Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

29 Nov, 2021

| WattBridge built its Topaz generating station in 2021 as a part of its target to build 4 GW of new gas generation in Texas. The Houston company is leading the charge for the state to create financial incentives to build gas plant capacity. Source: WattBridge |

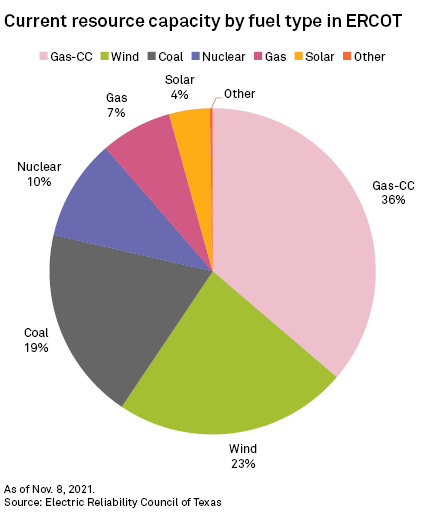

Gas plant developers see fresh opportunities to compete with low-cost renewable energy on the Electric Reliability Council of Texas Inc. grid as state regulators redesign the power market in response to blackouts caused by a deadly winter storm in February.

Houston-based WattBridge Energy LLC is among the companies urging regulators to incentivize new plants that can quickly provide backup power during emergencies. WattBridge, founded in 2019 as a vertically integrated developer and owner of natural gas plants, aims to build 4 GW of new gas capacity in ERCOT by 2025, one of the larger investments in new fossil fuel generation on Texas' main grid. The upstart company is nearly halfway to that goal.

"We think [intermittency] is the fundamental problem with the grid," WattBridge President Mike Alvarado told Texas lawmakers during a September legislative hearing on wholesale market redesign.

Renewable energy resources stand to lose ground, particularly after Gov. Greg Abbott encouraged his appointees at the Public Utility Commission of Texas to make it easier for investors to back new fossil fuel and nuclear plants.

The extent to which policy will drive fossil fuel investments reflects the national debate about gas's role as a bridge to low-cost, carbon-free power generation after recent power shortfalls in Texas and California.

"We think there needs to be a reliability standard," Alvarado said in an interview, referring to the PUC's bid to redesign the market. Such a standard should support "firm, dispatchable generation."

The U.S. Energy Information Administration said in a Nov. 22 report that 27.3 GW of natural gas capacity is scheduled to come online in the U.S. between 2022 and 2025, including 2.8 GW of planned capacity in Texas. The additions would increase the current U.S. gas capacity of 489.1 GW by 6%.

The February storm froze equipment along the natural gas supply chain, leading to Texas' grid instability.

"My biggest concern with the leading proposals the PUC is considering ... is that all rely on natural gas; unfortunately, little to no progress has been made to date to ensure that gas supply is winterized," Doug Lewin, an energy consultant and president of Stoic Energy, said in an email.

Berkshire eager for Texas expansion

WattBridge is not alone in wanting to invest in new gas generation in Texas. In the spring, Berkshire Hathaway Energy pitched an $8.3 billion plan to lawmakers to create a regulated utility that would build 10 new gas plants across the state. A bill that would do so did not make it to the governor's desk, but Berkshire is still eyeing the ERCOT market.

"Berkshire Hathaway Energy has been tracking the proceedings at the Public Utility Commission of Texas to see what ancillary service products and other solutions are adopted," a Berkshire spokesperson said in a Nov. 23 email. "Helping find a solution in Texas is a priority for Berkshire Hathaway Energy, and we're making a long-term commitment to expand our operations in the state."

Texas regulators would welcome such investments.

"We've got to get a stable price signal ... to drive investments in long-term assets — 20-, 30-year assets — and to keep our existing generation and market stable," Commissioner Lori Cobos said during a Nov. 19 PUC workshop discussion of market redesign.

Renewable energy advocates argue that locking in decades of new fossil fuel generation will increase energy costs and carbon emissions. Texas does not have a statewide net-zero commitment, but communities such as Houston, the state's largest city, have implemented their own carbon neutrality goals.

The U.S. Partnership for Renewable Energy Finance recommended in a Nov. 23 letter to the PUC that the commission "perform a more thorough analysis to evaluate the longer-term market design options now under consideration in order to fully understand their potential impacts on consumers and business investment in the Lone Star state."

"Texas has attracted more than $70 billion in new renewable energy investment because it is blessed with abundant renewable resources able to provide low-cost electricity generation," the letter said.

Upstart on building spree

WattBridge said quick-starting gas generation is the most pragmatic way to support the transition to carbon-free power. The company is a subsidiary of Missouri-based ProEnergy Services LLC, which refurbishes General Electric Co. LM6000 aeroderivative gas turbines that can start within 10 minutes.

WattBridge has built 1,824 MW of natural gas capacity in Texas over 20 months, financed by $1.25 billion in debt and equity. Another 1,728 MW is in advanced development. The company's building spree in the Houston area includes the ProEnergy South Houston Plant and the Topaz Generating Power Plant, both of which came online in 2021. In November, WattBridge announced the financial close on the Brotman Power Station, anticipated to come online in 2023.

"By filling gaps in energy supply with fast-start, reduced-emission power generation, these plants quickly and effectively enhance ERCOT grid reliability," ProEnergy CEO Jeff Canon said in an announcement.

The most significant challenge for companies that want to add new gas capacity is access to capital, WattBridge told regulators in a filing to the PUC's wholesale market redesign proceeding. WattBridge called for an ancillary services product that provides quick-starting, dispatchable power facilities with a minimum recovery in revenues over a 10-year period. That would provide a substitute for a financial hedge that gas generators often use to finance new plants in ERCOT.

"Renewable generation does not face this same challenge as a result of the guaranteed financial performance provided by the use of tax and renewable energy credits," WattBridge said in a filing. "These credits effectively act as a capacity payment to renewable generation."

|

An Enel SpA employee on a Texas wind farm. Renewable energy in the state stands to lose out in wholesale market reforms. |

Democrats in Washington, D.C., are pushing to expand such tax credits. In Texas, renewable energy interests face a less friendly policy environment, with Abbott, a Republican, blaming intermittent resources for the February disaster despite the fact that gas power contributed to the majority of outages.

Cyrus Reed, conservation director for the Lone Star Chapter of the Texas Sierra Club, said WattBridge's aggressive development contradicts the narrative that the Texas market is hostile to new gas plants.

"We're in Texas," Reed said. "I am not going to be able to convince the PUC to go to 100% renewable plus batteries. I can say that [we should], but it's not going to convince them. But our main goal is to ensure that in any existing market and future market changes, all technologies can compete for those services."

"We don't want them to pick gas as a winner," Reed added.

Debate over dispatchable energy credits

Commissioner Will McAdams proposed the creation of a clearinghouse for dispatchable energy credits similar to Texas' renewable energy credit system. The credits would help incentivize quick-starting backup power.

"Why would you design proposals to ensure increased reliability, at significant cost to consumers, that relies on a part of the system that is unreliable?" asked Lewin, the energy consultant. "Why create a dispatchable energy credit for a source that is not dispatchable in a winter storm? If the gas system is required to weatherize and if there is strong enforcement, that would change things. So far, we don't have that."

McAdams' proposal "does not help the resource adequacy problem, not one little bit," Sam Newell, a principal at Brattle Group, which analyzed market redesign proposals, told commissioners Nov. 19. Such a proposal would have the unintended consequence of driving down prices and making investment less attractive.

Battery storage is emerging as a solution, and the ERCOT interconnection queue contains roughly 36.5 GW of storage projects. Commissioners have expressed a desire to encourage more storage as costs become more competitive with gas generation.

An October analysis by financial advisory firm Lazard found that the levelized cost of energy for gas peaking plants was $151/MWh to $196/MWh. The cost for gas combined-cycle plants came in at $45/MWh to $74/MWh. The levelized cost of energy for one wholesale 50-MW/200-MWh battery storage project in Corpus Christi, Texas, paired with 100 MW of solar photovoltaic was $85/MWh in 2020, according to Lazard.

The annual average energy price in ERCOT was $25/MWh in 2020.

WattBridge has 800 MWh of short-term energy storage in advanced development, and it is also pursuing hydrogen as a fuel source for its turbines. Alvarado said the company's primary focus is to bring its gas turbines to the ERCOT market for now, but the executive sees other opportunities as renewable energy penetration grows across the nation.

"We're anxious and very positive about taking what we're doing here in ERCOT and replicating it in other markets," Alvarado said.