S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

4 Jan, 2022

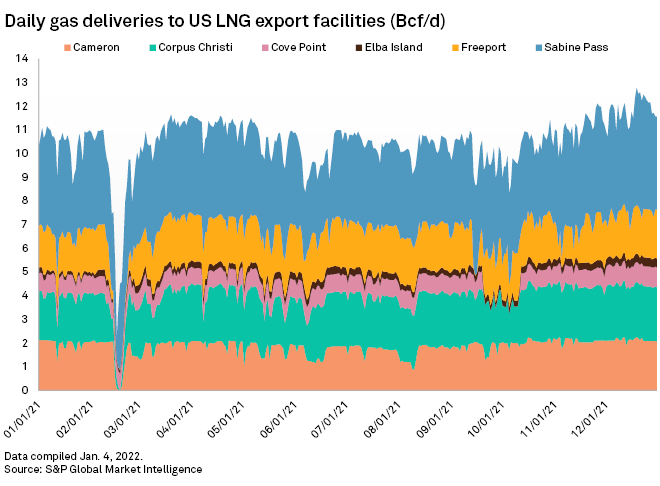

Natural gas deliveries to U.S. LNG export terminals reached record levels in the closing weeks of 2021, averaging 11.8 Bcf/d in December as the LNG facilities ramped up to meet surging demand in Europe and Asia.

Total feedgas deliveries to the six major operating U.S. LNG export facilities hit a high of about 12.8 Bcf/d on Dec. 19, 2021, and have not fallen below 11.5 Bcf/d in the weeks since then, according to S&P Global Market Intelligence pipeline flow data. Flows on Jan. 3 were about 11.8 Bcf/d.

The December 2021 average compared to an average of about 10.8 Bcf/d in December 2020, a time when sector activity had rebounded from the impacts of the COVID-19 pandemic.

Commissioning work on a sixth liquefaction train at Cheniere Energy Inc.'s flagship Sabine Pass LNG terminal in Louisiana explained part of the increase in feedgas demand in December 2021. The company said the train produced its first LNG on Nov. 23, 2021, and announced the loading of the first cargo of LNG sourced from the facility two weeks later. But high global gas prices were a key driver, with favorable export margins incentivizing U.S. operators to run their facilities at close to full throttle.

Analysts widely expected prices in end-user markets to remain well-supported during the winter and throughout 2022, and U.S. LNG exports are poised to continue rising.

Beyond the Sabine Pass unit, Venture Global LNG's Calcasieu Pass LNG export facility is also undergoing commissioning work in Louisiana. The facility, which will have an export capacity of about 10 million tonnes per year of LNG, will become the country's seventh major LNG export facility once it starts up in early 2022.

Venture Global told the Federal Energy Regulatory Commission on Jan. 3 that it is ready to introduce feedgas to the first liquefaction facilities. It asked for authorization to do so by Jan. 5.

The U.S. Energy Information Administration recently forecast that the new Venture Global and Cheniere facilities will increase the country's peak LNG production capacity from 11.6 Bcf/d as of November 2021 to 13.9 Bcf/d by the end of 2022 across the seven export facilities. The agency forecast that baseload U.S. LNG liquefaction capacity will increase from 9.5 Bcf/d to 11.4 Bcf/d over the same time frame.

With all of these terminals at full capacity, the U.S. would become the biggest global LNG producer, ahead of Australia and Qatar, which export 11.4 Bcf/d and 10.3 Bcf/d, respectively, according to the EIA.

An eighth U.S. export facility, the Golden Pass LNG Terminal in Texas, was about 40% complete as of late 2021. It was on target to start up in 2024, which would increase the country's peak export capacity to an estimated 16.3 Bcf/d, according to the EIA.