S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

30 Mar, 2021

By Corey Paul

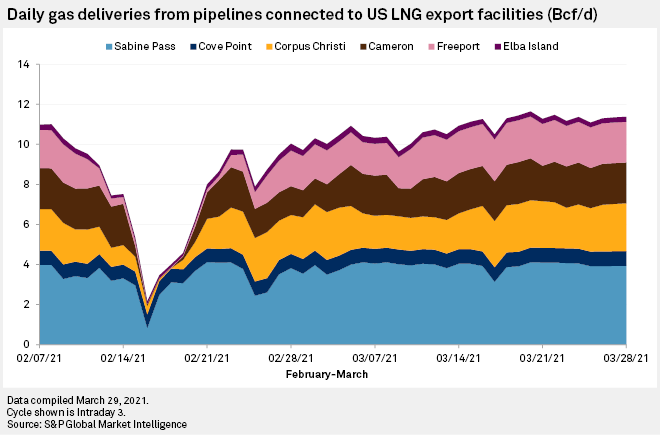

Natural gas deliveries to the six major U.S. LNG export terminals have been flowing at full bore since mid-March as global gas prices continued to support shipments of the fuel.

Market observers expected U.S. terminals to keep operating at close to their full capacity in the months ahead, when seasonal demand is typically lower. Total flows were about 11.4 Bcf/d on March 28, continuing to hover around record levels, according to pipeline flow data from S&P Global Market Intelligence.

S&P Global Platts Analytics has pointed to summer prices that remain favorable following tighter-than-expected winter demand, along with other factors such as available storage capacity in Europe and shipping costs that have fallen since the beginning of 2021. The benchmark LNG price for North Asia, the S&P Global Platts Japan Korea Marker, was assessed at $6.813/MMBtu for May on March 29.

Analysts at Goldman Sachs recently estimated an average 85% utilization rate at U.S. LNG export terminals during the summer, an outlook that reflects occasional feedgas fluctuations because of maintenance and other temporary events.

The total feedgas deliveries in March represented a sharp rebound. An extreme cold snap in Texas during mid-February had impacted operations at Gulf Coast gas liquefaction and export terminals. Flows to the major U.S. export facilities bottomed at about 2.2 Bcf/d on Feb. 16 during the winter weather, but the deliveries quickly recovered.

The ramp-up in deliveries was pronounced at Cheniere Energy Inc.'s Corpus Christi LNG terminal, where deliveries totaled about 2.4 Bcf/d on March 28. The Corpus Christi terminal is one of two facilities in Texas. Cheniere received authorization from the Federal Energy Regulatory Commission on March 25 to enter a third liquefaction unit at the facility into commercial service. The developer announced reaching substantial completion on train 3 on March 26.

Cheniere is also building a sixth train at its flagship Sabine Pass LNG terminal in Louisiana. As construction remained ahead of schedule, the developer said the train could begin producing LNG by the end of this year.

Other developments could add more support for U.S. LNG feedgas demand over the months ahead.

Developer Venture Global LNG told FERC in a March 17 filing that its Calcasieu Pass LNG terminal under construction in Louisiana could be ready to ship its first LNG cargo in late 2021, a year ahead of schedule. Venture Global expected full operations at Calcasieu Pass, which will be the country's seventh major LNG export plant, to begin in mid-2022. Venture Global also said its 23.4-mile TransCameron Pipeline LLC line connecting Calcasieu Pass to the interstate pipeline grid "is expected to commence service very soon."

S&P Global Market Intelligence and S&P Global Platts are owned by S&P Global Inc.