The range of renewable natural gas projects at gas utilities is moving beyond dairy and hog farms to include wastewater treatment plants, landfills, and other methane-waste producing facilities. |

U.S. gas distributors ramped up their commitment to a growing portfolio of renewable natural gas projects in the third quarter to coordinate with federal and state programs.

In the first two weeks of third-quarter earnings reports, they pointed to opportunities in renewable natural gas, or RNG, that are presented by proposed tax credits in the $1.75 trillion Build Back Better Act, and they updated investors on their projects.

On a South Jersey Industries Inc., or SJI, earnings call, President and CEO Mike Renna welcomed the proposed extension of existing federal tax credits to biogas facilities and a new hydrogen production tax credit in Democrats' Build Back Better bill.

"We're obviously encouraged by the fact that it is included in the bill, not only because I think it's certainly going to jumpstart the industry ... but I think it's also a reinforcement that decarbonization is on equal footing with electrification," Renna said. SJI planned to align its operations with New Jersey's state energy and environmental goals with decarbonization initiatives that include RNG facilities to process dairy waste into pipeline-quality fuel.

Gas utility operators with RNG projects in service or nearing start-up announced new developments, while new entrants to the renewable gas space outlined plans to establish a foothold in the growing market. There are roughly 300 RNG projects in operation or under construction today in the U.S., up from about 50 a few years ago, with nearly 100 more in development, according to Northwest Natural Holding Co.

NW Natural saw scope for further development of RNG, which is processed from methane waste into pipeline-quality biogas. "We project a substantial increase in RNG supply needed to meet voluntary and compliance-driven targets instituted by states and utilities," NW Natural President and CEO and current American Gas Association Chair David Anderson said during a Nov. 5 quarterly conference call. "We see promising investment potential in this area."

Northwest Natural Holding Co.

NW Natural announced it was forming a nonregulated subsidiary to invest in RNG projects and supply utilities and other sectors with the fuel, starting with a $50 million project to develop RNG production facilities at two landfills. The activity will be separate from NW Natural's investment in RNG projects and procurement through its Northwest Natural Gas Co. regulated utility.

Construction on the first of four projects to extract RNG from water treatment processes at Tyson Foods Inc. plants began in the fall, Anderson told investors during a Nov. 5 conference call. The project was undergoing regulatory review through a process established by Oregon Senate Bill 98, which allows NW Natural to invest up to 5% of its annual sales volume in Oregon in RNG projects and purchases.

The company has the option to invest up to $38 million in the projects and expected to move forward on the remaining three, NW Natural Vice President for Strategy and Business Development Justin Palfreyman said. Within the last couple weeks, regulators approved NW Natural's first two RNG procurement contracts through its purchased gas adjustment mechanism, in accordance with SB 98, he added.

Anderson said NW Natural's third-quarter request for proposals for additional RNG supply and investments generated a "very robust" response, and the company is evaluating a number of opportunities.

Chesapeake Utilities Corp.

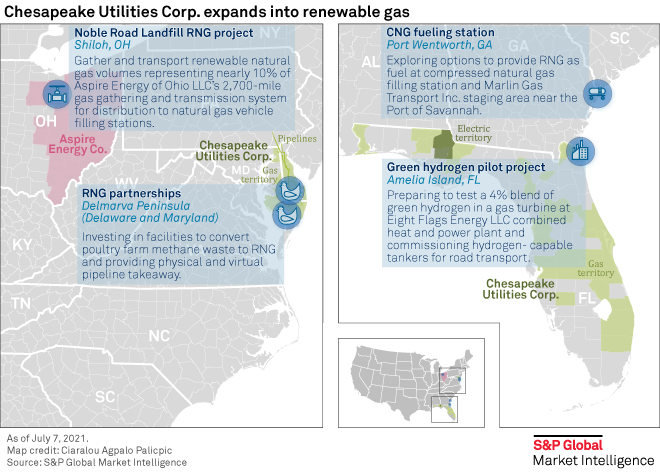

Chesapeake Utilities Corp., which has sought to integrate RNG throughout its diversified energy delivery business, provided updates on its efforts.

Its Aspire Energy of Ohio LLC subsidiary completed its $7.3 million, 33.1-mile pipeline to transfer RNG from the Noble Road landfill in Shiloh, Ohio, during the quarter.

Chesapeake is working on "a variety of opportunities" through its Marlin Gas Services LLC compressed natural gas trucking business that it cannot yet discuss publicly, President and CEO Jeff Householder said. "I would tell you that we see Marlin's growth opportunities in the future as largely focused on RNG transport," Householder told investors during a Nov. 4 conference call. "And so we're highly focused on marketing Marlin as an RNG transport operation."

Chesapeake also expected to complete a CNG filling station at the Port of Savannah by Mid-February. Chesapeake has explored offering RNG through the station, which will also serve as a staging ground to improve Marlin's access to the Georgia and Carolinas markets, Householder noted. In October, Chesapeake secured $9.6 million in sustainability-linked financing to fund RNG-focused capital investments at Marlin.

Asked about leveraging Chesapeake's relationships with RNG project developers in its Delmarva Peninsula gas utility territory, Householder stressed the company would continue to orient its investments around projects that solve environmental waste management problems. "We're not specifically out hunting renewable natural gas quantities," the CEO said. "We are hunting projects ... that deal with a fundamental waste issue."

DTE Energy Co.

DTE Energy Co. announced it had started construction on a new Wisconsin RNG project and entered into its first development in New York during the third quarter. In the prior quarter, DTE Energy began construction on its largest dairy farm RNG project to date, a development in South Dakota slated to enter service in 2022. Once it starts up, it will inject RNG into the Northern Natural Gas Co. system and sell supplies through California's Low Carbon Fuel Standard market, which is oriented around providing decarbonized transportation fuel.

The three facilities could produce more than 500 billion Btu of RNG for the vehicle fuel market, with 100% of the production tied to long-term offtake contracts, DTE President, CEO and Director Jerry Norcia said during an Oct. 27 earnings call.

DTE has focused on developing a couple of greenfield RNG dairy projects per year through its unregulated power and industrials segment, which it renamed DTE Vantage. The unit, which also develops cogeneration plants, delivers about $15 million of net income growth per year, according to the company. DTE has a $1 billion-$1.5 billion capital spending plan for DTE Vantage projects through 2026 and expected the unit to contribute $160 million to $170 million to operating earnings that year.

AltaGas Inc.

Following approval from the Maryland Public Service Commission, AltaGas Ltd. subsidiary Washington Gas Light Co. will partner with the Washington Suburban Sanitary Commission, or WSSC, on a project to process sewage waste into RNG. The $271 million facility, slated for completion in fall 2024, will capture methane generated during biosolids treatment and process it into RNG for sale on the open market.

Washington Gas will install 900 feet of pipeline and other infrastructure to supply gas to the Piscataway Bioenergy facility in Accokeek, Md., and offtake RNG from the development, according to WSCC. The project is small, but will provide the utility with experience building out an RNG project, according to Donald "Blue" Jenkins, who serves as president for AltaGas' utility operations and Washington Gas.

"This is our first foray into projects of this type," AltaGas president and CEO Randy Crawford said during an Oct. 28 conference call. "It will enable AtlaGas to refine and learn more about this promising technology, so we can identify other potential projects to expand the use of RNG in the years ahead. There are going to be more, and we're going to continue to invest in reducing our carbon emissions intensity, which includes products to help our customers to do the same."

One Gas Inc.

After One Gas Inc. executives expressed confidence in August that they could build a significant RNG program, project development picked up in several of the company's territories.

The company entered into agreements with four biogas development projects, including two wastewater treatment plants, a landfill, and a food waste project, according to One Gas Senior Vice President and COO Curtis Dinan. The company is designing interconnections with the facilities, which are poised to produce 700 billion Btu of RNG per year, Dinan said during the company's Nov. 2 quarterly conference call.

One Gas has entered into discussions with three dairy farms, another landfill and wastewater treatment plant, Dinan added.

In October, One Gas set a goal of reducing greenhouse gas emissions from its operations by 41% from 2014 levels by 2025, chiefly through pipeline replacement and protection. Asked about setting a longer-term emissions reduction target, One Gas President and CEO Robert McAnnally reiterated that executives will not establish emissions reductions targets before identifying "clear pathways to achieve the goals that we set out."

"We're really looking forward to understanding the full potential of what RNG can do to our emissions profile," One Gas CFO Caron Lawhorn added.

Dominion Energy Inc.

Dominion Energy Inc., which has focused on developing RNG facilities at dairy and hog farms, now has five projects under construction and two slated to enter service in the coming months, Executive Vice President and COO Diane Leopold said on a Nov. 5 earnings call. The company expected another four projects to enter the construction phase by year-end, Leopold added.

"All projects are going well — on time, on budget — and we're expecting to keep up that rough pace next year," Leopold said.

Dominion has one RNG facility in service as part of its 10-year plan to invest $500 million in the fuel. Align RNG, a joint venture of Dominion and Smithfield Foods Inc., began producing RNG from about two dozen hog farms in Utah in December 2020.