gas utility business, which serves nearly 1.1 million customers across the US West, Midwest and South.

Black Hills ended the process, announced in November 2022, following "extensive due diligence and rapidly changing market conditions," Vice President and Treasurer Kimberly Nooney said during a Feb. 8 conference call.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.